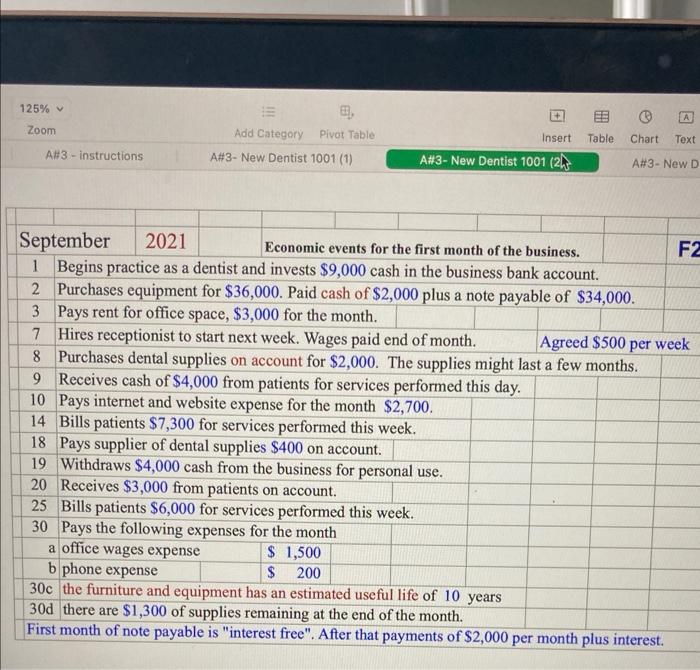

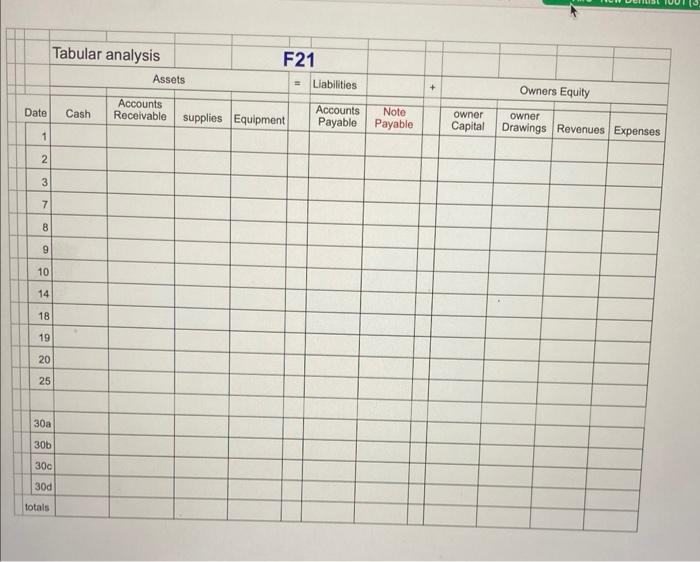

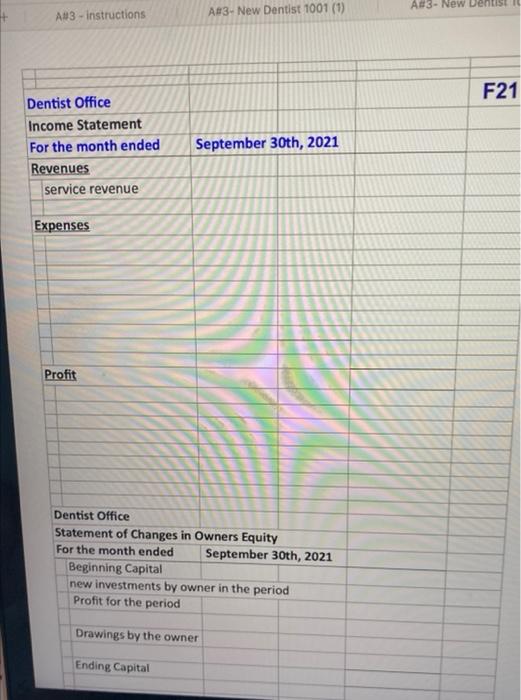

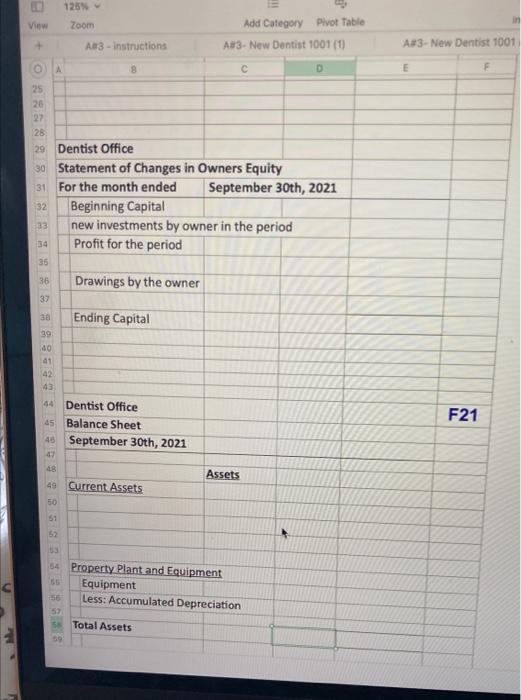

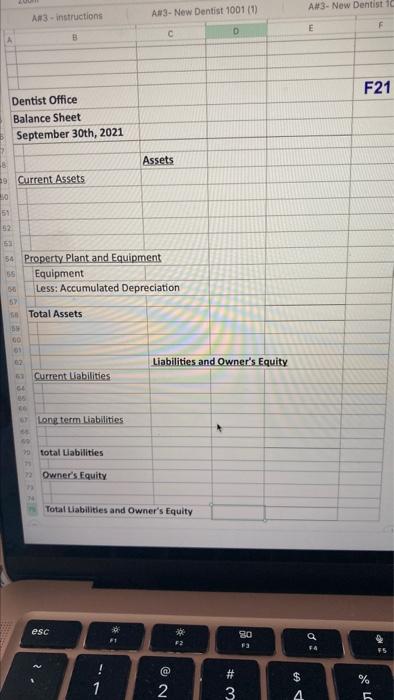

125% A Zoom e Add Category Pivot Table A#3 - New Dentist 1001 (1) Insert Table Chart Text A#3 - instructions A#3 - New Dentist 1001 (2 A#3 - New D September 2021 Economic events for the first month of the business. F2 1 Begins practice as a dentist and invests $9,000 cash in the business bank account. 2 Purchases equipment for $36,000. Paid cash of $2,000 plus a note payable of $34,000. 3 Pays rent for office space, $3,000 for the month. 7 Hires receptionist to start next week. Wages paid end of month. Agreed $500 per week 8 Purchases dental supplies on account for $2,000. The supplies might last a few months. 9 Receives cash of $4,000 from patients for services performed this day. 10 Pays internet and website expense for the month $2,700. 14 Bills patients $7,300 for services performed this week. 18 Pays supplier of dental supplies $400 on account. 19 Withdraws $4,000 cash from the business for personal use. 20 Receives $3,000 from patients on account. 25 Bills patients $6,000 for services performed this week. 30 Pays the following expenses for the month a office wages expense $ 1,500 b phone expense $ 200 30c the furniture and equipment has an estimated useful life of 10 years 30d there are $1,300 of supplies remaining at the end of the month. First month of note payable is "interest free". After that payments of $2,000 per month plus interest. Tabular analysis F21 Liabilities