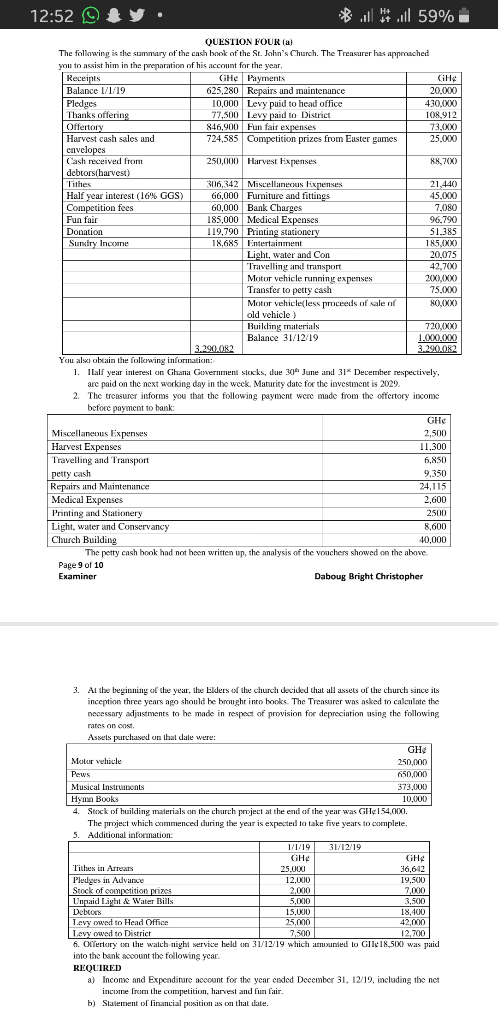

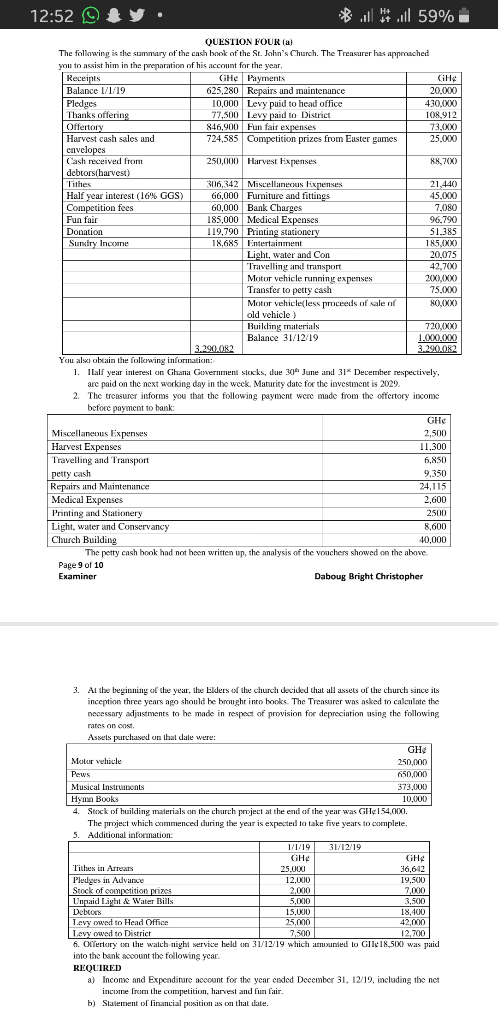

12:52 Pledges 26.100 * * Il 59% - QUESTION FOUR (A) The following is the summary of the cash book of the St. John's Church. The Treasurer has approached you to assist him in the preparation of his account for the year, Receipts GHe Payments CH Balance 1/1/19 625,280 Repairs and maintenance 20.0XX) 10,000 Levy puid to head office 430.0XX) Thanks offering 77,500 Levy paid to District 108,912 Offertory 846.900 Fun fair expenses 73.0XX Harvest cash sales and 724,585 Competition prizes from Easter games 25.0XX) cnvelopes Cash received from 250,000 Harvest Expenses 88,700) debtors harvest) Tithes 306,342 Miscellaneous Fixpenses 21,440 Half year interest (16% GGS) 66,000 Fumiture and fittings 45.000 Competition fees 60,000 Bank Charges 7.080 Fun fait 185,000 Medical Expenses 96.790 Donation 119,790 Printing stationery 51.385 Sundry Inexe 18,685 Entertainment 185,0XX) Licht, water and Con 20.075 Travelling and transport 42,70) Motor vehicle running expenses 20).XX Transfer to petty cash 75,000 Motor vehicleless proceeds of sale of 800XX) old vehicle ) Building materials 720_0xx) Balance 31/12/19 1.0XX0.0XX 3.290.082 3.290.082 You also obtain the following information: 1. Hall year interest on Ghana Gewernment stocks, due 30 June and 31* December respectively, arc paid on the next working day in the week. Maturity date for the investment is 2029 2. The treasurer inform you that the following payment were made from the offcctory income beforc payment to bank: GHE Miscellaneous Expenses 2.500 Harvest Expenses 11,300 Travelling and Transport 6,850 petty cash 9,350 Repairs and Maintenance 24,115 Medical Expenses 2.600 Printing and Stationery 2500 Light, water and Conservancy 8,600 Church Building 40.000 The petty cash book hnd not been written up, the analysis of the vouchers showed on the above Page 9 of 10 Examiner Daboug Bright Christopher 3. At the beginning of the year, the Elders of the church decided that all assets of the church since its inception three years ago should be brought into books. The Treasurer was asked to calculate the necessary adjustments to be made in respect of provision for deprecintion using the following rates on cost. Assels purchased on that date were: GH Motor vehicle 250,000 Pews 650,000 Musical Instruments 373,000 Hymn Books 10.000 4. Stock of building materials on the church project at the end of the year was GH154.000. The project which commenced during the year is expected to take five years to complete. 5. Additional information: 1/1/19 31/12/19 Cine CH Titles in Arrears 25.000 36,642 Pledges in Advance 12.000 19,500 Stock of competition prizes 2,000 7.000 Unpaid Laht & Water Bills 5,000 3,500 Debtes 15.000 Levy wed to Head Office 25,000 42,000 Levyowed to District 7,500 12,700 6. Offertery on the watch night service heli on 31/12/19 which amounted to GIIC18,500 was paid into the bank account the following year REQUIRED a) Income and Expenditure account for the year ended December 31. 