12. Target uses automation to record transactions at the checkout counter based on a perpetual inventory system. Their system records transactions using the same

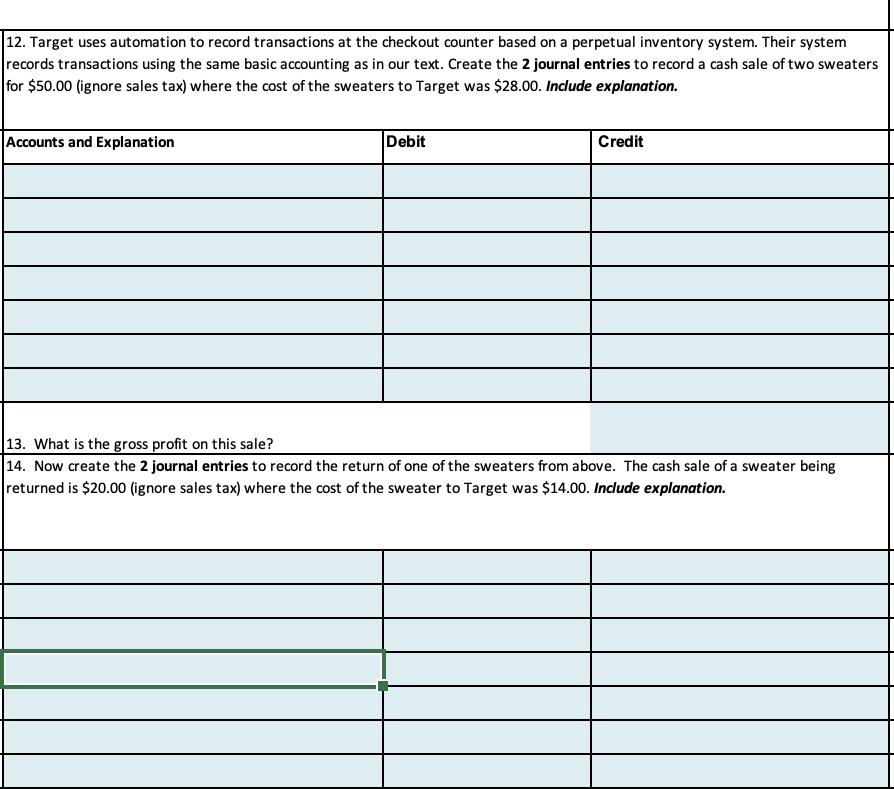

12. Target uses automation to record transactions at the checkout counter based on a perpetual inventory system. Their system records transactions using the same basic accounting as in our text. Create the 2 journal entries to record a cash sale of two sweaters for $50.00 (ignore sales tax) where the cost of the sweaters to Target was $28.00. Include explanation. Accounts and Explanation Debit Credit 13. What is the gross profit on this sale? 14. Now create the 2 journal entries to record the return of one of the sweaters from above. The cash sale of a sweater being returned is $20.00 (ignore sales tax) where the cost of the sweater to Target was $14.00. Include explanation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started