Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12. Ram, Rahim and Mohan were partners in a firm sharing profit and losses in the ratio of 7:6:7. Rahim retired and his share was

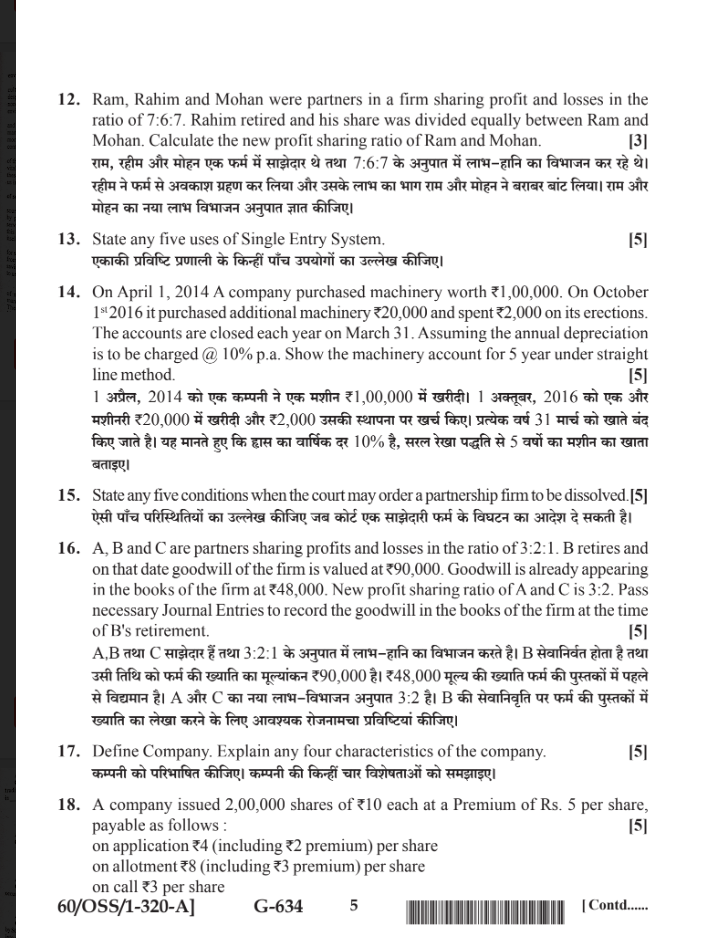

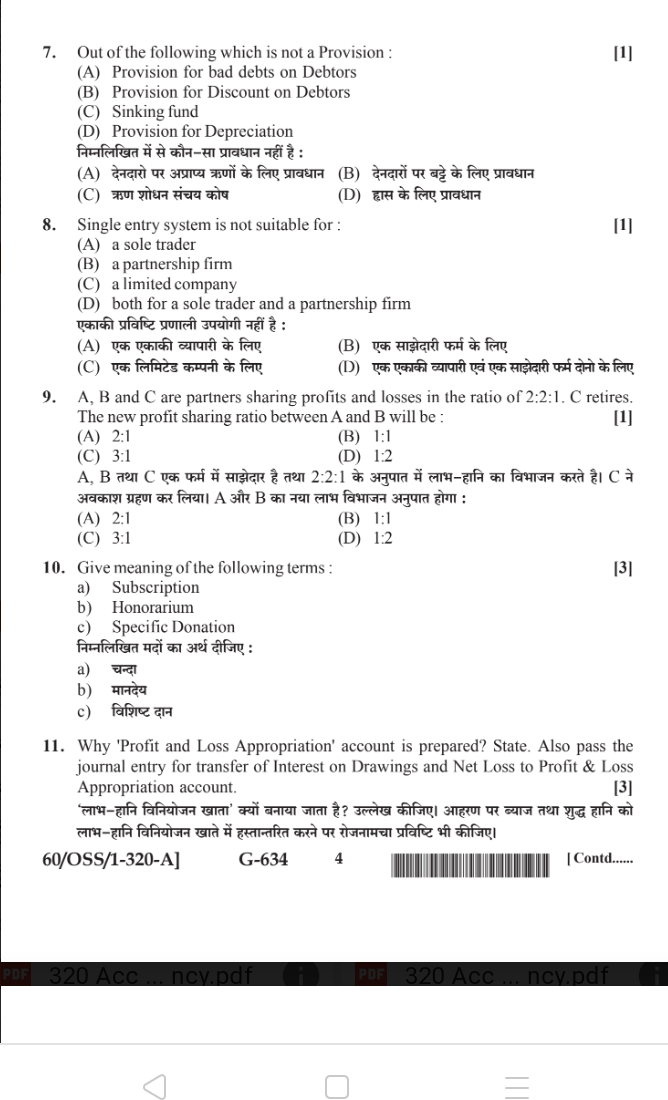

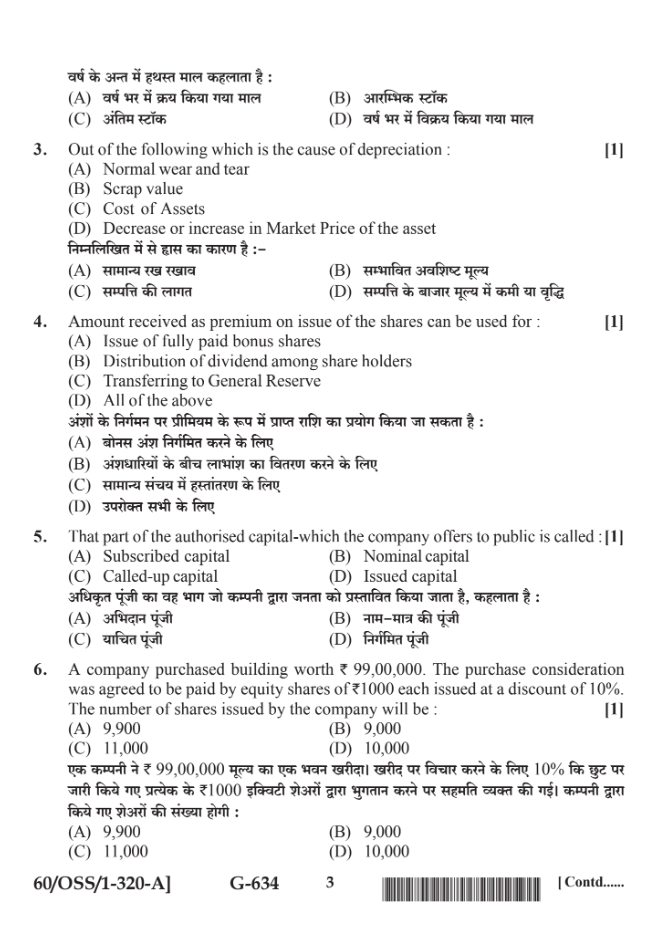

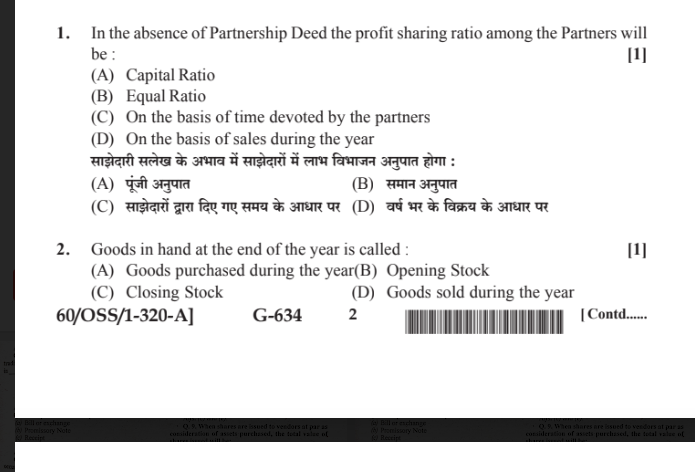

12. Ram, Rahim and Mohan were partners in a firm sharing profit and losses in the ratio of 7:6:7. Rahim retired and his share was divided equally between Ram and Mohan. Calculate the new profit sharing ratio of Ram and Mohan. [3] , 7:6:7 - 13. State any five uses of Single Entry System. [5] 14. On April 1,2014 A company purchased machinery worth 1,00,000. On October 1st2016 it purchased additional machinery 20,000 and spent 2,000 on its erections. The accounts are closed each year on March 31. Assuming the annual depreciation is to be charged @ 10\% p.a. Show the machinery account for 5 year under straight line method. [5] 1 , 2014 1,00,000 1 , 2016 20,000 2,000 31 10% , 5 15. State any five conditions when the court may order a partnership firm to be dissolved. [5] 16. A,B and C are partners sharing profits and losses in the ratio of 3:2:1. B retires and on that date goodwill of the firm is valued at 90,000. Goodwill is already appearing in the books of the firm at 48,000. New profit sharing ratio of A and C is 3:2. Pass necessary Journal Entries to record