Question

13) (24 marks) Required: From the information provided below, prepare ONLY the Cash Flows from Operating Activities section, of the statement of cash flows. Depreciation

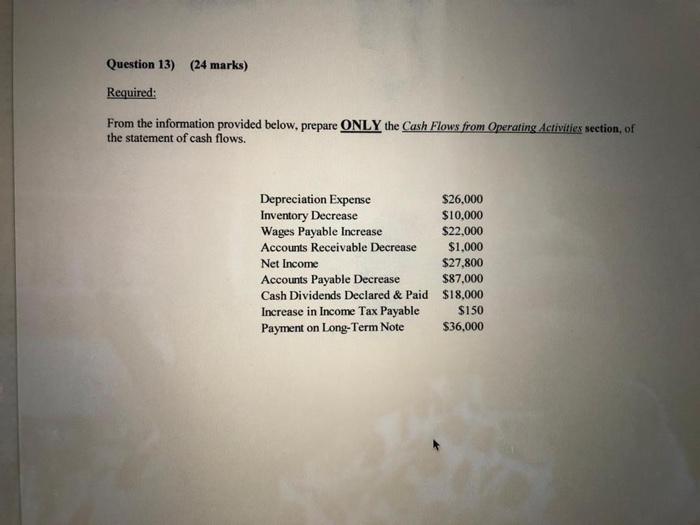

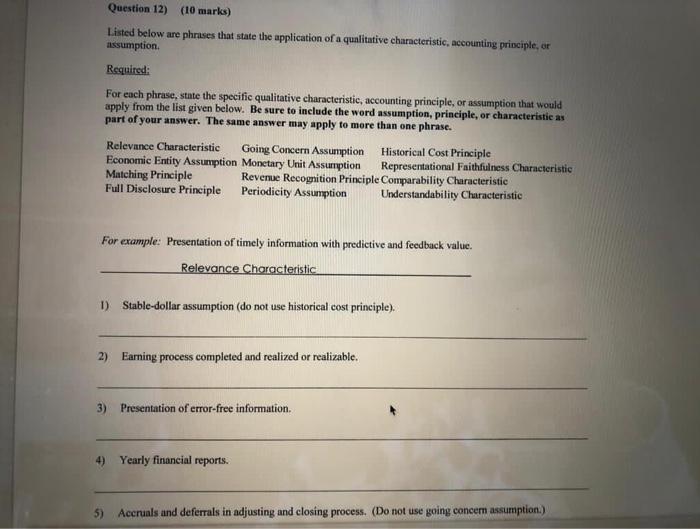

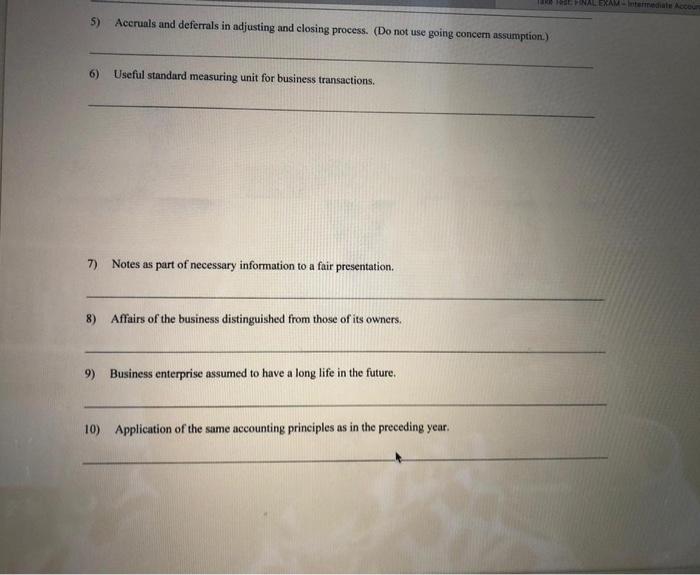

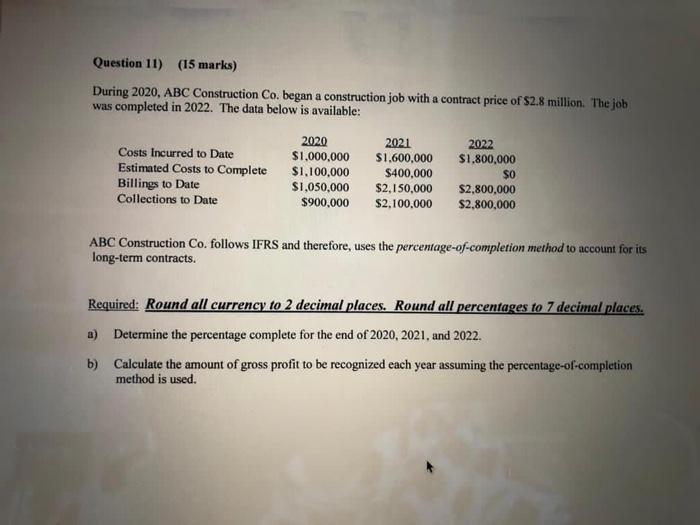

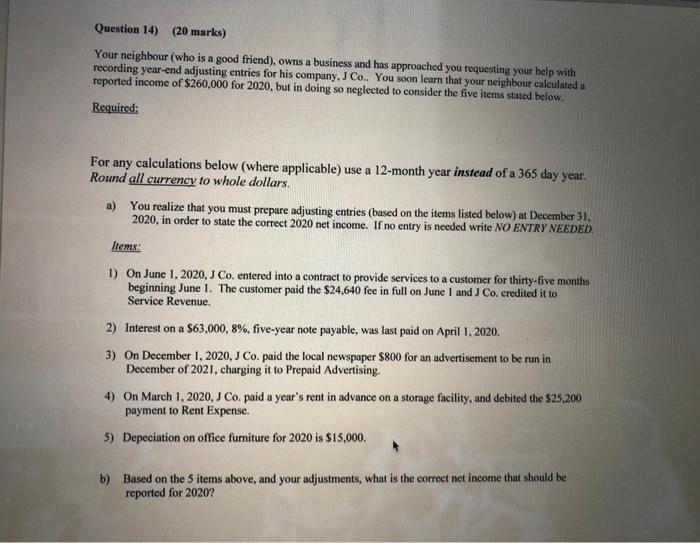

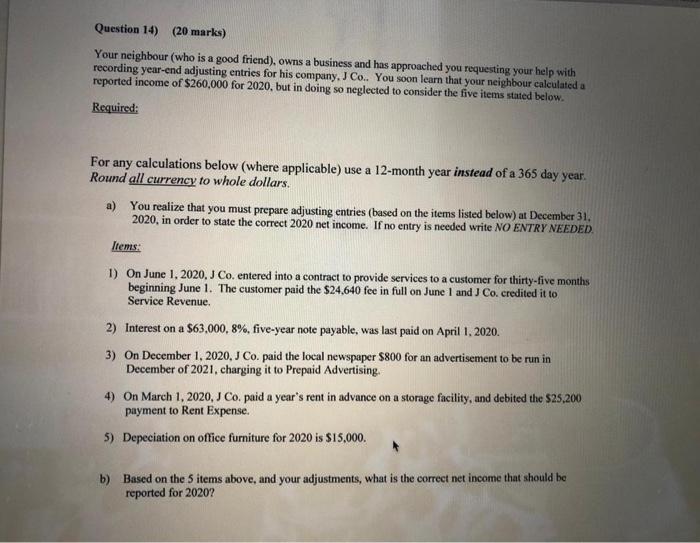

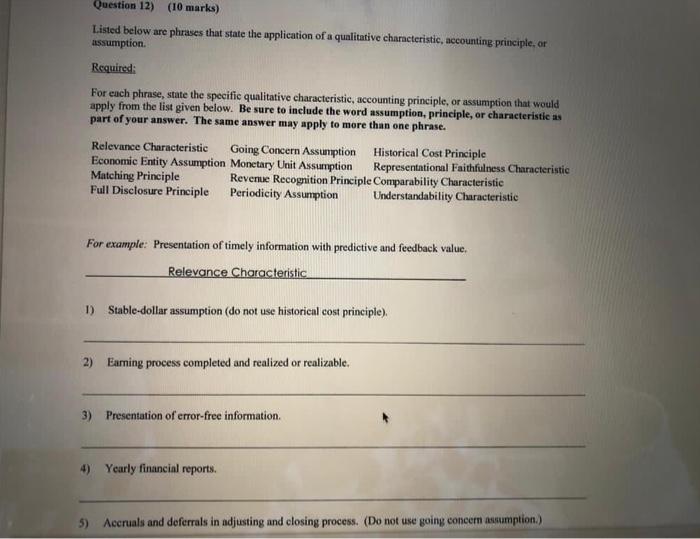

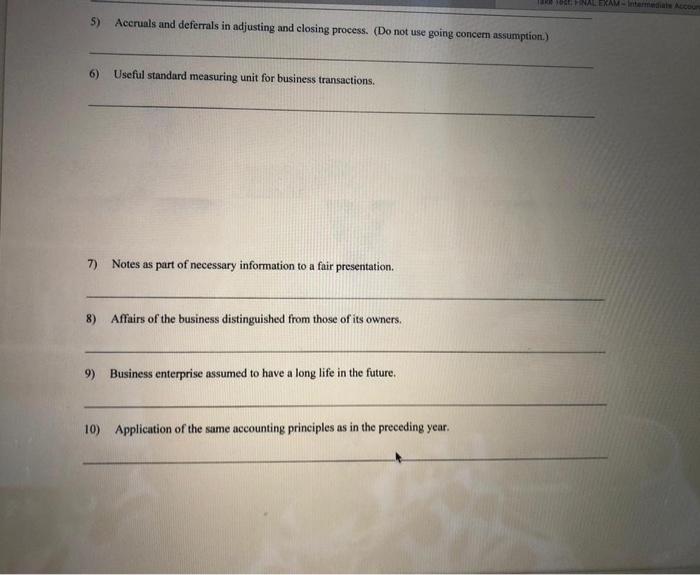

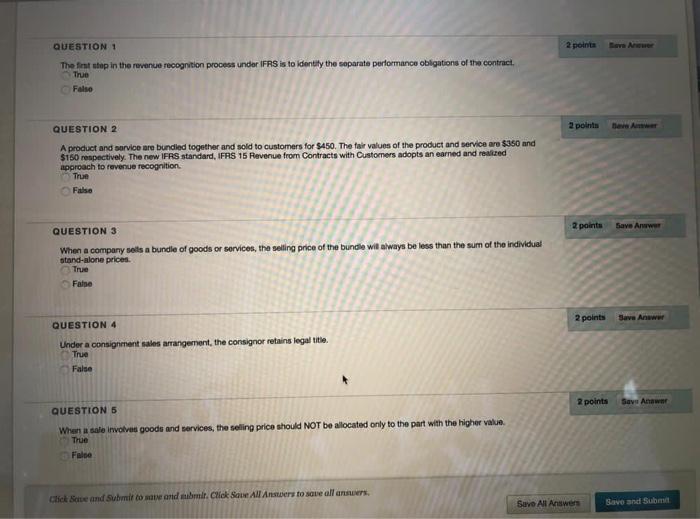

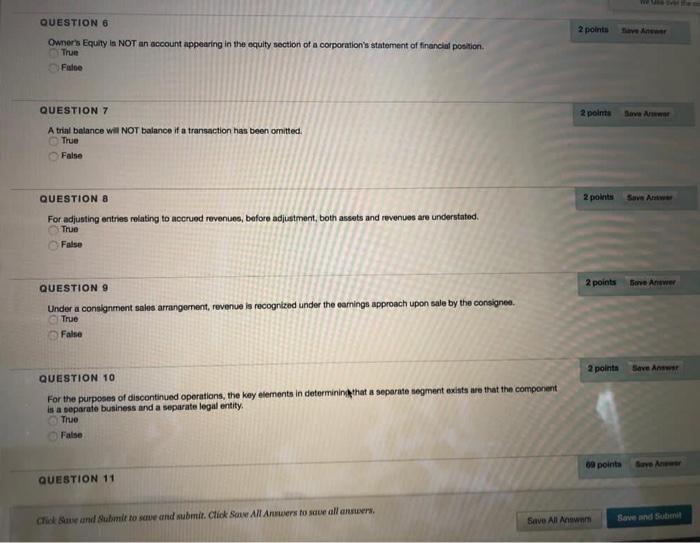

13) (24 marks) Required: From the information provided below, prepare ONLY the Cash Flows from Operating Activities section, of the statement of cash flows. Depreciation Expense $26,000 Inventory Decrease $10,000 Wages Payable Increase $22,000 Accounts Receivable Decrease $1,000 Net Income $27,800 Accounts Payable Decrease $87,000 Cash Dividends Declared & Paid $18,000 Increase in Income Tax Payable $150 Payment on Long-Term Note $36,000 Question 12) (10 marks) Listed below are phrases that state the application of a qualitative characteristic, accounting principle, or assumption. Required: For each phrase, state the specific qualitative characteristic, accounting principle, or assumption that would apply from the list given below. Be sure to include the word assumption, principle, or characteristic as part of your answer. The same answer may apply to more than one phrase. Relevance Characteristic Economic Entity Assumption Matching Principle Full Disclosure Principle Going Concern Assumption Monetary Unit Assumption Periodicity Assumption Historical Cost Principle Representational Faithfulness Characteristic Understandability Characteristic Revenue Recognition Principle Comparability Characteristic For example: Presentation of timely information with predictive and feedback value. Relevance Characteristic 1) Stable-dollar assumption (do not use historical cost principle). 