Answered step by step

Verified Expert Solution

Question

1 Approved Answer

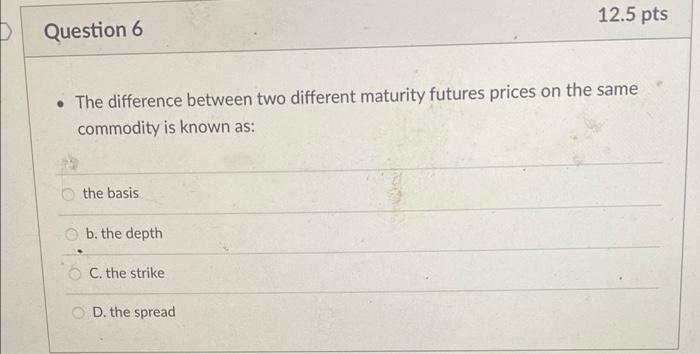

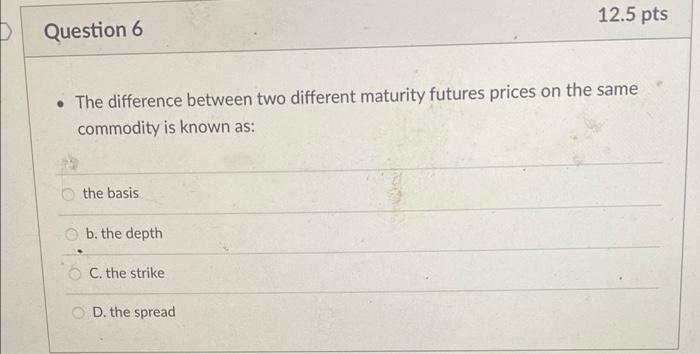

12.5 pts Question 6 The difference between two different maturity futures prices on the same commodity is known as: the basis b. the depth C.

