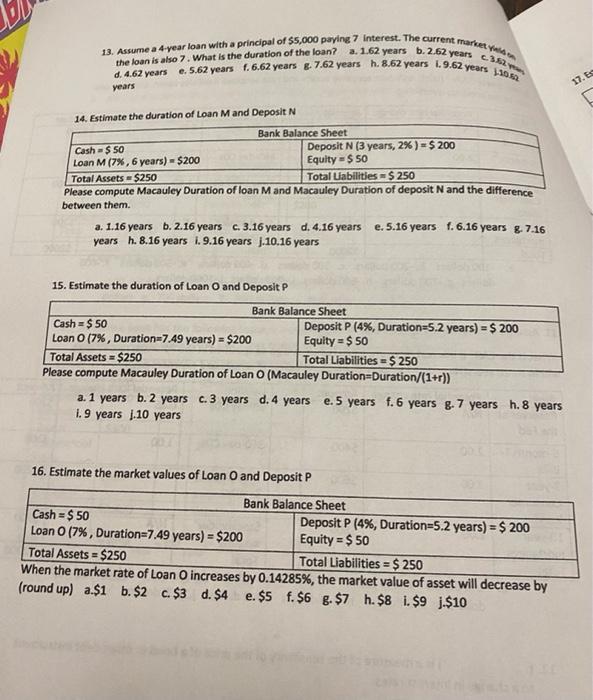

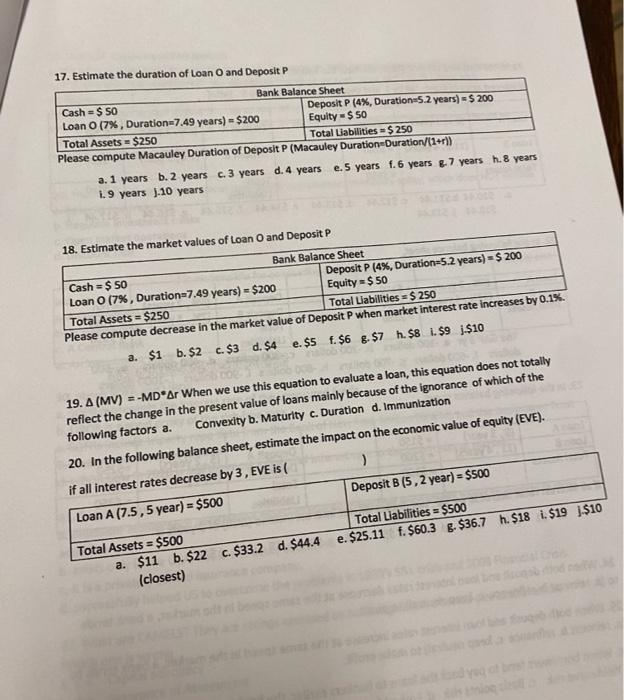

13. Assume a 4-year loan with a principal of $5,000 paying 7 interest. The current market ved the loan is also 7. What is the duration of the loan? a. 1.62 years b. 2.62 years c.3.82 d. 4.62 years e. 5.62 years 1.6.62 years g. 7.62 years h. 8.62 years 1.9.62 years 130 years 14. Estimate the duration of Loan M and Deposit N Bank Balance Sheet Cash-$50 Deposit N (3 years, 2%) = $ 200 Equity = $50 Loan M ( 7%, 6 years) $200 Total Assets $250 Total Liabilities - $250 Please compute Macauley Duration of loan M and Macauley Duration of deposit N and the difference between them. a. 1.16 years b. 2.16 years c. 3.16 years d. 4.16 years e. 5.16 years f. 6.16 years g. 7.16 years h. 8.16 years i.9.16 years j.10.16 years 15. Estimate the duration of Loan O and Deposit P Bank Balance Sheet Cash = $50 Deposit P (4%, Duration=5.2 years) = $ 200 Equity = $50 Loan O (7%, Duration=7.49 years) = $200 Total Assets $250 Total Liabilities - $ 250 Please compute Macauley Duration of Loan O (Macauley Duration=Duration/(1+r)) a. 1 years b. 2 years c. 3 years d. 4 years e. 5 years f. 6 years g. 7 years h. 8 years i. 9 years j.10 years 16. Estimate the market values of Loan O and Deposit P Cash=$50 Loan O (7%, Duration=7.49 years) = $200 Deposit P (4%, Duration=5.2 years) = $ 200 Equity = $ 50 Total Assets=$250 Total Liabilities = $ 250 When the market rate of Loan O increases by 0.14285%, the market value of asset will decrease by (round up) a.$1 b. $2 c. $3 d. $4 e. $5 f. $6 g. $7 h. $8 i.$9 j.$10 Bank Balance Sheet 17. Eg F 17. Estimate the duration of Loan O and Deposit P Bank Balance Sheet Cash = $50 Loan O (7%, Duration=7.49 years) = $200 Deposit P (4%, Duration=5.2 years) $200 Equity-$50 Total Assets $250 Total Liabilities = $ 250 Please compute Macauley Duration of Deposit P (Macauley Duration Duration/(1+r)) a. 1 years b. 2 years c. 3 years d. 4 years e. 5 years f. 6 years g. 7 years h.8 years 1.9 years J.10 years 18. Estimate the market values of Loan O and Deposit P Cash = $50 Deposit P (4%, Duration=5.2 years) = $ 200 Equity=$50 Loan O (7%, Duration=7.49 years) = $200 Total Liabilities = $250 Total Assets = $250 Please compute decrease in the market value of Deposit P when market interest rate increases by 0.1%. e. $5 f.$6 8. $7 h. $8 1.$9 j.$10 a. $1 b. $2 c. $3 d. $4 19. A (MV) = -MD Ar When we use this equation to evaluate a loan, this equation does not totally reflect the change in the present value of loans mainly because of the ignorance of which of the Convexity b. Maturity c. Duration d. Immunization following factors a. 20. In the following balance sheet, estimate the impact on the economic value of equity (EVE). if all interest rates decrease by 3, EVE is ( ) Deposit B (5,2 year) = $500 Loan A (7.5, 5 year) = $500 Total Liabilities= $500 Total Assets = $500 a. $11 b. $22 c. $33.2 d. $44.4 e. $25.11 f. $60.3 g. $36.7 h. $18 