Answered step by step

Verified Expert Solution

Question

1 Approved Answer

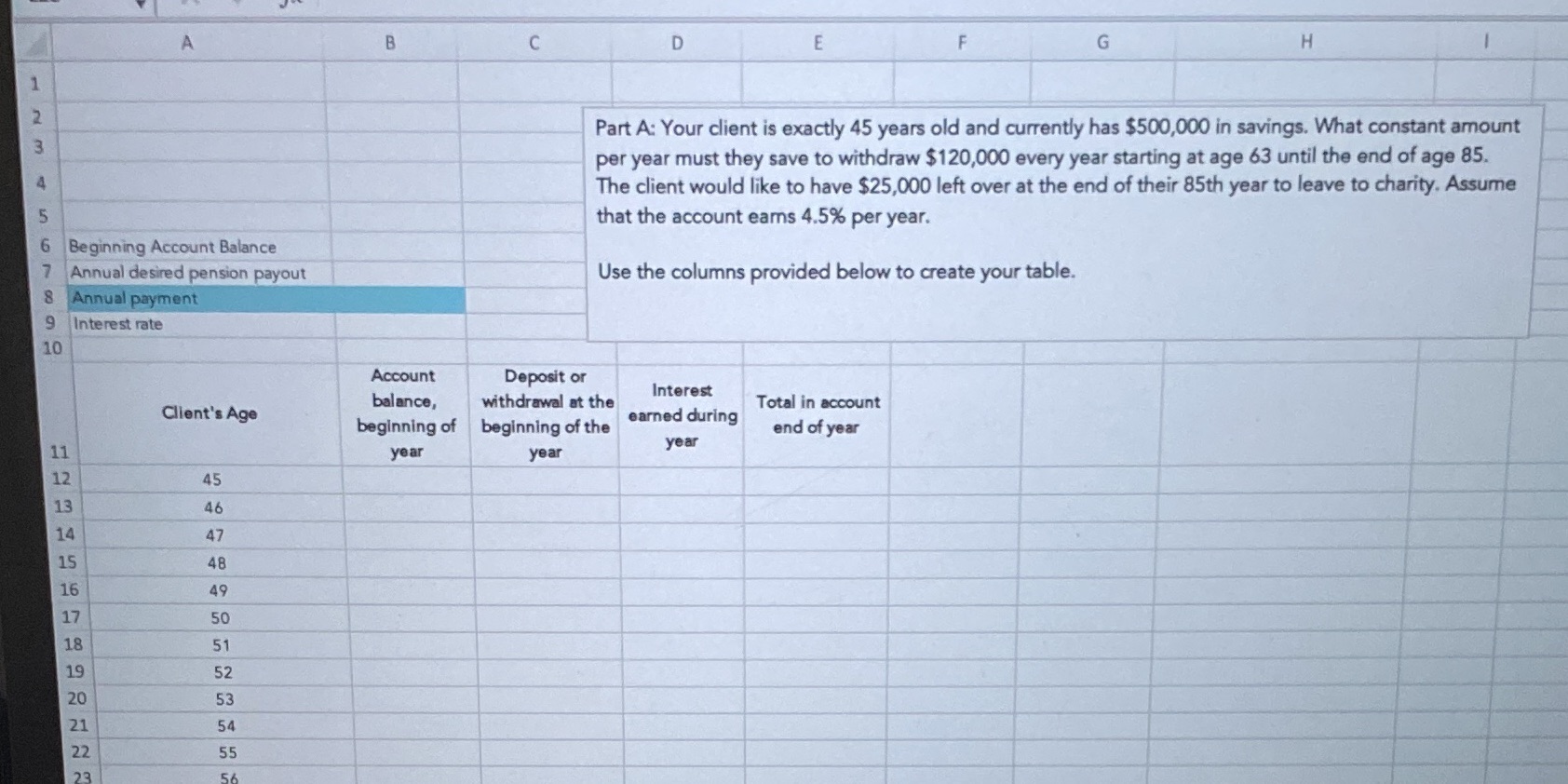

123 4 A 5 6 Beginning Account Balance 7 Annual desired pension payout 8 Annual payment Interest rate 9 10 11 12 13 14

123 4 A 5 6 Beginning Account Balance 7 Annual desired pension payout 8 Annual payment Interest rate 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 Client's Age 45 46 47 48 49 50 51 52 53 54 55 56 B Account balance, beginning of year C D Deposit or withdrawal at the beginning of the year E Interest earned during year F Total in account end of year G Part A: Your client is exactly 45 years old and currently has $500,000 in savings. What constant amount per year must they save to withdraw $120,000 every year starting at age 63 until the end of age 85. The client would like to have $25,000 left over at the end of their 85th year to leave to charity. Assume that the account earns 4.5% per year. Use the columns provided below to create your table. H 1

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the constant amount per year that the client needs to save we can use the following for...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started