Answered step by step

Verified Expert Solution

Question

1 Approved Answer

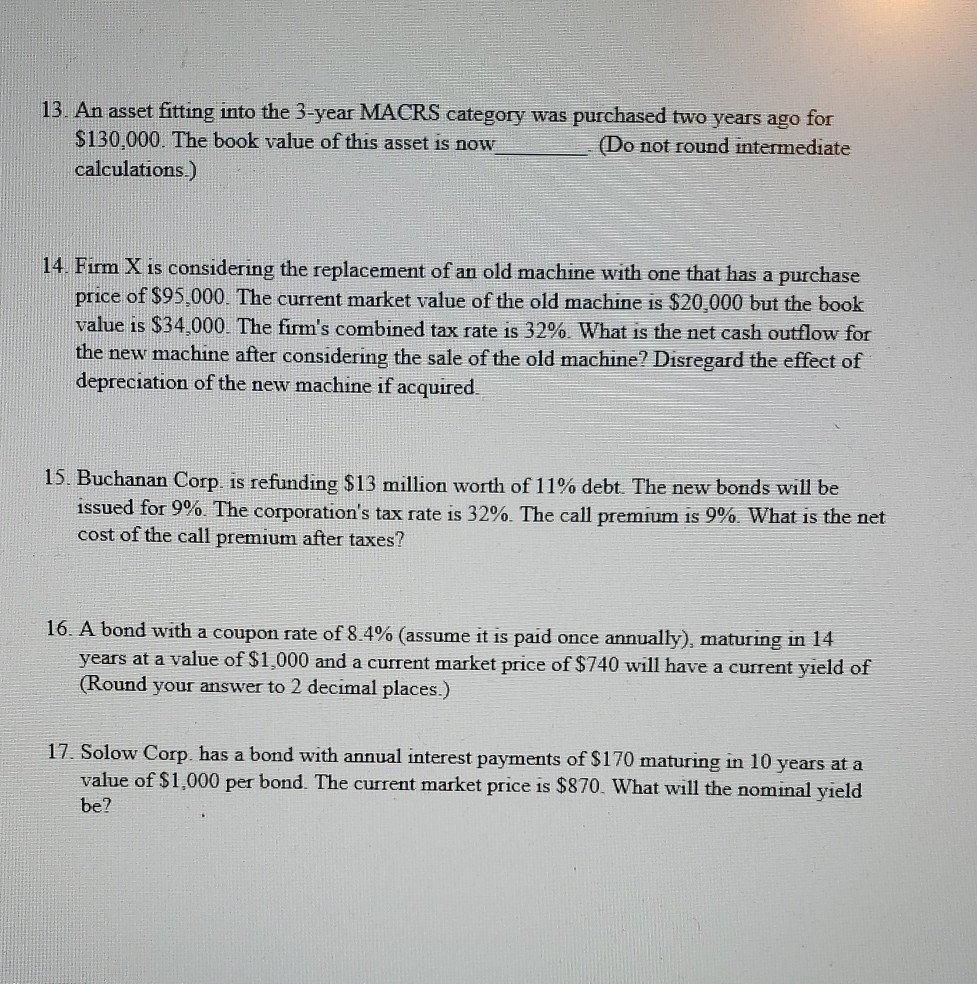

13. An asset fitting into the 3-year MACRS category was purchased two years ago for $130,000. The book value of this asset is now (Do

13. An asset fitting into the 3-year MACRS category was purchased two years ago for $130,000. The book value of this asset is now (Do not round intermediate calculations.) 14. Firm X is considering the replacement of an old machine with one that has a purchase price of $95.000. The current market value of the old machine is $20,000 but the book value is $34,000. The firm's combined tax rate is 32%. What is the net cash outflow for the new machine after considering the sale of the old machine? Disregard the effect of depreciation of the new machine if acquired. 15. Buchanan Corp. is refunding $13 million worth of 11% debt. The new bonds will be issued for 9%. The corporation's tax rate is 32%. The call premium is 9%. What is the net cost of the call premium after taxes? 16. A bond with a coupon rate of 8.4% (assume it is paid once annually), maturing in 14 years at a value of $1,000 and a current market price of $740 will have a current yield of (Round your answer to 2 decimal places.) 17. Solow Corp. has a bond with annual interest payments of $170 maturing in 10 years at a value of $1,000 per bond. The current market price is $870. What will the nominal yield be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started