i. $19 $10 (closest) Bank Balance Sheet 13. Assume a 4-year loan with a principal of $5,000 paying 7 interest. The current market ved the loan is also 7. What is the duration of the loan? a. 1.62 years b. 2.62 years c.3.82 d. 4.62 years e. 5.62 years 1.6.62 years g. 7.62 years h. 8.62 years 1.9.62 years 130 years 14. Estimate the duration of Loan M and Deposit N Bank Balance Sheet Cash-$50 Deposit N (3 years, 2%) = $ 200 Equity = $50 Loan M ( 7%, 6 years) $200 Total Assets $250 Total Liabilities - $250 Please compute Macauley Duration of loan M and Macauley Duration of deposit N and the difference between them. a. 1.16 years b. 2.16 years c. 3.16 years d. 4.16 years e. 5.16 years f. 6.16 years g. 7.16 years h. 8.16 years i.9.16 years j.10.16 years 15. Estimate the duration of Loan O and Deposit P Bank Balance Sheet Cash = $50 Deposit P (4%, Duration=5.2 years) = $ 200 Equity = $50 Loan O (7%, Duration=7.49 years) = $200 Total Assets $250 Total Liabilities - $ 250 Please compute Macauley Duration of Loan O (Macauley Duration=Duration/(1+r)) a. 1 years b. 2 years c. 3 years d. 4 years e. 5 years f. 6 years g. 7 years h. 8 years i. 9 years j.10 years 16. Estimate the market values of Loan O and Deposit P Cash=$50 Loan O (7%, Duration=7.49 years) = $200 Deposit P (4%, Duration=5.2 years) = $ 200 Equity = $ 50 Total Assets=$250 Total Liabilities = $ 250 When the market rate of Loan O increases by 0.14285%, the market value of asset will decrease by (round up) a.$1 b. $2 c. $3 d. $4 e. $5 f. $6 g. $7 h. $8 i.$9 j.$10 Bank Balance Sheet 17. Eg F 17. Estimate the duration of Loan O and Deposit P Bank Balance Sheet Cash = $50 Loan O (7%, Duration=7.49 years) = $200 Deposit P (4%, Duration=5.2 years) $200 Equity-$50 Total Assets $250 Total Liabilities = $ 250 Please compute Macauley Duration of Deposit P (Macauley Duration Duration/(1+r)) a. 1 years b. 2 years c. 3 years d. 4 years e. 5 years f. 6 years g. 7 years h.8 years 1.9 years J.10 years 18. Estimate the market values of Loan O and Deposit P Cash = $50 Deposit P (4%, Duration=5.2 years) = $ 200 Equity=$50 Loan O (7%, Duration=7.49 years) = $200 Total Liabilities = $250 Total Assets = $250 Please compute decrease in the market value of Deposit P when market interest rate increases by 0.1%. e. $5 f.$6 8. $7 h. $8 1.$9 j.$10 a. $1 b. $2 c. $3 d. $4 19. A (MV) = -MD Ar When we use this equation to evaluate a loan, this equation does not totally reflect the change in the present value of loans mainly because of the ignorance of which of the Convexity b. Maturity c. Duration d. Immunization following factors a. 20. In the following balance sheet, estimate the impact on the economic value of equity (EVE). if all interest rates decrease by 3, EVE is ( ) Deposit B (5,2 year) = $500 Loan A (7.5, 5 year) = $500 Total Liabilities= $500 Total Assets = $500 a. $11 b. $22 c. $33.2 d. $44.4 e. $25.11 f. $60.3 g. $36.7 h. $18 i. $19 $10 (closest) Bank Balance Sheet