Question

13 and 14 Ewing Corporation sold an office building that it used in its business for $885,388. Ewing bought the building ten years ago for

13 and 14

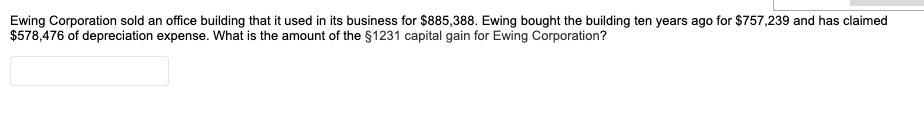

Ewing Corporation sold an office building that it used in its business for $885,388. Ewing bought the building ten years ago for $757,239 and has claimed $578,476 of depreciation expense. What is the amount of the 51231 capital gain for Ewing Corporation?

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer Part 1 For Corporations Section 291 recapture is 20 of the lesser of Depreciation taken or ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Numerical Analysis

Authors: Richard L. Burden, J. Douglas Faires

9th edition

538733519, 978-1133169338, 1133169333, 978-0538733519

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App