13.

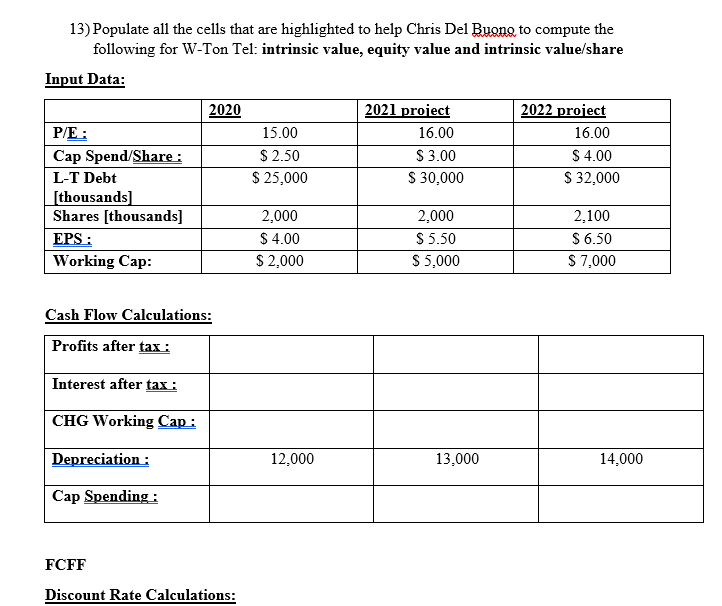

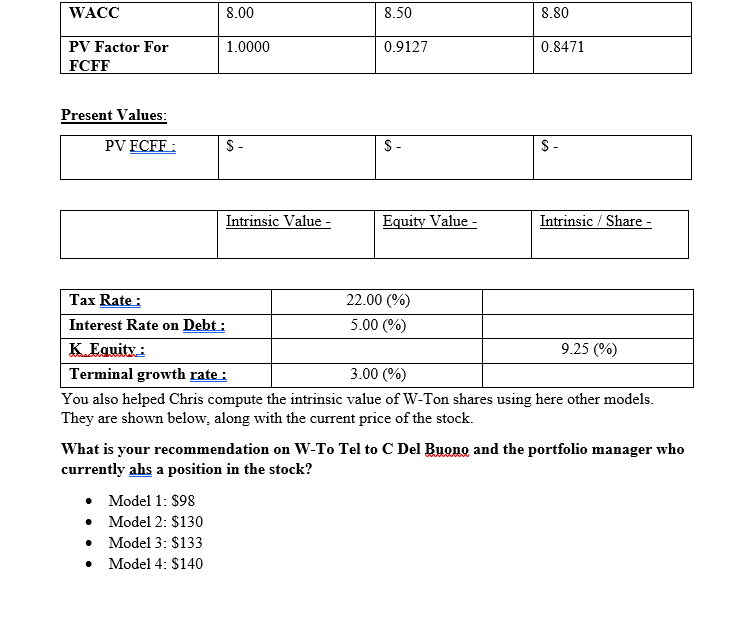

13) Populate all the cells that are highlighted to help Chris Del Buong to compute the following for W-Ton Tel: intrinsic value, equity value and intrinsic value/share Input Data: 2020 P/E: Cap Spend/Share: L-T Debt [thousands) Shares [thousands] 15.00 $ 2.50 $ 25,000 2021 project 16.00 S 3.00 $ 30,000 2022 project 16.00 $ 4.00 S 32,000 EPS : 2,000 $ 4.00 $ 2,000 2,000 $ 5.50 $ 5,000 2.100 $6.50 $ 7,000 Working Cap: Cash Flow Calculations: Profits after tax: Interest after tax : CHG Working Cap: Depreciation: 12,000 13,000 14.000 Cap Spending : FCFF Discount Rate Calculations: WACC 8.00 8.50 8.80 1.0000 0.9127 0.8471 PV Factor For FCFF Present Values: PV FCFF: S- S- S- Intrinsic Value - Equity Value - Intrinsic / Share - Tax Rate : 22.00% Interest Rate on Debt: 5.00 %) K. Equity: 9.25 (%) Terminal growth rate : 3.00(%) You also helped Chris compute the intrinsic value of W-Ton shares using here other models. They are shown below, along with the current price of the stock. What is your recommendation on W-To Tel to C Del Buono and the portfolio manager who currently ahs a position in the stock? Model 1: $98 Model 2: $130 Model 3: $133 Model 4: $140 13) Populate all the cells that are highlighted to help Chris Del Buong to compute the following for W-Ton Tel: intrinsic value, equity value and intrinsic value/share Input Data: 2020 P/E: Cap Spend/Share: L-T Debt [thousands) Shares [thousands] 15.00 $ 2.50 $ 25,000 2021 project 16.00 S 3.00 $ 30,000 2022 project 16.00 $ 4.00 S 32,000 EPS : 2,000 $ 4.00 $ 2,000 2,000 $ 5.50 $ 5,000 2.100 $6.50 $ 7,000 Working Cap: Cash Flow Calculations: Profits after tax: Interest after tax : CHG Working Cap: Depreciation: 12,000 13,000 14.000 Cap Spending : FCFF Discount Rate Calculations: WACC 8.00 8.50 8.80 1.0000 0.9127 0.8471 PV Factor For FCFF Present Values: PV FCFF: S- S- S- Intrinsic Value - Equity Value - Intrinsic / Share - Tax Rate : 22.00% Interest Rate on Debt: 5.00 %) K. Equity: 9.25 (%) Terminal growth rate : 3.00(%) You also helped Chris compute the intrinsic value of W-Ton shares using here other models. They are shown below, along with the current price of the stock. What is your recommendation on W-To Tel to C Del Buono and the portfolio manager who currently ahs a position in the stock? Model 1: $98 Model 2: $130 Model 3: $133 Model 4: $140