the goodwill in the books of the firm at the time of B's retirement. [5] A,B C 3:2:1 - B 90,000 48,000 A C - 3:2 B 17. Define Company. Explain any four characteristics of the company. [5] 18. A company issued 2,00,000 shares of 10 each at a Premium of Rs. 5 per share, payable as follows : [5] on application 4 (including 2 premium) per share on allotment 8 (including 3 premium) per share on call 3 per share 60/OSS/1-320-A] G-634 5 | Contd...... 7. Out of the following which is not a Provision : [1] (A) Provision for bad debts on Debtors (B) Provision for Discount on Debtors (C) Sinking fund (D) Provision for Depreciation - : (A) (B) (C) (D) 8. Single entry system is not suitable for : [1] (A) a sole trader (B) a partnership firm (C) a limited company (D) both for a sole trader and a partnership firm : (A) (B) (C) (D) 9. A,B and C are partners sharing profits and losses in the ratio of 2:2:1. C retires. The new profit sharing ratio between A and B will be : [1] (A) 2:1 (B) 1:1 (C) 3:1 (D) 1:2 A,B C 2:2:1 - C A B : (A) 2:1 (B) 1:1 (C) 3:1 (D) 1:2 10. Give meaning of the following terms: [3] a) Subscription b) Honorarium c) Specific Donation : a) b) c) 11. Why 'Profit and Loss Appropriation' account is prepared? State. Also pass the journal entry for transfer of Interest on Drawings and Net Loss to Profit \& Loss Appropriation account. [3] '- ' ? - 60/OSS/1320A] G-634 4 |Contd...... : (A) (B) (C) (D) 3. Out of