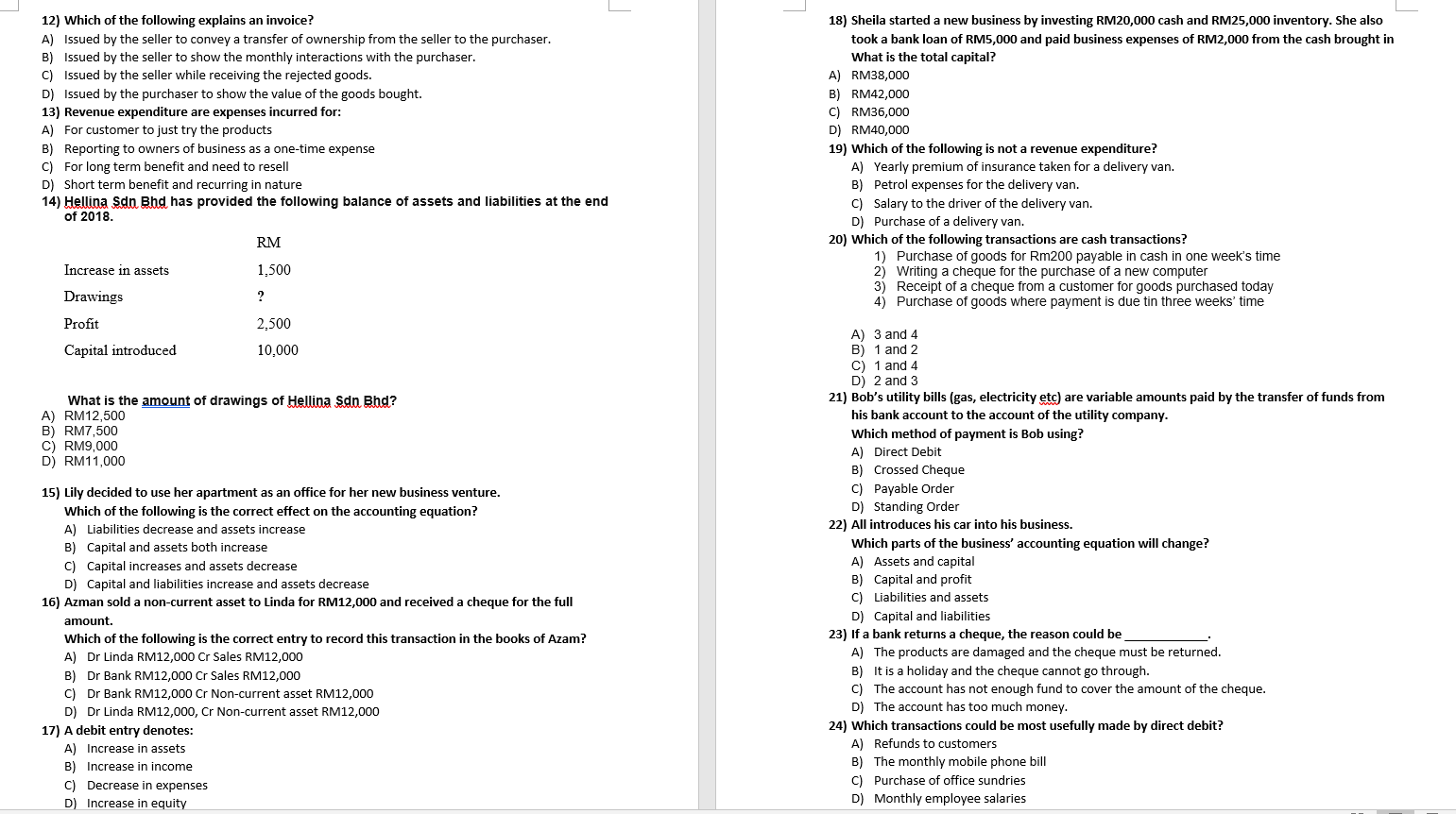

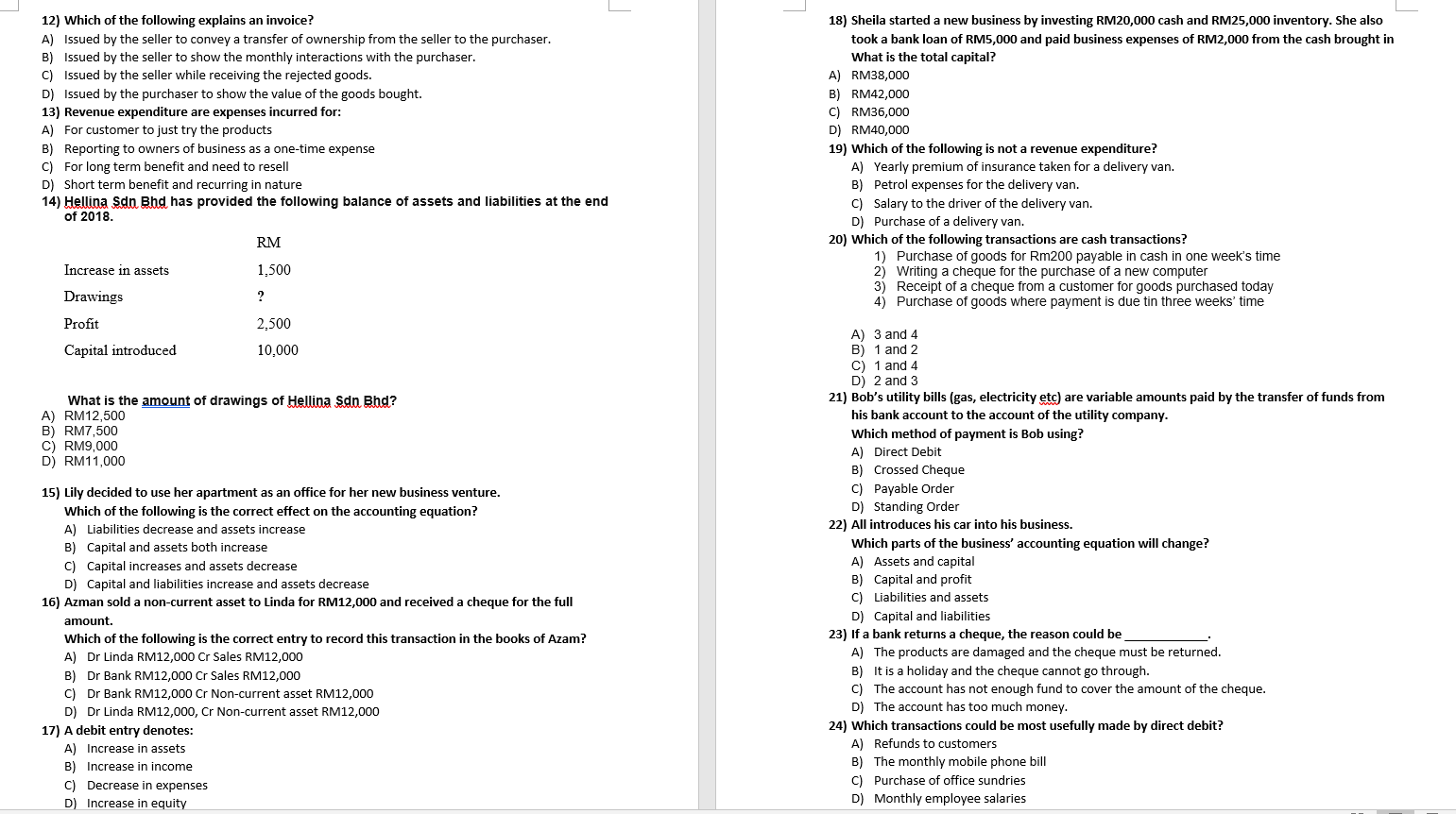

12) Which of the following explains an invoice? A) Issued by the seller to convey a transfer of ownership from the seller to the purchaser. B) Issued by the seller to show the monthly interactions with the purchaser. C) Issued by the seller while receiving the rejected goods. D) Issued by the purchaser to show the value of the goods bought. 13) Revenue expenditure are expenses incurred for: A) For customer to just try the products B) Reporting to owners of business as a one-time expense C) For long term benefit and need to resell D) Short term benefit and recurring in nature 14) Hellina Sdn Bhd has provided the following balance of assets and liabilities at the end of 2018. 18) Sheila started a new business by investing RM20,000 cash and RM25,000 inventory. She also took a bank loan of RM5,000 and paid business expenses of RM2,000 from the cash brought in What is the total capital? A) RM38,000 B) RM42,000 C) RM36,000 D) RM40,000 19) Which of the following is not a revenue expenditure? A) Yearly premium of insurance taken for a delivery van. B) Petrol expenses for the delivery van. C) Salary to the driver of the delivery van. D) Purchase of a delivery van. 20) Which of the following transactions are cash transactions? 1) Purchase of goods for Rm200 payable in cash in one week's time 2) Writing a cheque for the purchase of a new computer 3) Receipt of a cheque from a customer for goods purchased today 4) Purchase of goods where payment is due tin three weeks' time RM Increase in assets 1,500 Drawings ? Profit 2,500 Capital introduced 10.000 What is the amount of drawings of Hellina Sdn Bhd? A) RM12,500 B) RM7,500 C) RM9,000 D) RM11,000 15) Lily decided to