Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12. Splitoff Company produces three products from the same batch of raw material. Processing results in 15,000 pounds of product A which can be

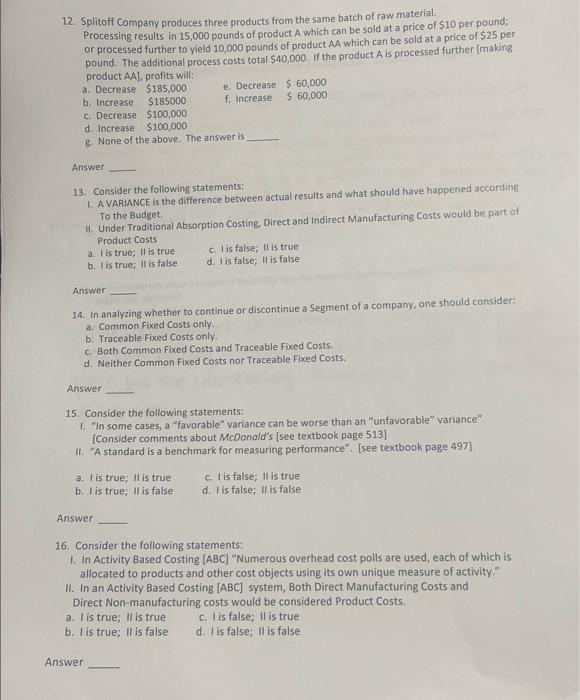

12. Splitoff Company produces three products from the same batch of raw material. Processing results in 15,000 pounds of product A which can be sold at a price of $10 per pound; or processed further to yield 10,000 pounds of product AA which can be sold at a price of $25 per pound. The additional process costs total $40,000. If the product A is processed further [making product AA], profits will: a. Decrease $185,000 b. Increase $185000 c. Decrease $100,000 d. Increase $100,000 e. Decrease $60,000 f. Increase $ 60,000 g. None of the above. The answer is Answer 13. Consider the following statements: I. A VARIANCE is the difference between actual results and what should have happened according To the Budget. II. Under Traditional Absorption Costing, Direct and Indirect Manufacturing Costs would be part of Product Costs a. I is true; Il is true b. I is true; Il is false Answer c. I is false; Il is truel d. I is false; Il is false 14. In analyzing whether to continue or discontinue a Segment of a company, one should consider: a. Common Fixed Costs only. b. Traceable Fixed Costs only. c. Both Common Fixed Costs and Traceable Fixed Costs. d. Neither Common Fixed Costs nor Traceable Fixed Costs. Answer 15. Consider the following statements: 1. "In some cases, a "favorable" variance can be worse than an "unfavorable" variance" [Consider comments about McDonald's [see textbook page 513] II. "A standard is a benchmark for measuring performance". [see textbook page 497] a. I is true; II is true b. I is true; II is false Answer c. I is false; Il is true d. I is false; Il is false 16. Consider the following statements: 1. In Activity Based Costing [ABC] "Numerous overhead cost polls are used, each of which is allocated to products and other cost objects using its own unique measure of activity." II. In an Activity Based Costing [ABC] system, Both Direct Manufacturing Costs and Direct Non-manufacturing costs would be considered Product Costs. c. I is false; II is true a. I is true; Il is true b. I is true; II is false d. I is false; II is false Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started