Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12.) the answer is already in picture. i just need to understand the steps on how to do this. I'd prefer steps using the tvm

12.) the answer is already in picture. i just need to understand the steps on how to do this. I'd prefer steps using the tvm but anything that will get me the right answer. thank you!

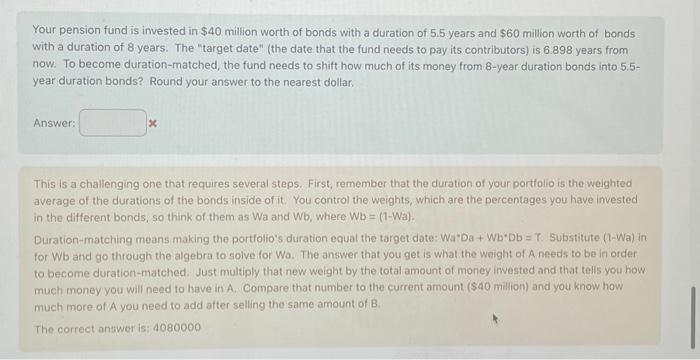

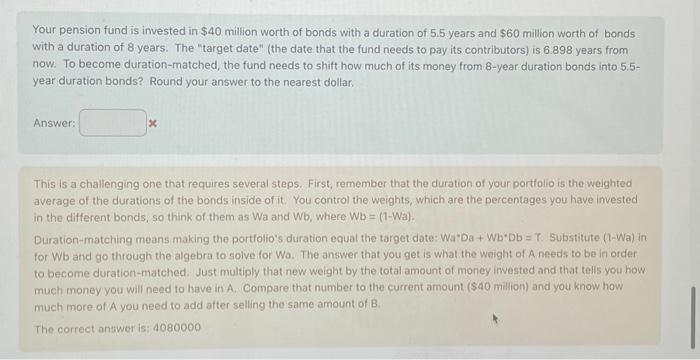

Your pension fund is invested in $40 million worth of bonds with a duration of 5.5 years and $60 million worth of bonds with a duration of 8 years. The "target date" (the date that the fund needs to pay its contributors) is 6.898 years from now. To become duration-matched, the fund needs to shift how much of its money from 8-year duration bonds into 5.5 -year duration bonds? Round your answer to the nearest dollar. Answer: This is a challenging one that requires several steps. First, remember that the duration of your portiolio is the weighted average of the durations of the bonds inside of it. You control the weights, which are the percentages you have invested in the different bonds, so think of them as Wa and Wb, where Wb =(1Wa). Duration-matching means making the portfolio's duration equal the target date: Wa' Da+WbDb=T. Substitute (1-Wa) in for Wb and go through the algebra to solve for Wa. The answer that you get is what the weight of A needs to be in order to become duration-matched. Just multiply that new weight by the total amount of money invested and that tells you how much money you will need to have in A. Compare that number to the current amount ( $40 million) and you know how much more of A you need to add after selling the same amount of B. The correct answer is: 4080000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started