Answered step by step

Verified Expert Solution

Question

1 Approved Answer

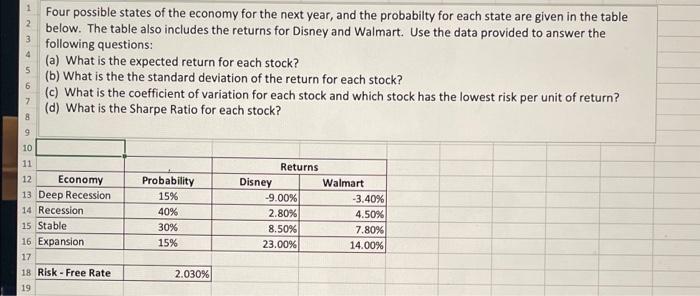

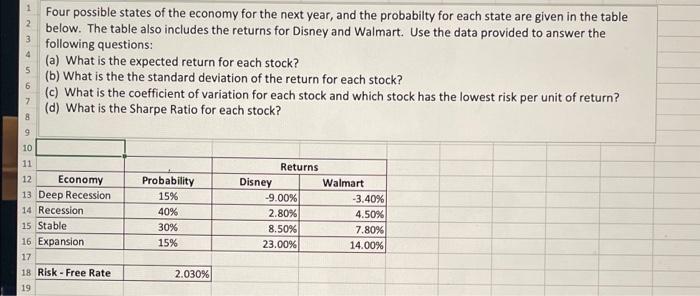

1.3 2 Four possible states of the economy for the next year, and the probabilty for each state are given in the table below. The

