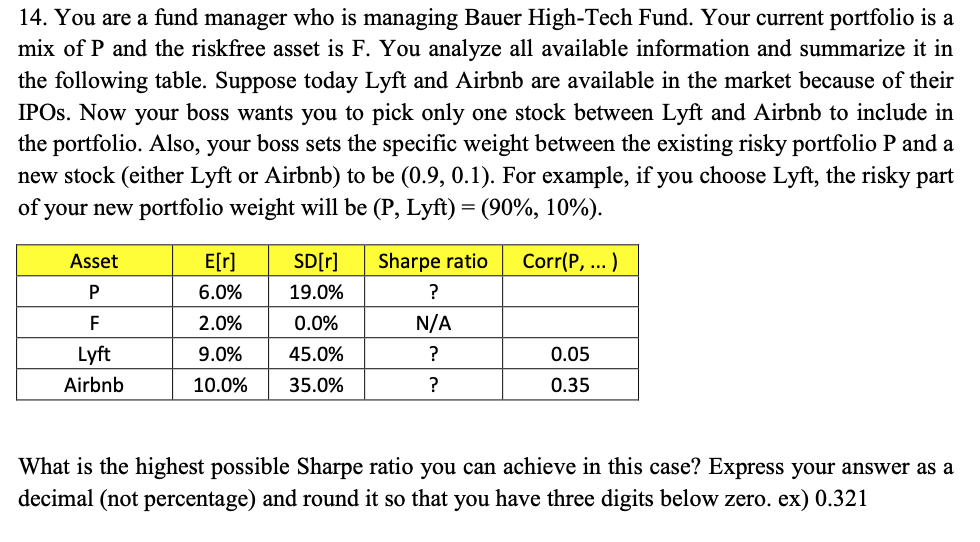

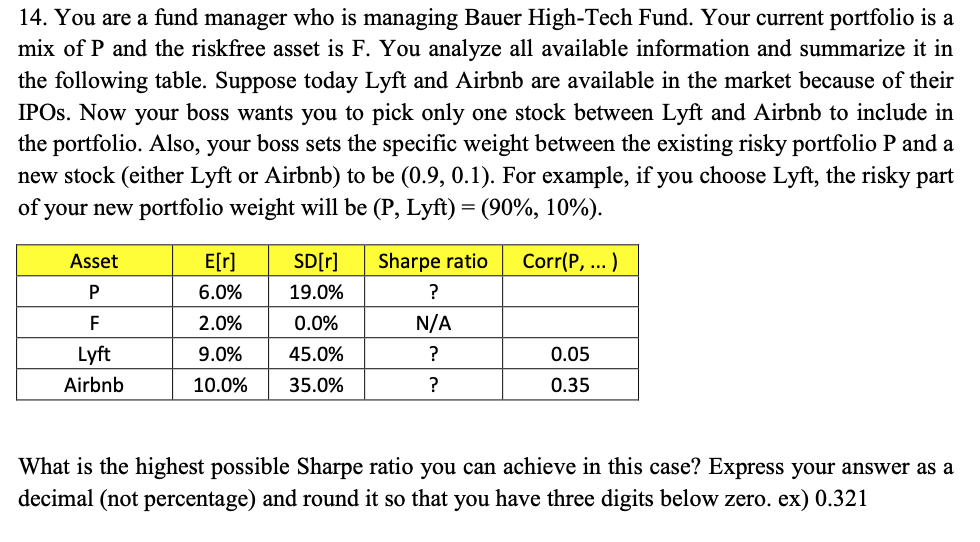

12. Suppose you can invest in only the market index fund and 12-month treasury bill because of some regulation. E[r]=10%, SD[r]=20%, and rf=2%. You are a portfolio manager at Fidelity. Suppose, based on your price of risk and the portfolio theory, you invest $0.5m in the market index fund and $0.5m in the 12-month treasury bill today. One year later, the annual net return of the market index fund turns out 10%. If E[r], SD[r], rf, and your price of risk remain the same, how should you rebalance your portfolio? That is, do you have to sell or buy the market index fund after you observe its high return of 10%, based on the portfolio theory? Express your answer in a following manner. For example, if your answer is Sell $0.24m worth of the market portfolio", then enter -0.24. If your answer is Buy $0.92m worth of the market portfolio", then enter 0.92. 13. One month ago Google stock price was $1,000 per share and Netflix stock price was $350 per share. You invested $0.6m in Google and $0.4m in Netflix. So, your initial portfolio weight is (Google, Netflix) = 60%, 40%). Today Google stock price rises to $1,284 per share and Netflix stock price falls to $329 per share. Assume there were no dividends paid in this period. Now you want to adjust your portfolio by selling one stock and buying the other stock while not changing the whole portfolio value. That is, you want to change the portfolio weight. Consider two scenarios as follows. (i) Following your insight as an investor, how much dollars would you move from Google to Netflix? If you want to transfer your money from Netflix to Google, express the dollar amount as a negative number and name it as $X1. (This question is simply asking your own judgment, and so you won't get any point or penalty from this question. However, write down your answer here (not on the answer sheet). You need it for the next question.) (ii) Suppose you accidentally liquidate your portfolio today and now you have only cash. If you are a rational and consistent investor, how much would you invest in Google today? Name it as $X2. (This question is simply asking your own judgment, and so you won't get any point or penalty from this question. However, write down your answer here (not on the answer sheet). You need it for the next question.) Question: What should be the sum of your answers from (i) and (ii) if you are rational, that is, X1+X2? Express your answer in a following manner. For example, if your answer is $0.982m, then enter 0.982. (Hint: You need to compute how much money you have in Google and Netflix after the stock price change.) 14. You are a fund manager who is managing Bauer High-Tech Fund. Your current portfolio is a mix of P and the riskfree asset is F. You analyze all available information and summarize it in the following table. Suppose today Lyft and Airbnb are available in the market because of their IPOs. Now your boss wants you to pick only one stock between Lyft and Airbnb to include in the portfolio. Also, your boss sets the specific weight between the existing risky portfolio P and a new stock (either Lyft or Airbnb) to be (0.9, 0.1). For example, if you choose Lyft, the risky part of your new portfolio weight will be (P, Lyft) = (90%, 10%). Asset Sharpe ratio Corr(P, ...) E[r] 6.0% 2.0% 9.0% 10.0% F Lyft Airbnb SD[r] 19.0% 0.0% 45.0% 35.0% N/A 0.05 0.35 ? What is the highest possible Sharpe ratio you can achieve in this case? Express your answer as a decimal (not percentage) and round it so that