2) Earning process completed and realized or realizable. 3) Presentation of error-free information. 4) Yearly financial reports. 5) Accruals and deferrals in adjusting and closing process. (Do not use going concern assumption.) TORK 1SE FINAL EXAM-Intermediate Accoun 5) Accruals and deferrals in adjusting and closing process. (Do not use going concern assumption.) 6) Useful standard measuring unit for business transactions. 7) Notes as part of necessary information to a fair presentation. 8) Affairs of the business distinguished from those of its owners. 9) Business enterprise assumed to have a long life in the future. 10) Application of the same accounting principles as in the preceding year. Question 11) (15 marks) During 2020, ABC Construction Co. began a construction job with a contract price of $2.8 million. The job was completed in 2022. The data below is available: 2020 2021 Costs Incurred to Date $1,000,000 $1,600,000 2022 $1,800,000 Estimated Costs to Complete $1,100,000 Billings to Date $1,050,000 Collections to Date $900,000 $400,000 $2,150,000 $2,100,000 $0 $2,800,000 $2,800,000 ABC Construction Co. follows IFRS and therefore, uses the percentage-of-completion method to account for its long-term contracts. Required: Round all currency to 2 decimal places. Round all percentages to 7 decimal places. a) Determine the percentage complete for the end of 2020, 2021, and 2022. b) Calculate the amount of gross profit to be recognized each year assuming the percentage-of-completion method is used. Question 14) (20 marks) Your neighbour (who is a good friend), owns a business and has approached you requesting your help with recording year-end adjusting entries for his company. J Co.. You soon learn that your neighbour calculated a reported income of $260,000 for 2020, but in doing so neglected to consider the five items stated below. Required: For any calculations below (where applicable) use a 12-month year instead of a 365 day year. Round all currency to whole dollars. a) You realize that you must prepare