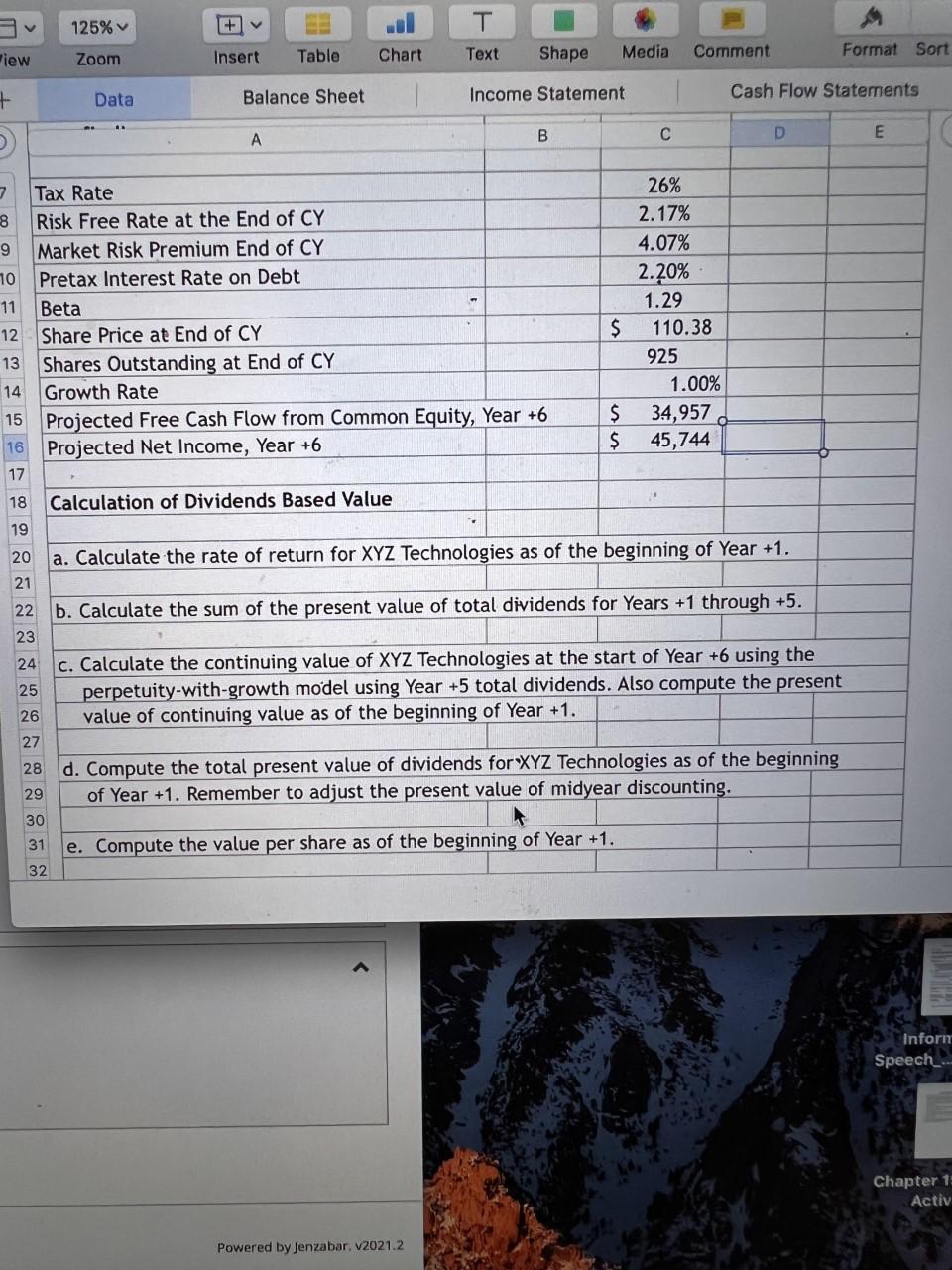

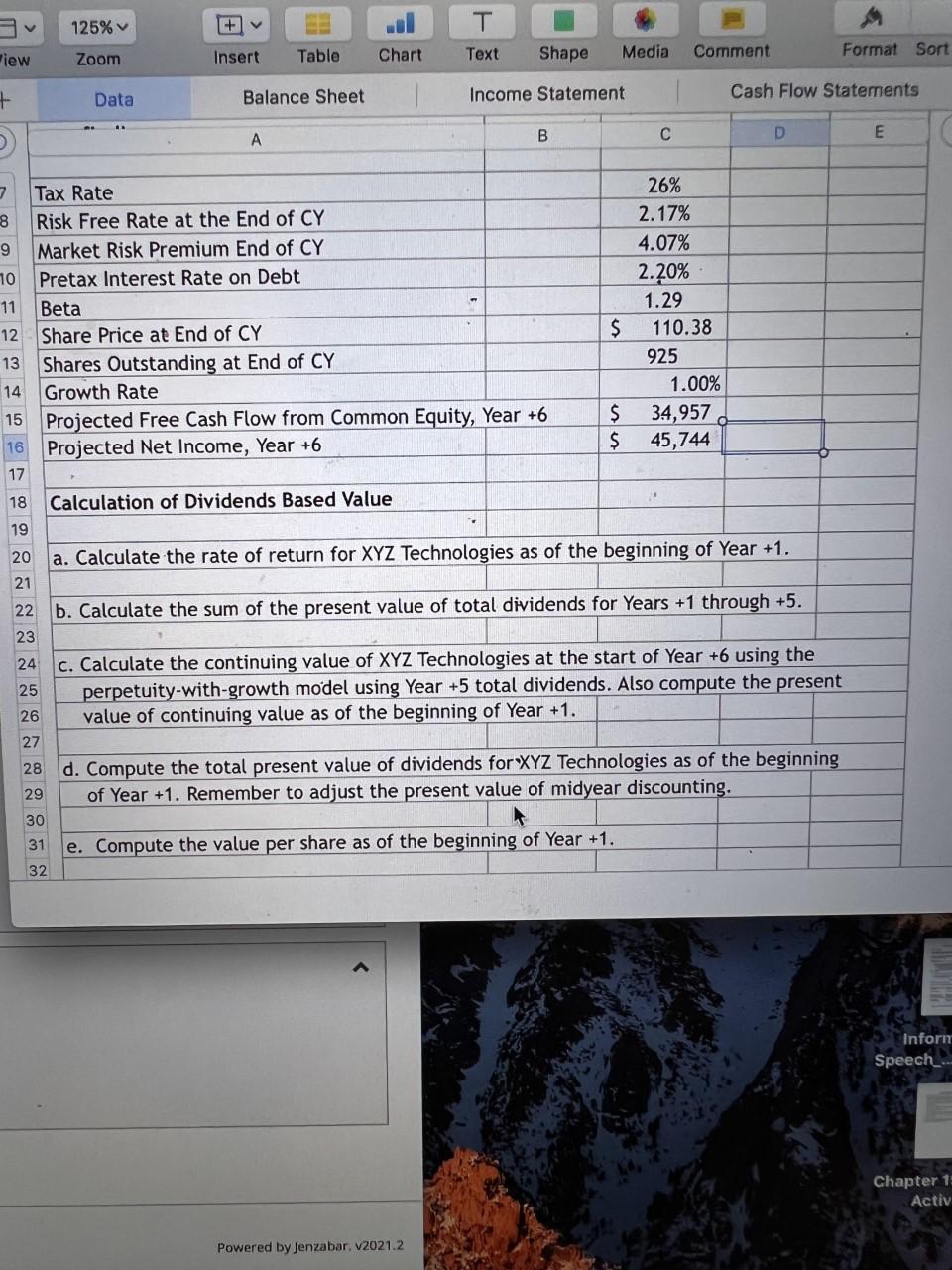

125% v F+ View Zoom Insert Table Chart Text Shape Media Format Sort Comment + Data Balance Sheet Cash Flow Statements Income Statement B D A E 7 Tax Rate 26% 8 Risk Free Rate at the End of CY 2.17% 9 Market Risk Premium End of CY 4.07% 70 Pretax Interest Rate on Debt 2.20% 11 Beta 1.29 12 Share Price at End of CY $ 110.38 13 Shares Outstanding at End of CY 925 14 Growth Rate 1.00% 15 Projected Free Cash Flow from Common Equity, Year +6 $ 34,957 16 Projected Net Income, Year +6 $ 45,744 17 18 Calculation of Dividends Based Value 19 20 a. Calculate the rate of return for XYZ Technologies as of the beginning of Year +1. 21 22 b. Calculate the sum of the present value of total dividends for Years +1 through +5. 23 24 c. Calculate the continuing value of XYZ Technologies at the start of Year +6 using the 25 perpetuity-with-growth model using Year +5 total dividends. Also compute the present 26 value of continuing value as of the beginning of Year +1. 27 28 d. Compute the total present value of dividends for XYZ Technologies as of the beginning 29 of Year +1. Remember to adjust the present value of midyear discounting. 30 31 e. Compute the value per share as of the beginning of Year +1. 