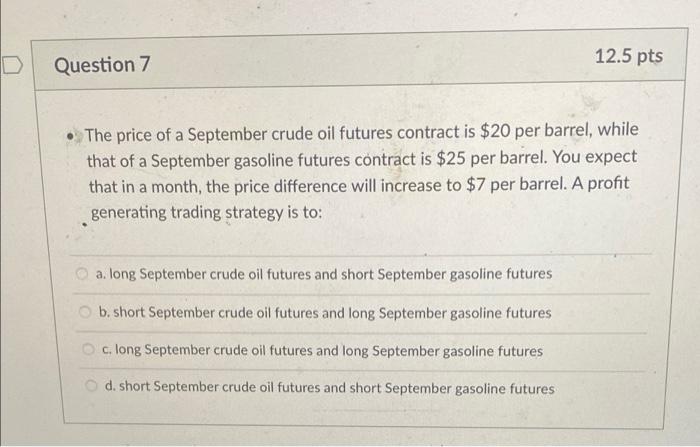

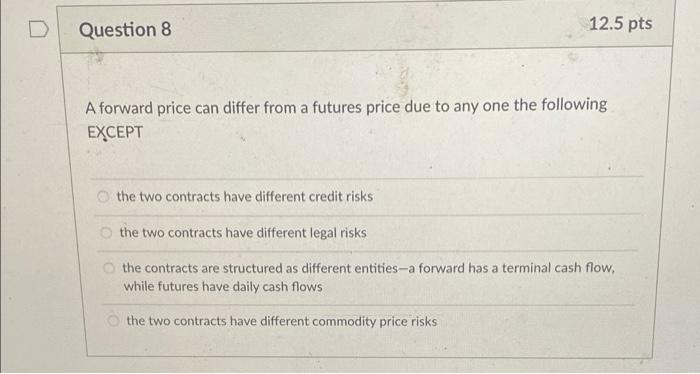

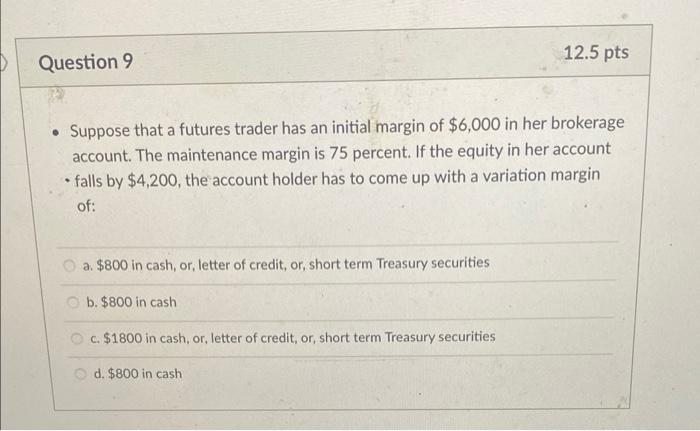

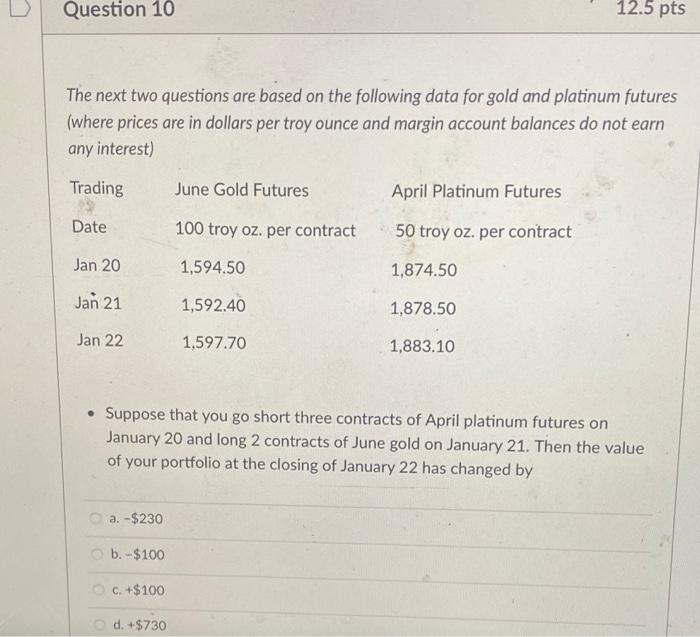

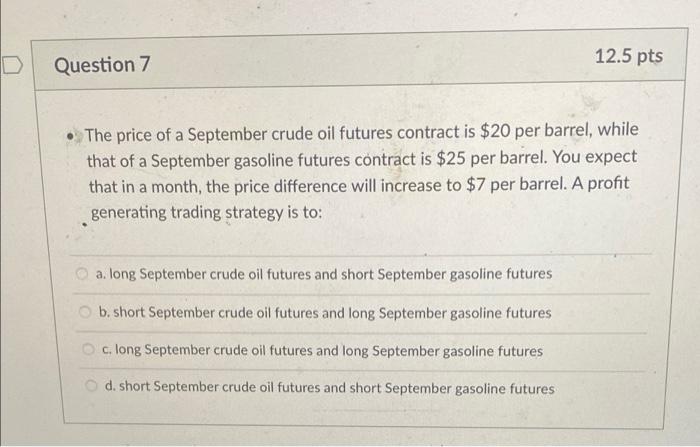

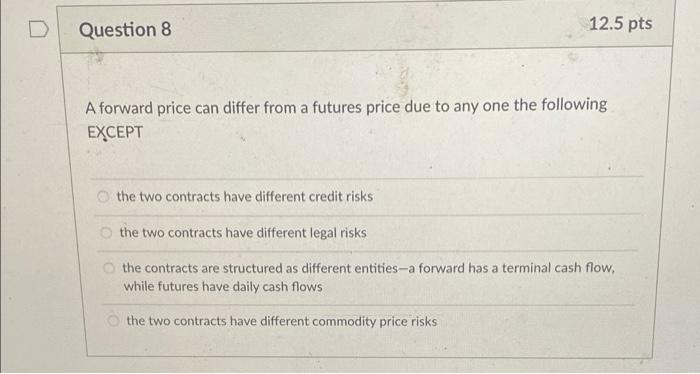

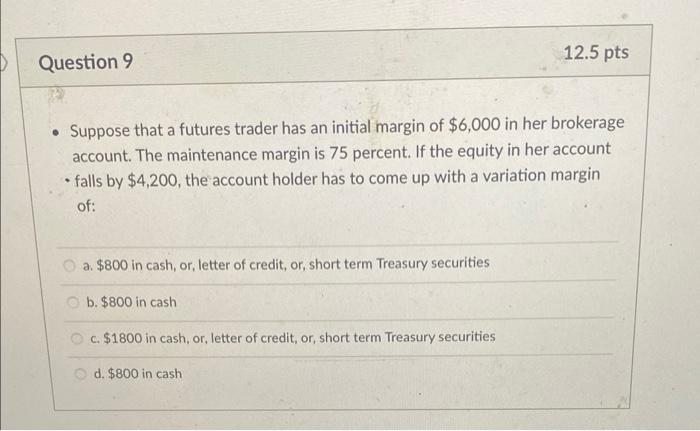

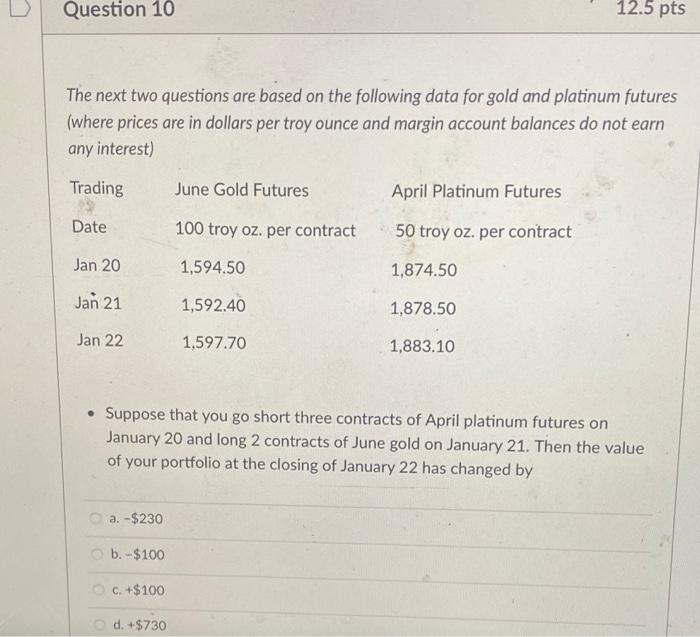

12.5 pts Question 6 The difference between two different maturity futures prices on the same commodity is known as: the basis b. the depth C. the strike D. the spread Question 7 12.5 pts The price of a September crude oil futures contract is $20 per barrel, while that of a September gasoline futures contract is $25 per barrel. You expect that in a month, the price difference will increase to $7 per barrel. A profit generating trading strategy is to: a. long September crude oil futures and short September gasoline futures b. short September crude oil futures and long September gasoline futures c. long September crude oil futures and long September gasoline futures d. short September crude oil futures and short September gasoline futures Question 8 12.5 pts A forward price can differ from a futures price due to any one the following EXCEPT the two contracts have different credit risks the two contracts have different legal risks the contracts are structured as different entities-a forward has a terminal cash flow, while futures have daily cash flows the two contracts have different commodity price risks 12.5 pts Question 9 Suppose that a futures trader has an initial margin of $6,000 in her brokerage account. The maintenance margin is 75 percent. If the equity in her account falls by $4,200, the account holder has to come up with a variation margin of: a $800 in cash, or, letter of credit, or, short term Treasury securities b. $800 in cash c. $1800 in cash, or, letter of credit, or, short term Treasury securities d. $800 in cash Question 10 12.5 pts The next two questions are based on the following data for gold and platinum futures (where prices are in dollars per troy ounce and margin account balances do not earn any interest) Trading June Gold Futures April Platinum Futures Date 100 troy oz. per contract 50 troy oz. per contract Jan 20 1,594.50 1,874.50 Jan 21 1,592.40 1,878.50 Jan 22 1,597.70 1,883.10 Suppose that you go short three contracts of April platinum futures on January 20 and long 2 contracts of June gold on January 21. Then the value of your portfolio at the closing of January 22 has changed by a. -$230 b. -$100 C. +$100 d. +$730

