Answered step by step

Verified Expert Solution

Question

1 Approved Answer

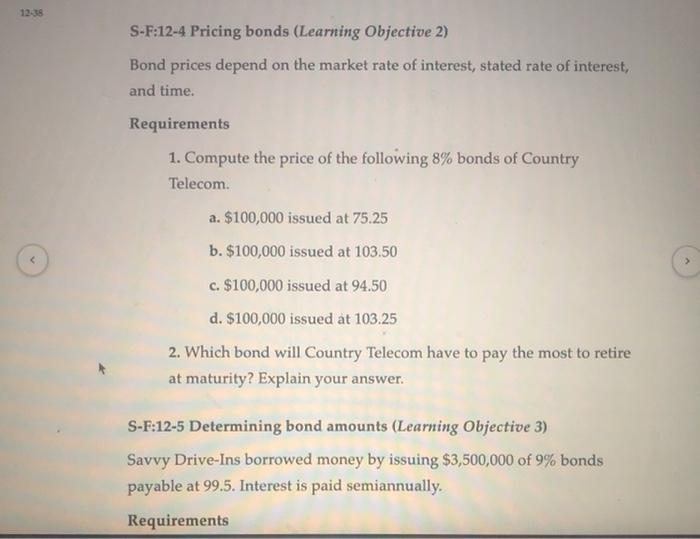

12-38 S-F:12-4 Pricing bonds (Learning Objective 2) Bond prices depend on the market rate of interest, stated rate of interest, and time. Requirements 1.

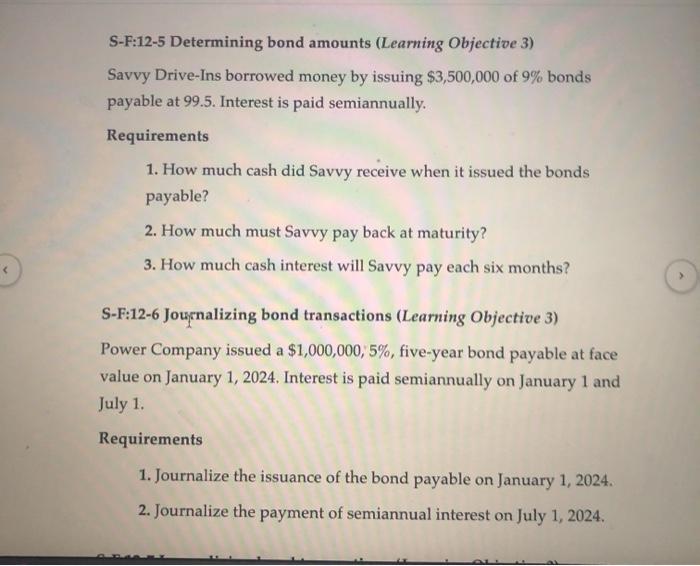

12-38 S-F:12-4 Pricing bonds (Learning Objective 2) Bond prices depend on the market rate of interest, stated rate of interest, and time. Requirements 1. Compute the price of the following 8% bonds of Country Telecom. a. $100,000 issued at 75.25 b. $100,000 issued at 103.50 c. $100,000 issued at 94.50 d. $100,000 issued at 103.25 2. Which bond will Country Telecom have to pay the most to retire at maturity? Explain your answer. S-F:12-5 Determining bond amounts (Learning Objective 3) Savvy Drive-Ins borrowed money by issuing $3,500,000 of 9% bonds payable at 99.5. Interest is paid semiannually. Requirements S-F:12-5 Determining bond amounts (Learning Objective 3) Savvy Drive-Ins borrowed money by issuing $3,500,000 of 9% bonds payable at 99.5. Interest is paid semiannually. Requirements 1. How much cash did Savvy receive when it issued the bonds payable? 2. How much must Savvy pay back at maturity? 3. How much cash interest will Savvy pay each six months? S-F:12-6 Journalizing bond transactions (Learning Objective 3) Power Company issued a $1,000,000, 5%, five-year bond payable at face value on January 1, 2024. Interest is paid semiannually on January 1 and July 1. Requirements 1. Journalize the issuance of the bond payable on January 1, 2024. 2. Journalize the payment of semiannual interest on July 1, 2024.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SF124 1 Price of the bond Face value x Issue rate 75250 103500 94500 103...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started