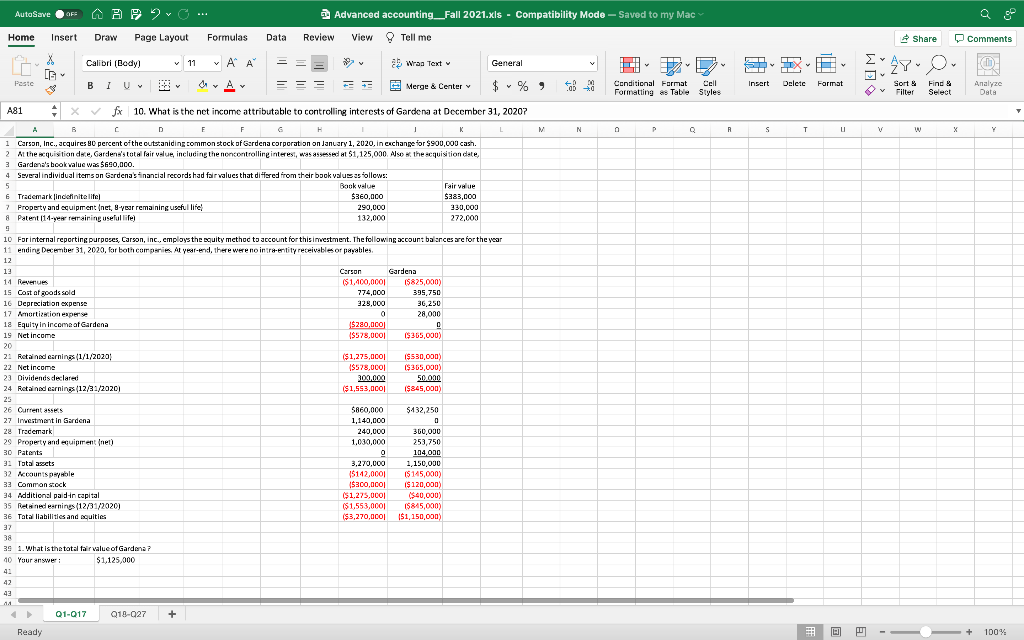

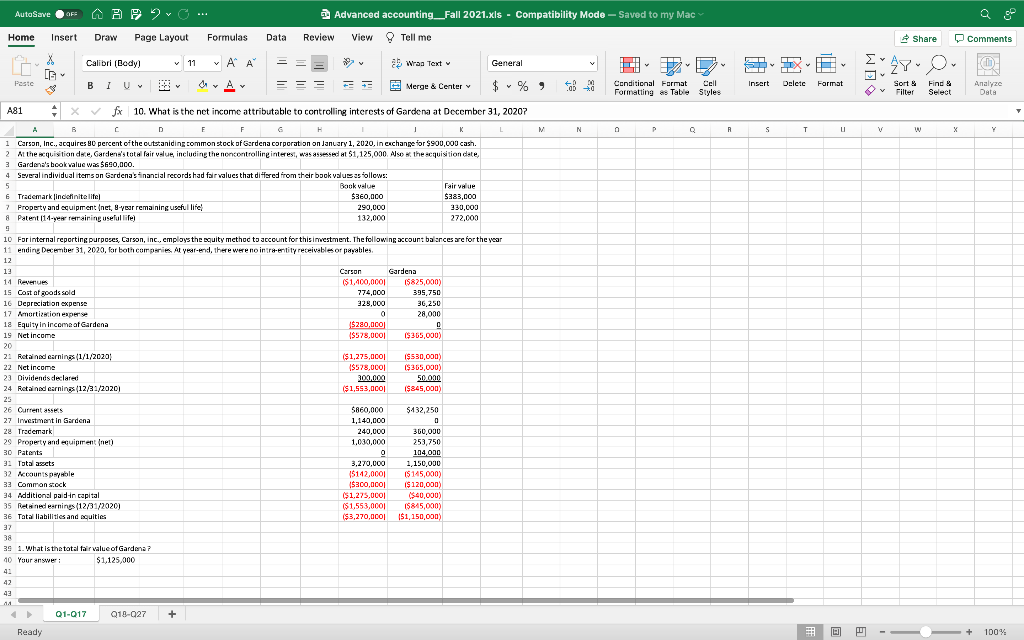

12. What is the consolidated balance for additional paid in capital at December 31, 2020?

| 13. What is the consolidated balance for common stock at December 31, 2020? |

| 14. What is the consolidated balance for revenue at December 31, 2020? |

| 15. What is the consolidated balance for cost of goods sold at December 31, 2020? |