adjusting entries (based on the items listed below) at December 31, 2020, in order to state the correct 2020 net income. If no entry is needed write NO ENTRY NEEDED. Items: 1) On June 1, 2020, J Co. entered into a contract to provide services to a customer for thirty-five months beginning June 1. The customer paid the $24,640 fee in full on June 1 and J Co. credited it to Service Revenue. 2) Interest on a $63,000, 8%, five-year note payable, was last paid on April 1, 2020. 3) On December 1, 2020, J Co. paid the local newspaper $800 for an advertisement to be run in December of 2021, charging it to Prepaid Advertising. 4) On March 1, 2020, J Co. paid a year's rent in advance on a storage facility, and debited the $25,200 payment to Rent Expense. 5) Depeciation on office furniture for 2020 is $15,000. b) Based on the 5 items above, and your adjustments, what is the correct net income that should be reported for 2020? Question 14) (20 marks) Your neighbour (who is a good friend), owns a business and has approached you requesting your help with recording year-end adjusting entries for his company, J Co.. You soon learn that your neighbour calculated a reported income of $260,000 for 2020, but in doing so neglected to consider the five items stated below. Required: For any calculations below (where applicable) use a 12-month year instead of a 365 day year. Round all currency to whole dollars. a) You realize that you must prepare adjusting entries (based on the items listed below) at December 31, 2020, in order to state the correct 2020 net income. If no entry is needed write NO ENTRY NEEDED. Items: 1) On June 1, 2020, J Co. entered into a contract to provide services to a customer for thirty-five months beginning June 1. The customer paid the $24,640 fee in full on June I and J Co. credited it to Service Revenue. 2) Interest on a $63,000, 8%, five-year note payable, was last paid on April 1, 2020. 3) On December 1, 2020, J Co. paid the local newspaper $800 for an advertisement to be run in December of 2021, charging it to Prepaid Advertising. 