you have three digits below zero. ex) 0.321 12. Suppose you can invest in only the market index fund and 12-month treasury bill because of some regulation. E[r]=10%, SD[r]=20%, and rf=2%. You are a portfolio manager at Fidelity. Suppose, based on your price of risk and the portfolio theory, you invest $0.5m in the market index fund and $0.5m in the 12-month treasury bill today. One year later, the annual net return of the market index fund turns out 10%. If E[r], SD[r], rf, and your price of risk remain the same, how should you rebalance your portfolio? That is, do you have to sell or buy the market index fund after you observe its high return of 10%, based on the portfolio theory? Express your answer in a following manner. For example, if your answer is Sell $0.24m worth of the market portfolio", then enter -0.24. If your answer is Buy $0.92m worth of the market portfolio", then enter 0.92. 13. One month ago Google stock price was $1,000 per share and Netflix stock price was $350 per share. You invested $0.6m in Google and $0.4m in Netflix. So, your initial portfolio weight is (Google, Netflix) = 60%, 40%). Today Google stock price rises to $1,284 per share and Netflix stock price falls to $329 per share. Assume there were no dividends paid in this period. Now you want to adjust your portfolio by selling one stock and buying the other stock while not changing the whole portfolio value. That is, you want to change the portfolio weight. Consider two scenarios as follows. (i) Following your insight as an investor, how much dollars would you move from Google to Netflix? If you want to transfer your money from Netflix to Google, express the dollar amount as a negative number and name it as $X1. (This question is simply asking your own judgment, and so you won't get any point or penalty from this question. However, write down your answer here (not on the answer sheet). You need it for the next question.) (ii) Suppose you accidentally liquidate your portfolio today and now you have only cash. If you are a rational and consistent investor, how much would you invest in Google today? Name it as $X2. (This question is simply asking your own judgment, and so you won't get any point or penalty from this question. However, write down your answer here (not on the answer sheet). You need it for the next question.) Question: What should be the sum of your answers from (i) and (ii) if you are rational, that is, X1+X2? Express your answer in a following manner. For example, if your answer is $0.982m, then enter 0.982. (Hint: You need to compute how much money you have in Google and Netflix after the stock price change.) 14. You are a fund manager who is managing Bauer High-Tech Fund. Your current portfolio is a mix of P and the riskfree asset is F. You analyze all available information and summarize it in the following table. Suppose today Lyft and Airbnb are available in the market because of their IPOs. Now your boss wants you to pick only one stock between Lyft and Airbnb to include in the portfolio. Also, your boss sets the specific weight between the existing risky portfolio P and a new stock (either Lyft or Airbnb) to be (0.9, 0.1). For example, if you choose Lyft, the risky part of your new portfolio weight will be (P, Lyft) = (90%, 10%). Asset Sharpe ratio Corr(P, ...) E[r] 6.0% 2.0% 9.0% 10.0% F Lyft Airbnb SD[r] 19.0% 0.0% 45.0% 35.0% N/A 0.05 0.35 ? What is the highest possible Sharpe ratio you can achieve in this case? Express your answer as a decimal (not percentage) and round it so that you have three digits below zero. ex) 0.321