Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1&2) What is the required journal entry? 3.) Which procedure is good or weak? 4.) What is the correct journal entry? 5.) How to prepare

1&2) What is the required journal entry?

3.) Which procedure is good or weak?

4.) What is the correct journal entry?

5.) How to prepare the bank reconciliation and prepare the necessary journal entries?

what are the correct journal entries for 1 &2?

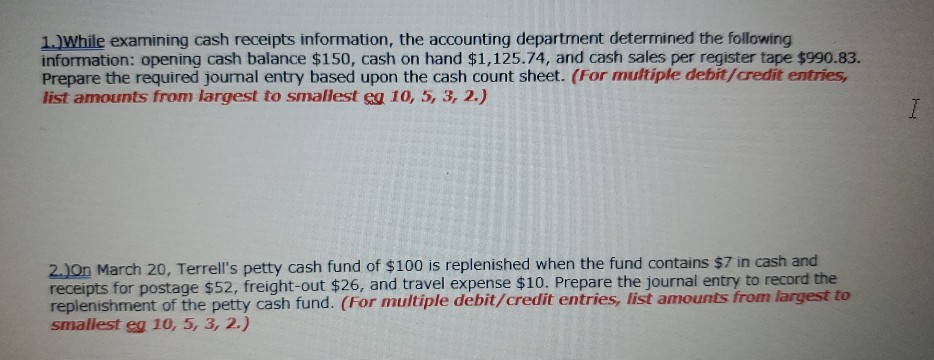

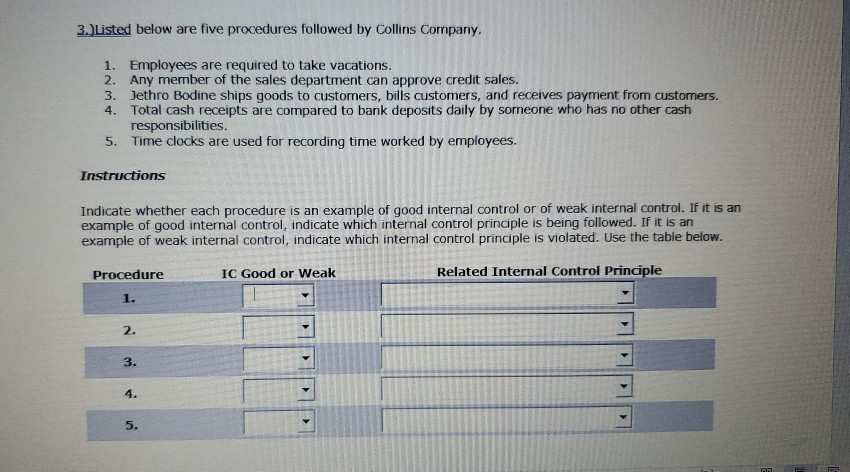

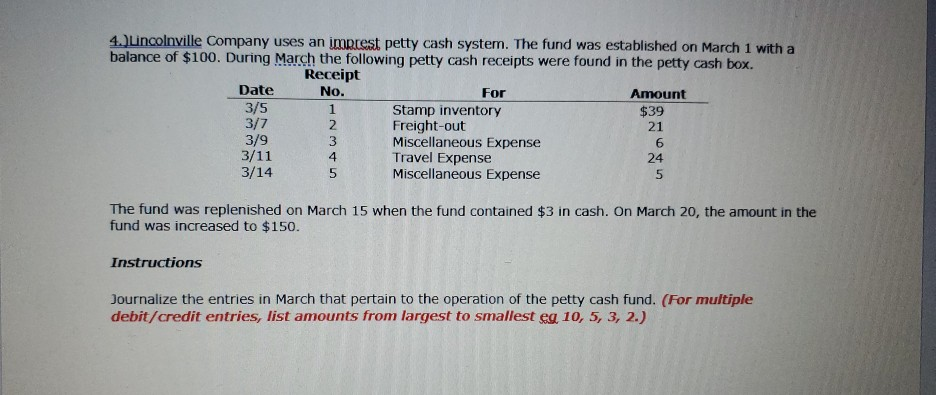

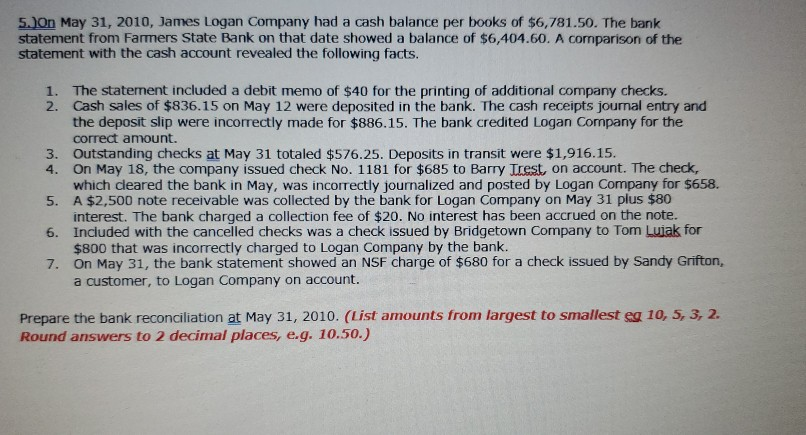

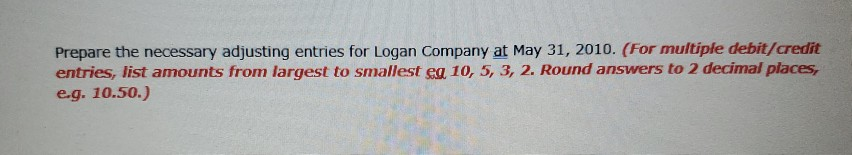

1. While examining cash receipts information, the accounting department determined the following information: opening cash balance $150, cash on hand $1,125.74, and cash sales per register tape $990.83. Prepare the required journal entry based upon the cash count sheet. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3, 2.) 7 2.)On March 20, Terrell's petty cash fund of $100 is replenished when the fund contains $7 in cash and receipts for postage $52, freight-out $26, and travel expense $10. Prepare the journal entry to record the replenishment of the petty cash fund. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3, 2.) 3.)Listed below are five procedures followed by Collins Company. 1. Employees are required to take vacations. 2. Any member of the sales department can approve credit sales. 3. Jethro Bodine ships goods to customers, bills customers, and receives payment from customers. 4. Total cash receipts are compared to bank deposits daily by someone who has no other cash responsibilities. 5. Time clocks are used for recording time worked by employees. Instructions Indicate whether each procedure is an example of good internal control or of weak internal control. If it is an example of good internal control, indicate which internal control principle is being followed. If it is an example of weak internal control, indicate which internal control principle is violated. Use the table below. IC Good or Weak Related Internal Control Principle Procedure 1. 2. 3. 5. 