4) On March 1, 2020, J Co. paid a year's rent in advance on a storage facility, and debited the $25,200 payment to Rent Expense. 5) Depeciation on office furniture for 2020 is $15,000. b) Based on the 5 items above, and your adjustments, what is the correct net income that should be reported for 2020? Question 12) (10 marks) Listed below are phrases that state the application of a qualitative characteristic, accounting principle, or assumption. Required: For each phrase, state the specific qualitative characteristic, accounting principle, or assumption that would apply from the list given below. Be sure to include the word assumption, principle, or characteristic as part of your answer. The same answer may apply to more than one phrase. Relevance Characteristic Economic Entity Assumption Matching Principle Full Disclosure Principle Going Concern Assumption Monetary Unit Assumption Revenue Recognition Principle Periodicity Assumption Historical Cost Principle Representational Faithfulness Characteristic Comparability Characteristic Understandability Characteristic For example: Presentation of timely information with predictive and feedback value. Relevance Characteristic 1) Stable-dollar assumption (do not use historical cost principle). 2) Earning process completed and realized or realizable. 3) Presentation of error-free information. 4) Yearly financial reports. 5) Accruals and deferrals in adjusting and closing process. (Do not use going concern assumption.) TERM TERE FINAL EXAM-Intermedials Accoun 5) Accruals and deferrals in adjusting and closing process. (Do not use going concern assumption.) 6) Useful standard measuring unit for business transactions. 7) Notes as part of necessary information to a fair presentation. 8) Affairs of the business distinguished from those of its owners. 9) Business enterprise assumed to have a long life in the future. 