1.3

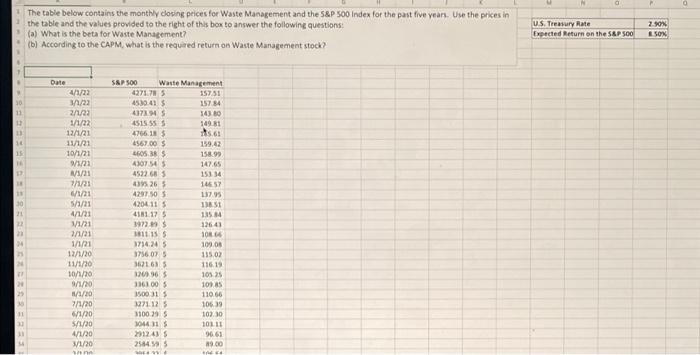

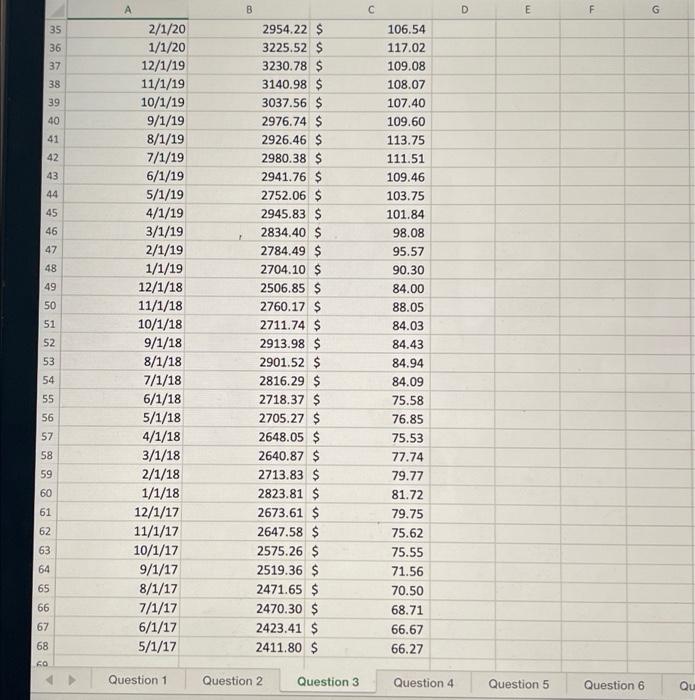

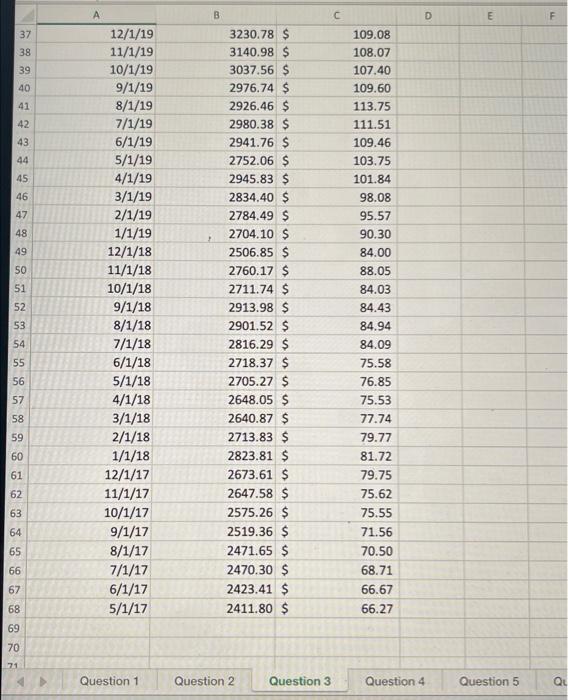

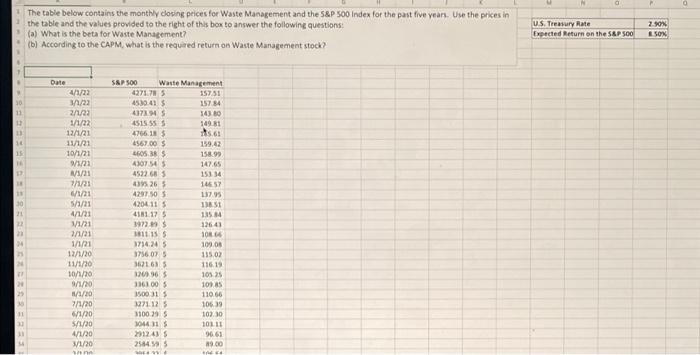

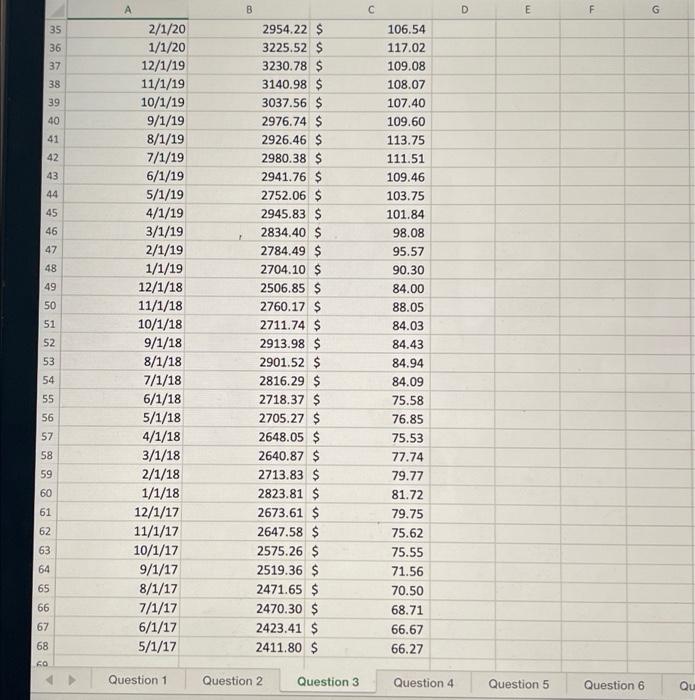

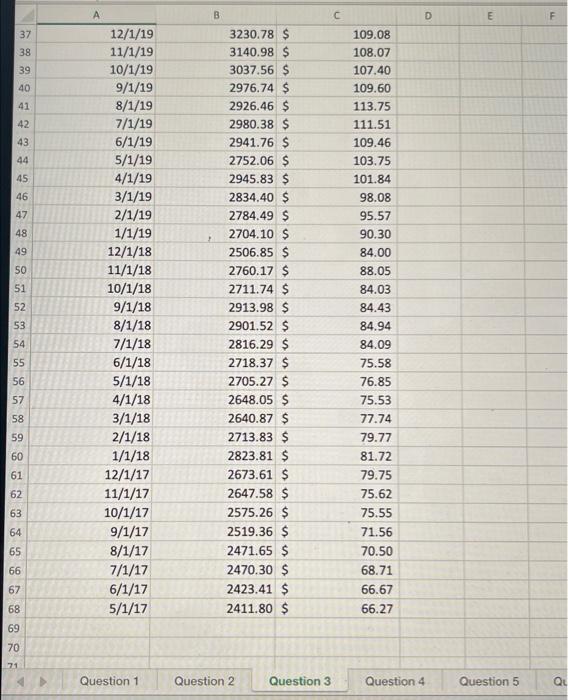

2 Four possible states of the economy for the next year, and the probabilty for each state are given in the table below. The table also includes the returns for Disney and Walmart. Use the data provided to answer the following questions: (a) What is the expected return for each stock? (b) What is the the standard deviation of the return for each stock? (c) What is the coefficient of variation for each stock and which stock has the lowest risk per unit of return? (d) What is the Sharpe Ratio for each stock? 10 mm 999 11 12 Economy 13 Deep Recession 14 Recession 15 Stable 16 Expansion 17 18 Risk - Free Rate Probability 15% 40% 30% 15% Returns Disney Walmart -9.00% -3.40% 2.80% 4.50% 8.50% 7.80% 23.00% 14.00% 2.030% 19 The table below contains the monthly closing prices for Waste Management and the S&P SOO Index for the past five years. Use the prices in the table and the values provided to the right of this box to answer the following questions: (a) What is the beta for Waste Management? (6) According to the CAPM, what is the required return on Waste Management stock? US Treasury Rate Expected Return on the S&P 500 2. E SON 30 11 16 15 1 11 11 Date 4/1/22 11/22 2/1/23 11/22 12/1/21 11/12 10/1/21 W12 11/21 11/21 6/1/21 51/21 4/1/21 1/21 3/1/21 11/21 12/1/20 11/1/20 10/1/20 9/1/20 11/20 7/1/20 6/1/20 5/1/20 4/1/20 31/20 S&P500 Waste Management 4271.783 15751 4530.41 $ 15784 437245 143 80 4515 55 149.81 4766.15 456700 159.42 4605385 152.99 43075 147.65 4532685 15334 439265 1465 4297 50 S 137.95 4204115 151 4181175 125.84 397295 1264 151115 5 106 3714.245 109.00 3756 075 135.02 36216 11619 12065 10525 1161005 101 AS 100315 110.66 1271125 106.39 310095 10230 304313 10111 2312435 9661 25845 8 C D