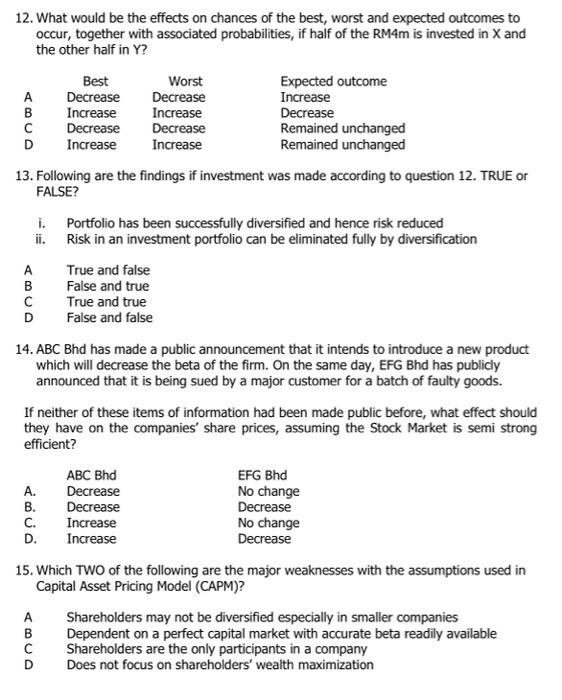

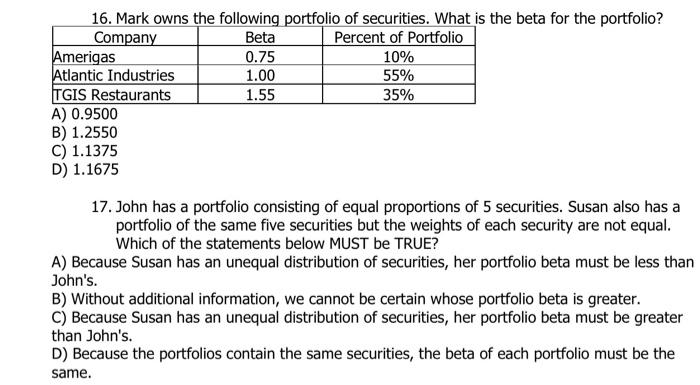

12. What would be the effects on chances of the best, worst and expected outcomes to occur, together with associated probabilities, if half of the RM4m is invested in X and the other half in Y? B Best Worst Expected outcome A Decrease Decrease Increase B Increase Increase Decrease Decrease Decrease Remained unchanged D Increase Increase Remained unchanged 13. Following are the findings if investment was made according to question 12. TRUE or FALSE? i. Portfolio has been successfully diversified and hence risk reduced ii. Risk in an investment portfolio can be eliminated fully by diversification True and false False and true True and true D False and false 14. ABC Bhd has made a public announcement that it intends to introduce a new product which will decrease the beta of the firm. On the same day, EFG Bhd has publicly announced that it is being sued by a major customer for a batch of faulty goods. If neither of these items of information had been made public before, what effect should they have on the companies' share prices, assuming the Stock Market is semi strong efficient? ABC Bhd EFG Bhd A. Decrease No change B. Decrease Decrease C. Increase No change D. Increase Decrease 15. Which TWO of the following are the major weaknesses with the assumptions used in Capital Asset Pricing Model (CAPM)? Shareholders may not be diversified especially in smaller companies B Dependent on a perfect capital market with accurate beta readily available Shareholders are the only participants in a company Does not focus on shareholders' wealth maximization A D 16. Mark owns the following portfolio of securities. What is the beta for the portfolio? Company Beta Percent of Portfolio Amerigas 0.75 10% Atlantic Industries 1.00 55% TGIS Restaurants 1.55 35% A) 0.9500 B) 1.2550 C) 1.1375 D) 1.1675 17. John has a portfolio consisting of equal proportions of 5 securities. Susan also has a portfolio of the same five securities but the weights of each security are not equal. Which of the statements below MUST be TRUE? A) Because Susan has an unequal distribution of securities, her portfolio beta must be less than John's. B) Without additional information, we cannot be certain whose portfolio beta is greater. C) Because Susan has an unequal distribution of securities, her portfolio beta must be greater than John's. D) Because the portfolios contain the same securities, the beta of each portfolio must be the same. 12. What would be the effects on chances of the best, worst and expected outcomes to occur, together with associated probabilities, if half of the RM4m is invested in X and the other half in Y? B Best Worst Expected outcome A Decrease Decrease Increase B Increase Increase Decrease Decrease Decrease Remained unchanged D Increase Increase Remained unchanged 13. Following are the findings if investment was made according to question 12. TRUE or FALSE? i. Portfolio has been successfully diversified and hence risk reduced ii. Risk in an investment portfolio can be eliminated fully by diversification True and false False and true True and true D False and false 14. ABC Bhd has made a public announcement that it intends to introduce a new product which will decrease the beta of the firm. On the same day, EFG Bhd has publicly announced that it is being sued by a major customer for a batch of faulty goods. If neither of these items of information had been made public before, what effect should they have on the companies' share prices, assuming the Stock Market is semi strong efficient? ABC Bhd EFG Bhd A. Decrease No change B. Decrease Decrease C. Increase No change D. Increase Decrease 15. Which TWO of the following are the major weaknesses with the assumptions used in Capital Asset Pricing Model (CAPM)? Shareholders may not be diversified especially in smaller companies B Dependent on a perfect capital market with accurate beta readily available Shareholders are the only participants in a company Does not focus on shareholders' wealth maximization A D 16. Mark owns the following portfolio of securities. What is the beta for the portfolio? Company Beta Percent of Portfolio Amerigas 0.75 10% Atlantic Industries 1.00 55% TGIS Restaurants 1.55 35% A) 0.9500 B) 1.2550 C) 1.1375 D) 1.1675 17. John has a portfolio consisting of equal proportions of 5 securities. Susan also has a portfolio of the same five securities but the weights of each security are not equal. Which of the statements below MUST be TRUE? A) Because Susan has an unequal distribution of securities, her portfolio beta must be less than John's. B) Without additional information, we cannot be certain whose portfolio beta is greater. C) Because Susan has an unequal distribution of securities, her portfolio beta must be greater than John's. D) Because the portfolios contain the same securities, the beta of each portfolio must be the same