12/19, including the net income from the competition, harvest and fun fair. b) Statement of financial pwitions on that date 12:52 Pledges 26.100 * * Il 59% - QUESTION FOUR (A) The following is the summary of the cash book of the St. John's Church. The Treasurer has approached you to assist him in the preparation of his account for the year, Receipts GHe Payments CH Balance 1/1/19 625,280 Repairs and maintenance 20.0XX) 10,000 Levy puid to head office 430.0XX) Thanks offering 77,500 Levy paid to District 108,912 Offertory 846.900 Fun fair expenses 73.0XX Harvest cash sales and 724,585 Competition prizes from Easter games 25.0XX) cnvelopes Cash received from 250,000 Harvest Expenses 88,700) debtors harvest) Tithes 306,342 Miscellaneous Fixpenses 21,440 Half year interest (16% GGS) 66,000 Fumiture and fittings 45.000 Competition fees 60,000 Bank Charges 7.080 Fun fait 185,000 Medical Expenses 96.790 Donation 119,790 Printing stationery 51.385 Sundry Inexe 18,685 Entertainment 185,0XX) Licht, water and Con 20.075 Travelling and transport 42,70) Motor vehicle running expenses 20).XX Transfer to petty cash 75,000 Motor vehicleless proceeds of sale of 800XX) old vehicle ) Building materials 720_0xx) Balance 31/12/19 1.0XX0.0XX 3.290.082 3.290.082 You also obtain the following information: 1. Hall year interest on Ghana Gewernment stocks, due 30 June and 31* December respectively, arc paid on the next working day in the week. Maturity date for the investment is 2029 2. The treasurer inform you that the following payment were made from the offcctory income beforc payment to bank: GHE Miscellaneous Expenses 2.500 Harvest Expenses 11,300 Travelling and Transport 6,850 petty cash 9,350 Repairs and Maintenance 24,115 Medical Expenses 2.600 Printing and Stationery 2500 Light, water and Conservancy 8,600 Church Building 40.000 The petty cash book hnd not been written up, the analysis of the vouchers showed on the above Page 9 of 10 Examiner Daboug Bright Christopher 3. At the beginning of the year, the Elders of the church decided that all assets of the church since its inception three years ago should be brought into books. The Treasurer was asked to calculate the necessary adjustments to be made in respect of provision for deprecintion using the following rates on cost. Assels purchased on that date were: GH Motor vehicle 250,000 Pews 650,000 Musical Instruments 373,000 Hymn Books 10.000 4. Stock of building materials on the church project at the end of the year was GH154.000. The project which commenced during the year is expected to take five years to complete. 5. Additional information: 1/1/19 31/12/19 Cine CH Titles in Arrears 25.000 36,642 Pledges in Advance 12.000 19,500 Stock of competition prizes 2,000 7.000 Unpaid Laht & Water Bills 5,000 3,500 Debtes 15.000 Levy wed to Head Office 25,000 42,000 Levyowed to District 7,500 12,700 6. Offertery on the watch night service heli on 31/12/19 which amounted to GIIC18,500 was paid into the bank account the following year REQUIRED a) Income and Expenditure account for the year ended December 31. 12/19, including the net income from the competition, harvest and fun fair. b) Statement of financial pwitions on that date