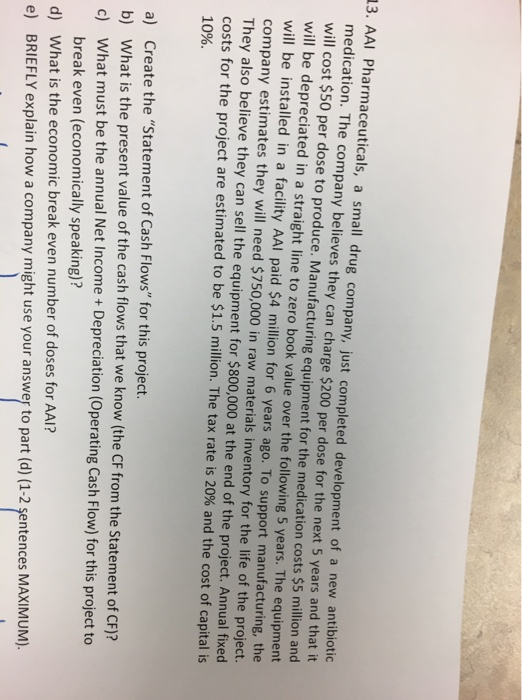

13. AAI Pharmaceuticals, a small drug company, just completed development of a new antibiotic medication. The company believes they can charge $200 per dose for the next 5 years and that it will cost $50 per dose to produce. Manufacturing equipment for the medication costs $5 million and will be depreciated in a straight line to zero book value over the following 5 years. The equipment will be installed in a facility AAI paid $4 million for 6 years ago. To support manufacturing, the company estimates they will need $750,000 in raw materials inventory for the life of the project. They also believe they can sell the equipment for $800,000 at the end of the project. Annual fixed costs for the project are estimated to be $1.5 million. The tax rate is 20% and the cost of capital is 10% a) Create the "Statement of Cash Flows" for this project. b) What is the present value of the cash flows that we know (the CF from the Statement of CF)? c) What must be the annual Net Income + Depreciation (Operating Cash Flow) for this project to break even (economically speaking)? d) What is the economic break even number of doses for AAI? e) BRIEFLY explain how a company might use your answer to part (d) (1-2 sentences MAXIMUM). 13. AAI Pharmaceuticals, a small drug company, just completed development of a new antibiotic medication. The company believes they can charge $200 per dose for the next 5 years and that it will cost $50 per dose to produce. Manufacturing equipment for the medication costs $5 million and will be depreciated in a straight line to zero book value over the following 5 years. The equipment will be installed in a facility AAI paid $4 million for 6 years ago. To support manufacturing, the company estimates they will need $750,000 in raw materials inventory for the life of the project. They also believe they can sell the equipment for $800,000 at the end of the project. Annual fixed costs for the project are estimated to be $1.5 million. The tax rate is 20% and the cost of capital is 10% a) Create the "Statement of Cash Flows" for this project. b) What is the present value of the cash flows that we know (the CF from the Statement of CF)? c) What must be the annual Net Income + Depreciation (Operating Cash Flow) for this project to break even (economically speaking)? d) What is the economic break even number of doses for AAI? e) BRIEFLY explain how a company might use your answer to part (d) (1-2 sentences MAXIMUM)