E E F G 35 36 37 38 39 40 41 42 43 44 45 SAGB 46 47 48 49 50 52 53 2/1/20 1/1/20 12/1/19 11/1/19 10/1/19 9/1/19 8/1/19 7/1/19 6/1/19 5/1/19 4/1/19 3/1/19 2/1/19 1/1/19 12/1/18 11/1/18 10/1/18 9/1/18 8/1/18 7/1/18 6/1/18 5/1/18 4/1/18 3/1/18 2/1/18 1/1/18 12/1/17 11/1/17 10/1/17 9/1/17 8/1/17 7/1/17 6/1/17 5/1/17 2954.22 $ 3225.52 $ 3230.78 $ 3140.98 $ 3037.56 $ 2976.74 $ 2926.46 $ 2980.38 $ 2941.76 $ 2752.06 $ 2945.83 $ 2834.40 $ 2784.49 $ 2704.10 $ 2506.85 $ 2760.17 $ 2711.74 $ 2913.98 $ 2901.52 $ 2816.29 $ 2718.37 $ 2705.27 $ 2648.05 $ 2640.87 $ 2713.83 $ 2823.81 $ 2673.61 $ 2647.58 $ 2575.26 $ 2519.36 $ 2471.65 $ 2470.30 $ 2423.41 $ 2411.80 $ 106.54 117.02 109.08 108.07 107.40 109.60 113.75 111.51 109.46 103.75 101.84 98.08 95.57 90.30 84.00 88.05 84.03 84.43 84.94 84.09 75.58 76.85 75.53 77.74 79.77 81.72 79.75 75.62 75.55 71.56 70.50 68.71 66.67 66.27 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 B Question 1 Question 2 Question 3 Question 4 Question 5 Question 6 Qu A B c D E F 37 38 39 40 41 42 43 44 45 46 47 48 109.08 108.07 107.40 109.60 113.75 111.51 109.46 103.75 101.84 98.08 95.57 90.30 84.00 88.05 84.03 84.43 84.94 84.09 75.58 76.85 75.53 77.74 49 50 51 12/1/19 11/1/19 10/1/19 9/1/19 8/1/19 7/1/19 6/1/19 5/1/19 4/1/19 3/1/19 2/1/19 1/1/19 12/1/18 11/1/18 10/1/18 9/1/18 8/1/18 7/1/18 6/1/18 5/1/18 4/1/18 3/1/18 2/1/18 1/1/18 12/1/17 11/1/17 10/1/17 9/1/17 8/1/17 7/1/17 6/1/17 5/1/17 52 53 3230.78 $ 3140.98 $ 3037.56 $ 2976.74 $ 2926.46 $ 2980.38 $ 2941.76 $ 2752.06 $ 2945.83 $ 2834.40 $ 2784.49 $ 2704.10 $ 2506.85 $ 2760.17 $ 2711.74 $ 2913.98 $ 2901.52 $ 2816.29 $ 2718.37 $ 2705.27 $ 2648.05 $ 2640.87 $ 2713.83 $ 2823.81 $ 2673.61 $ 2647.58 $ 2575.26 $ 2519.36 $ 2471.65 $ 2470.30 $ 2423.41 $ 2411.80 $ 54 55 56 57 58 59 60 61 62 63 64 81.72 79.75 75.62 75.55 71.56 70.50 68.71 66.67 66.27 65 66 67 68 69 70 71 Question 1 Question 2 Question 3 Question 4 Question 5 QL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started