Answered step by step

Verified Expert Solution

Question

1 Approved Answer

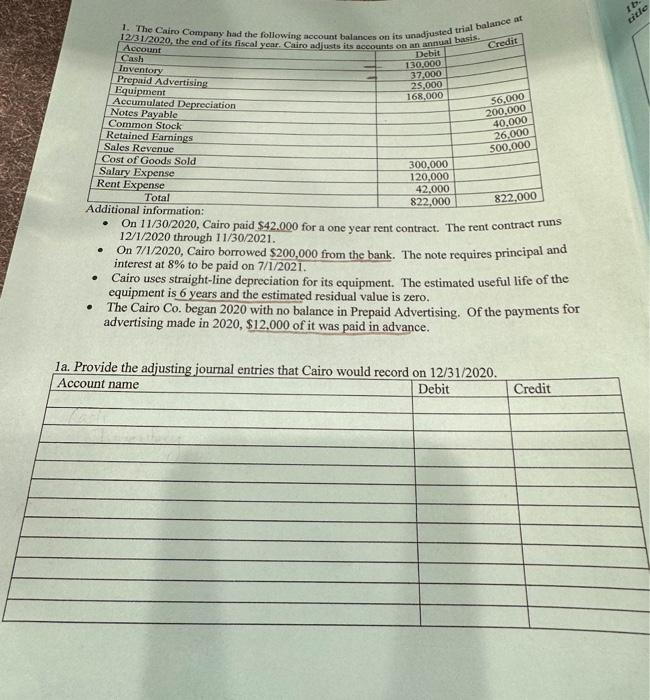

12/31/2020, the end of its fiscal year. Cairo adjusts its accounts on an annual basis. 1. The Cairo Company had the following account balances

12/31/2020, the end of its fiscal year. Cairo adjusts its accounts on an annual basis. 1. The Cairo Company had the following account balances on its unadjusted trial balance at Account Credit Debit Cash Inventory 130,000 37,000 Prepaid Advertising Equipment 25,000 168,000 Accumulated Depreciation Notes Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Salary Expense Rent Expense Total . 822,000 Additional information: On 11/30/2020, Cairo paid $42.000 for a one year rent contract. The rent contract runs 12/1/2020 through 11/30/2021. On 7/1/2020, Cairo borrowed $200,000 from the bank. The note requires principal and interest at 8% to be paid on 7/1/2021. . . 300,000 120,000 42,000 822,000 56,000 200,000 40,000 26,000 500,000 Cairo uses straight-line depreciation for its equipment. The estimated useful life of the equipment is 6 years and the estimated residual value is zero. The Cairo Co. began 2020 with no balance in Prepaid Advertising. Of the payments for advertising made in 2020, $12,000 of it was paid in advance. 1a. Provide the adjusting journal entries that Cairo would record on 12/31/2020. Account name Debit Credit 1b. title

Step by Step Solution

★★★★★

3.27 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Date 12312020 12312020 12312020 Adjustment Journal Entries as on 12312020 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started