Answered step by step

Verified Expert Solution

Question

1 Approved Answer

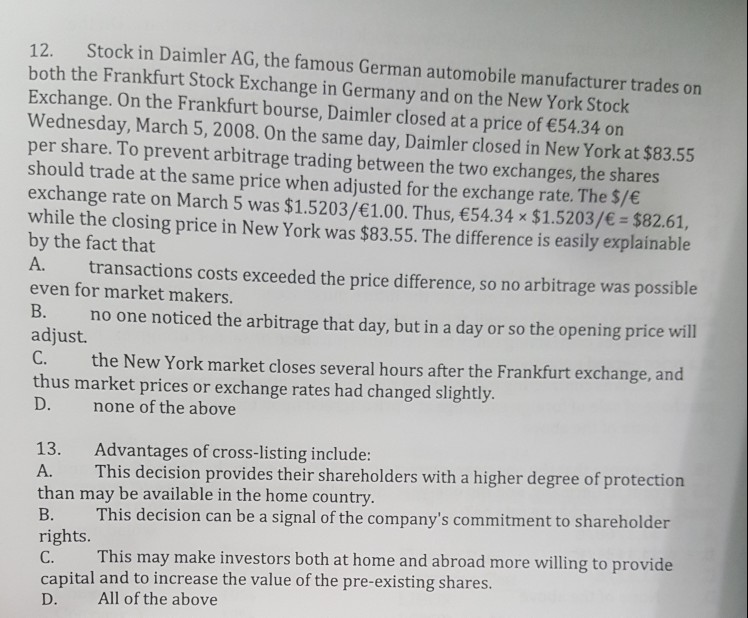

12. Stock in Daimler AG, the famous German automobile manufacturer trades on both the Frankfurt Stock Exchange in Germany and on the New York Stock

12. Stock in Daimler AG, the famous German automobile manufacturer trades on both the Frankfurt Stock Exchange in Germany and on the New York Stock Exchange. On the Frankfurt bourse, Daimler closed at a price of 54.34 on Wednesday, March 5, 2008. On the same day, Daimler closed in New York at $83.55 per share. To prevent arbitrage trading between the two exchanges, the shares should trade at the same price when adjusted for the exchange rate. The S/ exchange rate on March 5 was $1.5203/1.00. Thus, 54.34 x $1.5203/ $82.61, while the closing price in New York was $83.55. The difference is easily explainable by the fact that A. transactions costs exceeded the price difference, so no arbitrage was possible even for market makers. B. no one noticed the arbitrage that day, but in a day or so the opening price will adjust. C. the New York market closes several hours after the Frankfurt exchange, and thus market prices or exchange rates had changed slightly. D. none of the above 13. Advantages of cross-listing include: A. This decision provides their shareholders with a higher degree of protection than may be available in the home country. B. This decision can be a signal of the company's commitment to shareholder rights C. This may make investors both at home and abroad more willing to provide capital and to increase the value of the pre-existing shares. D. All of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started