12.5 pts Question 6 The difference between two different maturity futures prices on the same commodity is known as: the basis b. the depth C. the strike D. the spread Question 7 12.5 pts The price of a September crude oil futures contract is $20 per barrel, while that of a September gasoline futures contract is $25 per barrel. You expect that in a month, the price difference will increase to $7 per barrel. A profit generating trading strategy is to: a. long September crude oil futures and short September gasoline futures b. short September crude oil futures and long September gasoline futures c. long September crude oil futures and long September gasoline futures d. short September crude oil futures and short September gasoline futures Question 8 12.5 pts A forward price can differ from a futures price due to any one the following EXCEPT the two contracts have different credit risks the two contracts have different legal risks the contracts are structured as different entities-a forward has a terminal cash flow, while futures have daily cash flows the two contracts have different commodity price risks 12.5 pts Question 9 Suppose that a futures trader has an initial margin of $6,000 in her brokerage account. The maintenance margin is 75 percent. If the equity in her account falls by $4,200, the account holder has to come up with a variation margin of: a $800 in cash, or, letter of credit, or, short term Treasury securities b. $800 in cash c. $1800 in cash, or, letter of credit, or, short term Treasury securities d. $800 in cash Question 10 12.5 pts The next two questions are based on the following data for gold and platinum futures (where prices are in dollars per troy ounce and margin account balances do not earn any interest) Trading June Gold Futures April Platinum Futures Date 100 troy oz. per contract 50 troy oz. per contract Jan 20 1,594.50 1,874.50 Jan 21 1,592.40 1,878.50 Jan 22 1,597.70 1,883.10 Suppose that you go short three contracts of April platinum futures on January 20 and long 2 contracts of June gold on January 21. Then the value of your portfolio at the closing of January 22 has changed by a. -$230 b. -$100 C. +$100 d. +$730

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started