Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1&2 selections are neither, project a, project b, or both project a and b. 3 selection is yes or no 4 selection is The NPV

1&2 selections are neither, project a, project b, or both project a and b.

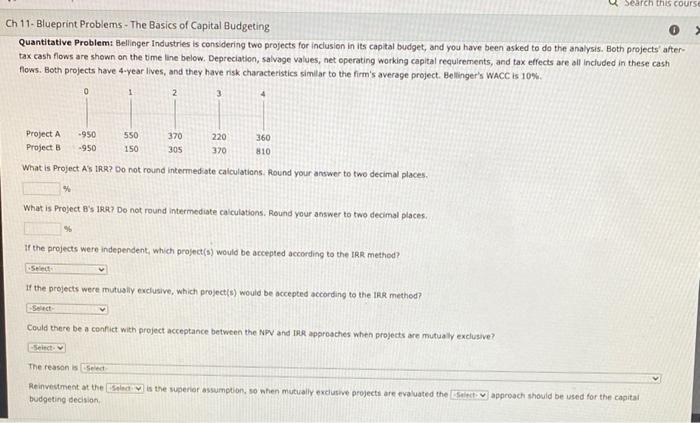

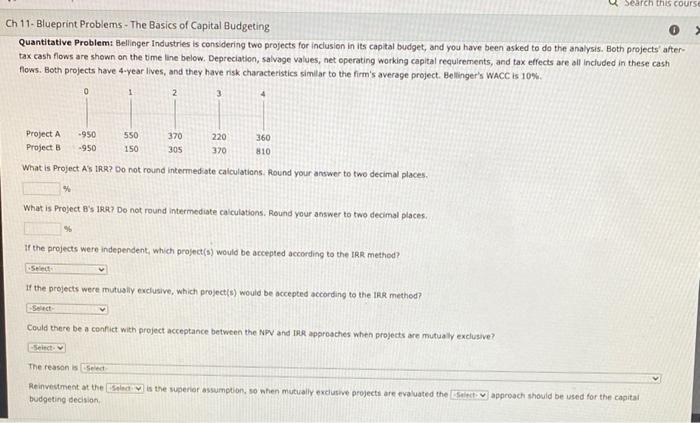

Search this course Ch 11- Blueprint Problems - The Basics of Capital Budgeting Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects after- tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 10% 1 2 0 3 4 Project A Project B .950 -950 550 150 370 305 220 370 360 810 What is Project AS TRR? Do not round intermediate calculations. Round your answer to two decimal places % What is Project 8's IRR? Do not round intermediate calculations. Round your answer to two decimal places. If the projects were independent, which project(s) would be accepted according to the IRR method? If the projects were mutually exclusive, which project(s) would be accepted according to the 110R method? Could there be a confict with project acceptance between the NPV and the approaches when projects are mutually exclusive? Seit. The reason is Select Reinvestment at the end is the superior assumption, so when mutually exclusive projects are evaluated the approach should be used for the capital budgeting decision 3 selection is yes or no

4 selection is The NPV and IRR approaches is the same reinvestment rate assumption and so both approaches reach the same project acceptance when mutually exclusive projects are or The MPV and IRR approaches use different reinvestment rate assumptions and so that there can be a conflict and project acceptance when mutually exclusive projects are

5 selection IRR or WACC

6 selection NPV or IRR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started