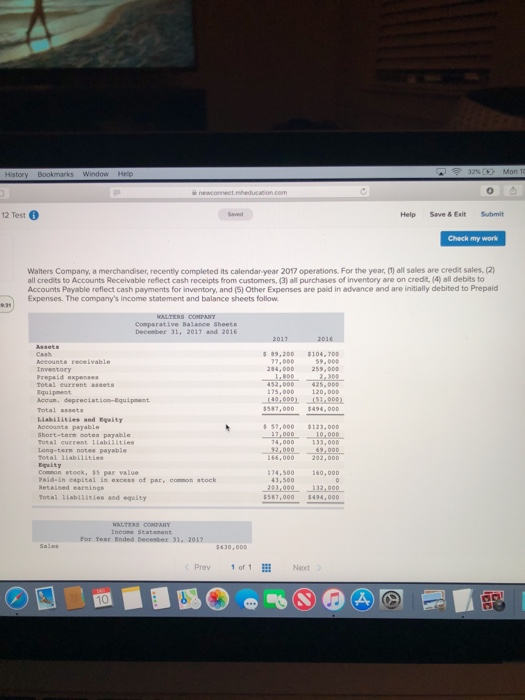

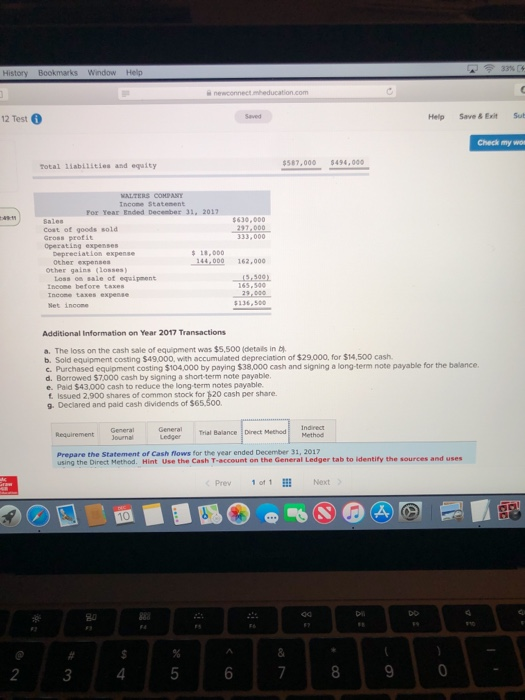

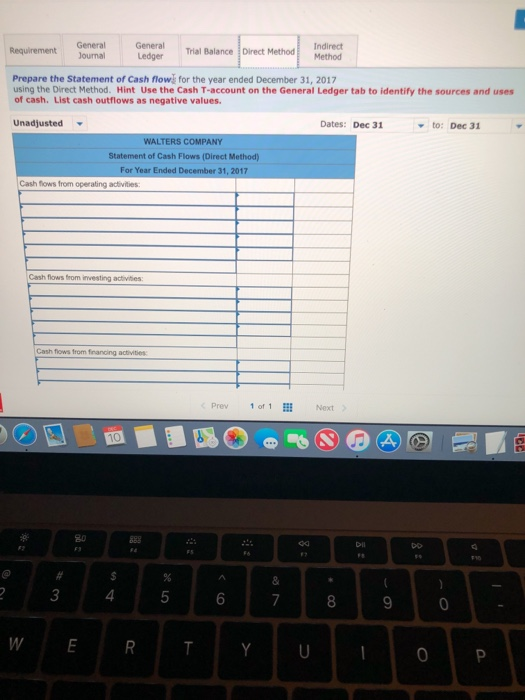

12 Test Help Save & Exit Submit Check my work Walters Company, a merchandiser, recently completed its calendar-year 2017 operations. For the year, (1) all sales are credit sales, (2) all credits to Accounts Recelvable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. The company's income statement and balance sheets follow WALTERS COMPANT Decenber 31, 2017 and 2016 Enveatory eivable Prepaid expenses ,200 104,700 24, DDD 259,000 32,0000 129,.0 Equ ipment quipmeut rentta (40 000) 11,O0D) 587,000 $494,000 Liabilities and Eesity Accounts payable Short-term sotes payable 157,000 17,000 $123,000 -0,000. 74,000- 92,000 6,000 66,000 202,000 Long-tern notes payable Common stoek, $s par value Paid-in eapital in excess of par, common stock Retaised earnings 74,500160,000 43,500 203 000 132,000 Totai liabilities and equity 587,000 494,000 ncoRe 630,000 Prev 1 of 1 Next ucation.com 12 Test Help Save &Exit Sub Check my wos Total 1iabilities and equity $587,000 $494,000 ALTERS COMPANY For Year Ended Decenber 31 1Sales 630,000 Cost of goods sold Gross protit Operating expenses 18.000 44,000 162,000 Depreciation expense Other gains (losses) Loss on sale of equipment ore taxes expense 136,500 Additional Information on Year 2017 Transactions a. The loss on the cash sale of equipment was $5,500 (details in b. b. Sold equipment costing $49,000, with accumulated depreciation of $29,000, for $14,500 cash c. Purchased equipment costing $104,000 by paying $38,000 cash and signing a long-term note payable for the balance d. Borrowed $7,000 cash by signing a short-term note payable e. Paid $43,000 cash to reduce the long-term notes payable. issued 2.900 shares of common stock for 20 cash per share. g. Deciared and paid cash dividends of $65,500 General Trial Balance Direct Method Method Ledger Requirement Genera Prepare the Statement of Cash flows for the year ended December 31, 2017 using the Direct Method. Hint Use the Cash T-account on the General Ledger tab to identify the sources and uses Prev lof1 Next 2 3 4 6 Indirect General Trial Balance Direct Method Method Requirement Journal General Prepare the Statement of Cash flow for the year ended December 31, 2017 using the Direct Method. Hint Use the Cash T-account on the General Ledger tab to identify the sources and uses of cash. List cash outflows as negative values. Unadjusted Dates: Dec 31 to: Dec 31 WALTERS COMPANY Statement of Cash Flows (Direct Method) For Year Ended December 31, 2017 Cash fows from operaling acbivities: Cash flows from investing activities Cash fiows from financing activities: Prev1 of 1E Next 3 4 6 0 0 newconnect com 2 Test Help Cash Tlows from operaing activibes: 8:34 Cash flows from investing activities: Cash flows from financing activities: 10, 111: Next Dil bo 3 4