the following which is the cause of depreciation : [1] (A) Normal wear and tear (B) Scrap value (C) Cost of Assets (D) Decrease or increase in Market Price of the asset :- (A) (B) (C) (D) 4. Amount received as premium on issue of the shares can be used for : [1] (A) Issue of fully paid bonus shares (B) Distribution of dividend among share holders (C) Transferring to General Reserve (D) All of the above : (A) (B) (C) (D) 5. That part of the authorised capital-which the company offers to public is called :[1] (A) Subscribed capital (B) Nominal capital (C) Called-up capital (D) Issued capital , : (A) (B) - (C) (D) 6. A company purchased building worth 99,00,000. The purchase consideration was agreed to be paid by equity shares of 1000 each issued at a discount of 10%. The number of shares issued by the company will be : [1] (A) 9,900 (B) 9,000 (C) 11,000 (D) 10,000 99,00,000 10% 1000 : (A) 9,900 (B) 9,000 (C) 11,000 (D) 10,000 1. In the absence of Partnership Deed the profit sharing ratio among the Partners will be : [1] (A) Capital Ratio (B) Equal Ratio (C) On the basis of time devoted by the partners (D) On the basis of sales during the year : (A) (B) (C) (D) 2. Goods in hand at the end of the year is called : [1] (A) Goods purchased during the year(B) Opening Stock (C) Closing Stock (D) Goods sold during the year 60/OSS/1-320-A] G-634 2 [Contd

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started