Assets + Owners Equity Date Cash Accounts Receivable supplies Equipment Note Accounts Payable Payable owner owner Capital Drawings Revenues Expenses 1 2 2 3 ON 7 8 g 9 10 14 18 19 20 25 30a 30b 300 30d totals A3- New Dentist A#3 - Instructions A83. New Dentist 1001 (1) F21 Dentist Office Income Statement For the month ended Revenues service revenue September 30th, 2021 Expenses Profit Dentist Office Statement of Changes in Owners Equity For the month ended September 30th, 2021 Beginning Capital new investments by owner in the period Profit for the period Drawings by the owner Ending Capital 125% Zoom View Add Category Pivot Table + A3 - instructions A83- New Dentist 1001 (1) A#3- New Dentist 1001 8 D E F 25 26 27 28 29 Dentist Office 30 Statement of Changes in Owners Equity 31 For the month ended September 30th, 2021 32 Beginning Capital 33 new investments by owner in the period Profit for the period 35 Drawings by the owner 37 Ending Capital 39 34 36 38 40 41 42 43 F21 84 Dentist Office 45 Balance Sheet 48 September 30th, 2021 47 Assets 49 Current Assets 50 51 52 64 Property Plant and Equipment Equipment Less: Accumulated Depreciation 53 Total Assets AX3. New Dentist All-New Dentist 1001 (1) A3 - instructions E F 0 B F21 Dentist Office Balance Sheet September 30th, 2021 Assets Current Assets 20 51 52 53 54 Property Plant and Equipment Equipment Less: Accumulated Depreciation 5 Total Assets 15 00 61 62 Liabilities and Owner's Equity Current Liabilities 05 Long term Liabilities o total Labilities Owner's Equity Total abilities and Owner's Equity R esc * 30 F2 a F 45 @ * 1 2 W# $ 4 3 % 5