Question

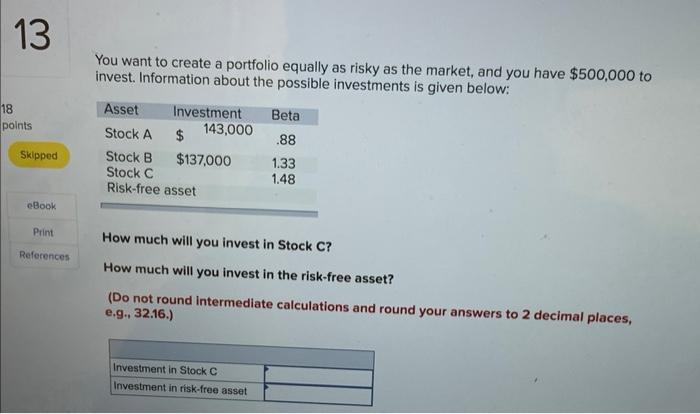

13 18 points Skipped eBook Print References You want to create a portfolio equally as risky as the market, and you have $500,000 to

13 18 points Skipped eBook Print References You want to create a portfolio equally as risky as the market, and you have $500,000 to invest. Information about the possible investments is given below: Asset Stock A Stock B Stock C Risk-free asset Investment Beta $ 143,000 .88 $137,000 1.33 1.48 How much will you invest in Stock C? How much will you invest in the risk-free asset? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Investment in Stock C Investment in risk-free asset

Step by Step Solution

3.53 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

If portfolio is equally as risky as market means beta 1 beta ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Corporate Finance

Authors: Stephen A. Ross, Randolph Westerfield, Bradford D. Jordan

6th Edition

978-0073405131, 9780073405131

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App