Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12. The progressive income tax and transfer payments are the two main: A) automatic stabilizers. B) monetary policy tools. C) long-run aggregate supply management

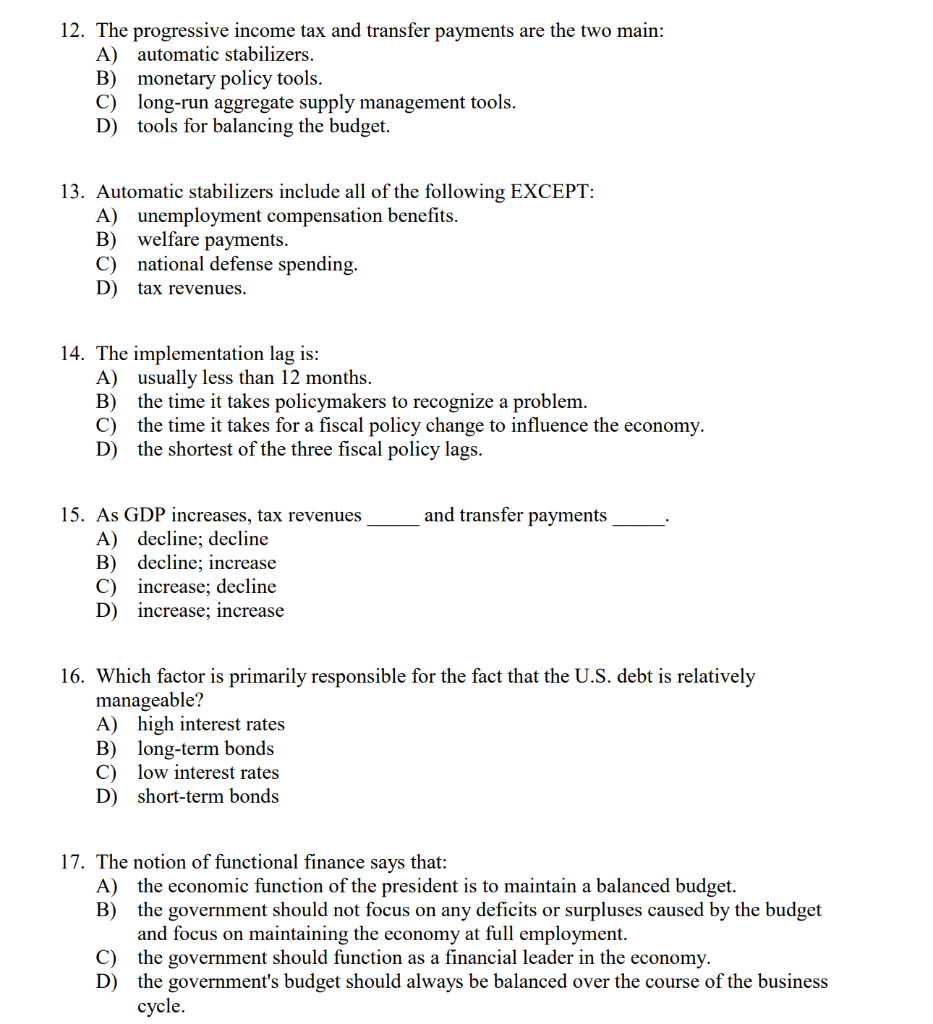

12. The progressive income tax and transfer payments are the two main: A) automatic stabilizers. B) monetary policy tools. C) long-run aggregate supply management tools. D) tools for balancing the budget. 13. Automatic stabilizers include all of the following EXCEPT: A) unemployment compensation benefits. B) welfare payments. C) national defense spending. D) tax revenues. 14. The implementation lag is: A) usually less than 12 months. B) the time it takes policymakers to recognize a problem. C) the time it takes for a fiscal policy change to influence the economy. D) the shortest of the three fiscal policy lags. 15. As GDP increases, tax revenues A) decline; decline B) decline; increase C) increase; decline D) increase; increase and transfer payments 16. Which factor is primarily responsible for the fact that the U.S. debt is relatively manageable? A) high interest rates B) long-term bonds C) low interest rates D) short-term bonds 17. The notion of functional finance says that: A) the economic function of the president is to maintain a balanced budget. B) the government should not focus on any deficits or surpluses caused by the budget and focus on maintaining the economy at full employment. C) the government should function as a financial leader in the economy. D) the government's budget should always be balanced over the course of the business cycle.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

12 automatic stabilizers Explanation The bestknown automatic stabilizers are progressively graduated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started