Answered step by step

Verified Expert Solution

Question

1 Approved Answer

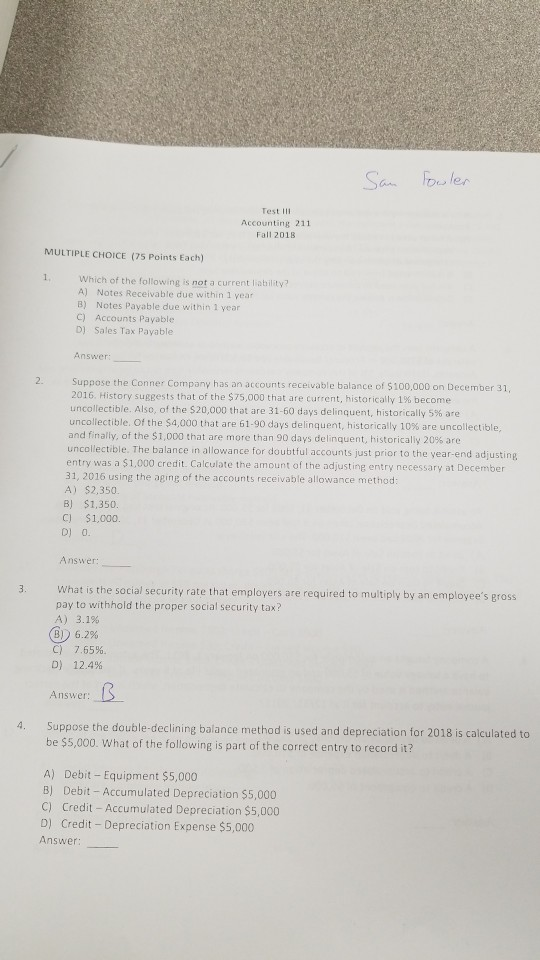

1-2,4 Test III Accounting 211 Fall 201B MULTIPLE CHOICE (75 Points Each) 1, Which of the following is not a current liability? A) Notes Receivable

1-2,4

Test III Accounting 211 Fall 201B MULTIPLE CHOICE (75 Points Each) 1, Which of the following is not a current liability? A) Notes Receivable due within 1 year B) Notes Payable due within 1 year C) Accounts Payable D) Sales Tax Payable Answer 2. Suppose the Conner Company has an accounts receivable balance of $100,000 on December 31, 2016" History suggests that of the $75,000 that are current, historically 1% become uncollectible. Also, of the S2 0,000 that are 31-60 days delinquent, historically 5% are uncollectible. Of the $4,000 that are 61.90 days delinquent, historically 10% are uncollectible and finally, of the $1,000 that are more than 90 days delinquent, historical',20% are uncollectible. The balance in allowance for doubtful accounts just prior to the year-end adjusting entry was a $1,000 credit. Calculate the amount of the adjusting entry necessary at December 31, 2016 using the aging of the accounts receivable allowance method A) $2,350 B) $1,350. C) $1,000. Answer:- What is the social security rate that employers are required to multiply by an employee's gross pay to withhold the proper social security tax? A) 3.1% B) 6.2% C) 7.65%. D) 12.4% Answer Suppose the double-declining balance method is used and depreciation for 2018 is calculated to be $5,000. What of the following is part of the correct entry to record it? 4. A) Debit - Equipment $5,000 B) Debit - Accumulated Depreciation $5,000 C) Credit - Accumulated Depreciation $5,000 D) Credit - Depreciation Expense $5,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started