4. Lincolnville Company uses an imrcest petty cash system. The fund was established on March 1 with a balance of $100. During March the following petty cash receipts were found in the petty cash box. Receipt Date No. For Amount 3/5 1 Stamp inventory $39 3/7 Freight-out 21 3/9 Miscellaneous Expense 6 3/11 Travel Expense 24 3/14 Miscellaneous Expense 5 UAWN The fund was replenished on March 15 when the fund contained $3 in cash. On March 20, the amount in the fund was increased to $150. Instructions Journalize the entries in March that pertain to the operation of the petty cash fund. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3, 2.) 5.On May 31, 2010, James Logan Company had a cash balance per books of $6,781.50. The bank statement from Farmers State Bank on that date showed a balance of $6,404.60. A comparison of the statement with the cash account revealed the following facts. 1. The statement included a debit memo of $40 for the printing of additional company checks. 2. Cash sales of $836.15 on May 12 were deposited in the bank. The cash receipts journal entry and the deposit slip were incorrectly made for $886.15. The bank credited Logan Company for the correct amount. 3. Outstanding checks at May 31 totaled $576.25. Deposits in transit were $1,916.15. 4. On May 18, the company issued check No. 1181 for $685 to Barry Trest, on account. The check, which cleared the bank in May, was incorrectly journalized and posted by Logan Company for $658. 5. A $2,500 note receivable was collected by the bank for Logan Company on May 31 plus $80 interest. The bank charged a collection fee of $20. No interest has been accrued on the note. 6. Included with the cancelled checks was a check issued by Bridgetown Company to Tom Luiak for $800 that was incorrectly charged to Logan Company by the bank. 7. On May 31, the bank statement showed an NSF charge of $680 for a check issued by Sandy Grifton, a customer, to Logan Company on account. Prepare the bank reconciliation at May 31, 2010. (List amounts from largest to smallest eg 10, 5, 3, 2. Round answers to 2 decimal places, e.g. 10.50.) Prepare the necessary adjusting entries for Logan Company at May 31, 2010. (For multiple debit/credit entries, list amounts from largest to smallest ea 10, 5, 3, 2. Round answers to 2 decimal places, e.g. 10.50.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started