AutoSave OFS Evo ... 20 a Advanced accounting_Fall 2021.xls - Compatibility Mode - Saved to my Mac ow Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments v SR V V v Insert Delete Format Sort & Conditional Format Cell Formatting as Table Styles Find & Select Filter Analyze Data V T M N P R S T U V v w X Y 272.000 X Calibri (Body) v 11 v A A ab Wran Text General G Paste B 1 I U A - Merge & Center $ - % A81 + x fx 10. What is the net income attributable to controlling interests of Gardena at December 31, 20207 , A C c D F F G 1 K L 1 Carson, Inc., acquires 80 percent of the outstanding common stock of Gardena corporation on January 1, 2020, in cxchange for $900,000 cash. 2. At the acquisition dece, Gardena's total fair value, including the noncontrolling interest, was assessed at $1,125,000 Also the acquisition date 3 Gardena's book value was $690.000 4 Several individual items on Gardenas financial records had fair values that differed from their book valusas follows: 5 . Book value Fair value E Trademark indefinitelitel $360,000 $383,000 7 Property and equipment (net, 8-year remaining useful life 290,000 330,000 8 Patent 14-yeerreraining useful life 132,000 9 10 For internal reporting purposes, Carson, Inc., employs the equity method to account for this investment. The following account balances are for the year 11 ending December 31, 2020, for both comperiesAl year-end, there were no intra-entity receivebles or payables. 12 13 Carson Gardena 11 Reveru (51,100,0001 15825,000) 15 Cost of goods sold 774,000 395,750 16 Depreciation expense 329,000 36,250 17 Amortizacionespers 0 o 28,000 18 Equity in income al Gardena 1$280,000 0 19 Net income $578,000 ($365,000) 20 2: Retained earnings (1/1/2020 ($1,275,000 1 I$530,000) 22 Net income $578,000 ($365,000) 23 Dividends declared 300,000 50.000 24 Retained earnings (12/31/20201 ($ 1,553,000 1$845,000) 25 26 Current $860,000 $432,250 27 Investment in Gardena 1,140,000 0 28 Trademark 240,000 360,000 29 Property and equipment het) 1,030,000 253,750 30 Patents 0 o 104,000 31 Total acts 3,270,000 1,150,000 32 Accounts payable {$112.0001 $ 145,000) 33 Commons.ock ($300,000 $ 120,000) 34 Additional paid in capital ($1,275,000 ($40,000) 35 Retained earnings (12/31/2020) ($ 1,553,000 15845,000) 36 Total liabilities and culties ($3,270,000 1$1,150,000) 37 38 39 1. What is the total fair value of Gardena? 10 Your answer: $1,125,000 4 42 43 Q1-Q17 Q19-027 + Ready + 100% AutoSave OFS Evo ... 20 a Advanced accounting_Fall 2021.xls - Compatibility Mode - Saved to my Mac ow Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments v SR V V v Insert Delete Format Sort & Conditional Format Cell Formatting as Table Styles Find & Select Filter Analyze Data V T M N P R S T U V v w X Y 272.000 X Calibri (Body) v 11 v A A ab Wran Text General G Paste B 1 I U A - Merge & Center $ - % A81 + x fx 10. What is the net income attributable to controlling interests of Gardena at December 31, 20207 , A C c D F F G 1 K L 1 Carson, Inc., acquires 80 percent of the outstanding common stock of Gardena corporation on January 1, 2020, in cxchange for $900,000 cash. 2. At the acquisition dece, Gardena's total fair value, including the noncontrolling interest, was assessed at $1,125,000 Also the acquisition date 3 Gardena's book value was $690.000 4 Several individual items on Gardenas financial records had fair values that differed from their book valusas follows: 5 . Book value Fair value E Trademark indefinitelitel $360,000 $383,000 7 Property and equipment (net, 8-year remaining useful life 290,000 330,000 8 Patent 14-yeerreraining useful life 132,000 9 10 For internal reporting purposes, Carson, Inc., employs the equity method to account for this investment. The following account balances are for the year 11 ending December 31, 2020, for both comperiesAl year-end, there were no intra-entity receivebles or payables. 12 13 Carson Gardena 11 Reveru (51,100,0001 15825,000) 15 Cost of goods sold 774,000 395,750 16 Depreciation expense 329,000 36,250 17 Amortizacionespers 0 o 28,000 18 Equity in income al Gardena 1$280,000 0 19 Net income $578,000 ($365,000) 20 2: Retained earnings (1/1/2020 ($1,275,000 1 I$530,000) 22 Net income $578,000 ($365,000) 23 Dividends declared 300,000 50.000 24 Retained earnings (12/31/20201 ($ 1,553,000 1$845,000) 25 26 Current $860,000 $432,250 27 Investment in Gardena 1,140,000 0 28 Trademark 240,000 360,000 29 Property and equipment het) 1,030,000 253,750 30 Patents 0 o 104,000 31 Total acts 3,270,000 1,150,000 32 Accounts payable {$112.0001 $ 145,000) 33 Commons.ock ($300,000 $ 120,000) 34 Additional paid in capital ($1,275,000 ($40,000) 35 Retained earnings (12/31/2020) ($ 1,553,000 15845,000) 36 Total liabilities and culties ($3,270,000 1$1,150,000) 37 38 39 1. What is the total fair value of Gardena? 10 Your answer: $1,125,000 4 42 43 Q1-Q17 Q19-027 + Ready + 100%