32 Inforir Speech_ Chapter 1 Activ Powered by Jenzabar. V2021.2 125% v F+ View Zoom Insert Table Chart Text Shape Media Format Sort Comment + Data Balance Sheet Cash Flow Statements Income Statement B D A E 7 Tax Rate 26% 8 Risk Free Rate at the End of CY 2.17% 9 Market Risk Premium End of CY 4.07% 70 Pretax Interest Rate on Debt 2.20% 11 Beta 1.29 12 Share Price at End of CY $ 110.38 13 Shares Outstanding at End of CY 925 14 Growth Rate 1.00% 15 Projected Free Cash Flow from Common Equity, Year +6 $ 34,957 16 Projected Net Income, Year +6 $ 45,744 17 18 Calculation of Dividends Based Value 19 20 a. Calculate the rate of return for XYZ Technologies as of the beginning of Year +1. 21 22 b. Calculate the sum of the present value of total dividends for Years +1 through +5. 23 24 c. Calculate the continuing value of XYZ Technologies at the start of Year +6 using the 25 perpetuity-with-growth model using Year +5 total dividends. Also compute the present 26 value of continuing value as of the beginning of Year +1. 27 28 d. Compute the total present value of dividends for XYZ Technologies as of the beginning 29 of Year +1. Remember to adjust the present value of midyear discounting. 30 31 e. Compute the value per share as of the beginning of Year +1. 32 Inforir Speech_ Chapter 1 Activ Powered by Jenzabar. V2021.2