10) Application of the same accounting principles as in the preceding year. QUESTION 1 The first step in the revenue recognition process under IFRS is to identify the separate performance obligations of the contract. True False QUESTION 2 A product and service are bundled together and sold to customers for $450. The fair values of the product and service are $350 and $150 respectively. The new IFRS standard, IFRS 15 Revenue from Contracts with Customers adopts an earned and realized approach to revenue recognition. True False QUESTION 3 When a company sells a bundle of goods or services, the selling price of the bundle will always be less than the sum of the individual True stand-alone prices. False QUESTION 4 Under a consignment sales arrangement, the consignor retains legal title. True False 2 points Save Ariewer 2 points Dave Answer 2 points Save Answer 2 points Save Answer QUESTION 5 2 points Save Anawar When a sale involves goods and services, the selling price should NOT be allocated only to the part with the higher value. True False Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and Submit weaver QUESTION 6 Owner's Equity is NOT an account appearing in the equity section of a corporation's statement of financial position. True False 2 points Save Answer QUESTION 7 A trial balance will NOT balance if a transaction has been omitted. True False 2 points Save Awar QUESTION 8 2 points Save Antwer For adjusting entries relating to accrued revenues, before adjustment, both assets and revenues are understated. True False 2 points Sove Answer QUESTION 9 Under a consignment sales arrangement, revenue is recognized under the earings approach upon sale by the consignee. True False QUESTION 10 For the purposes of discontinued operations, the key elements in determining that a separate segment exists are that the component is a separate business and a separate legal entity. True False QUESTION 11 2 points Save Answer 69 points Save Anowar Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answer Save and Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started