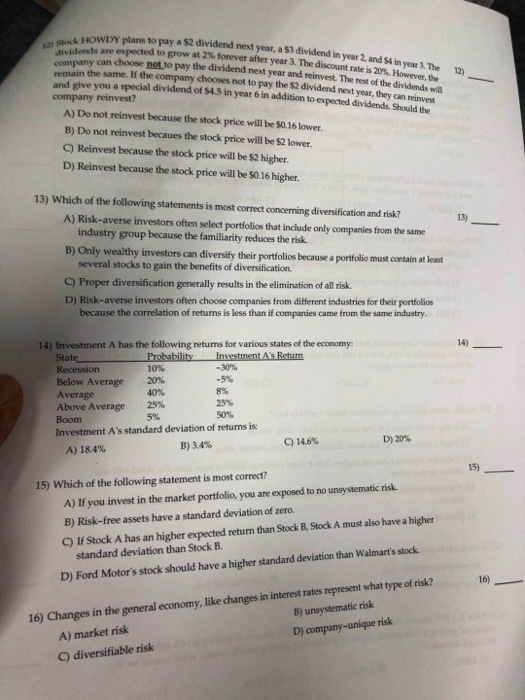

12 Stock HOWDY plans to pay a $2 dividend next year, a $3 dividend in year 2, and S4 in year 3. The dividends are expected to grow at 2 % forever after year 3. The discount rate is 20% However, the company can choose not to pay the dividend next year and reinvest. The rest of the dividends will 12) remain the same. If the company chooses not to pay the $2 dividend next year, they can reinvest and give you a special dividend of $45 in year 6 in addition to expected dividends. Should the company reinvest? A) Do not reinvest because the stock price will be $0.16 lower. B) Do not reinvest becaues the stock price will be $2 lower. C) Reinvest because the stock price will be $2 higher. D) Reinvest because the stock price will be $0.16 higher. 13) Which of the following statements is most correct concerning diversification and risk? A) Risk-averse investors often select portfolios that include only companies from the same industry group because the familiarity reduces the risk 13) B) Only wealthy investors can diversify their portfolios because a portfolio must contain at least several stocks to gain the benefits of diversification C) Proper diversification generally results in the elimination of all risk. D) Risk-averse investors often choose companies from different industries for their portfolios because the correlation of returns is less than if companies came from the same industry. 14) 14) Investment A has the following returns for various states of the economy Investment A's Retum -30 % -5 % Probability 10 % State Recession Below Average 20% 8% 40% Average Above Average 25% 50 % 25% 5% Boom Investment A's standard deviation of returns is D) 20% C) 14.6 % B) 3.4% A) 18.4% 15) 15) Which of the following statement is most correct? exposed to no unsystematic risk A) If you invest in the market portfolio, you are C) If Stock A has an higher expected return than Stock B, Stock A must also have a higher standard deviation than Stock B B) Risk-free assets have a standard deviation of zero. D) Ford Motor's stock should have a higher standard deviation than Walmart's stock 16) B) unsystematic risk 16) Changes in the general economy, like changes in interest rates represent what type of risk? D) company-unique risk A) market risk C) diversifiable risk