use her apartment as an office for her new business venture. Which of the following is the correct effect on the accounting equation? A) Liabilities decrease and assets increase B) Capital and assets both increase C) Capital increases and assets decrease D) Capital and liabilities increase and assets decrease 16) Azman sold a non-current asset to Linda for RM12,000 and received a cheque for the full amount. Which of the following is the correct entry to record this transaction in the books of Azam? A) Dr Linda RM12,000 Cr Sales RM12,000 B) Dr Bank RM12,000 Cr Sales RM12,000 C) Dr Bank RM12,000 Cr Non-current asset RM12,000 D) Dr Linda RM12,000, Cr Non-current asset RM12,000 17) A debit entry denotes: A) Increase in assets B) Increase in income C) Decrease in expenses D) Increase in equity A) 3 and 4 B) 1 and 2 C) 1 and 4 D) 2 and 3 21) Bob's utility bills (gas, electricity etc) are variable amounts paid by the transfer of funds from his bank account to the account of the utility company. Which method of payment is Bob using? A) Direct Debit B) Crossed Cheque C) Payable Order D) Standing Order 22) All introduces his car into his business. Which parts of the business' accounting equation will change? A) Assets and capital B) Capital and profit C) Liabilities and assets D) Capital and liabilities 23) If a bank returns a cheque, the reason could be A) The products are damaged and the cheque must be returned. B) It is a holiday and the cheque cannot go through. C) The account has not enough fund to cover the amount of the cheque. D) The account has too much money. 24) Which transactions could be most usefully made by direct debit? A) Refunds to customers B) The monthly mobile phone bill C) Purchase of office sundries D) Monthly employee salaries