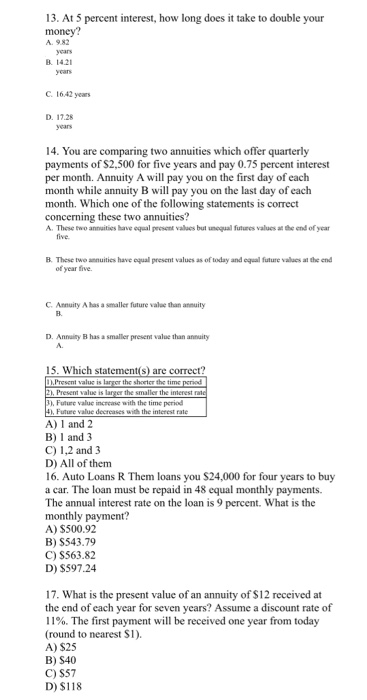

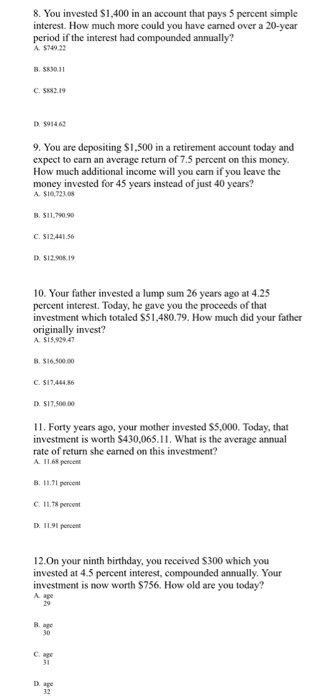

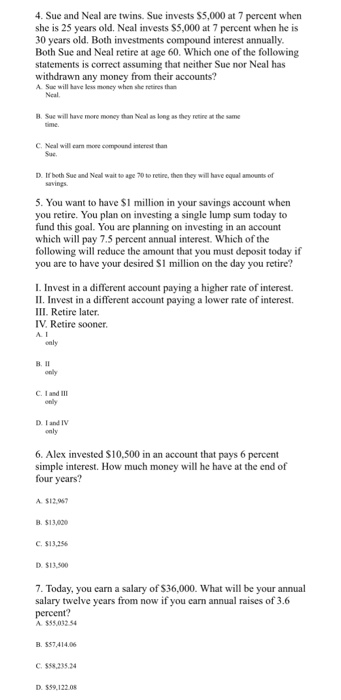

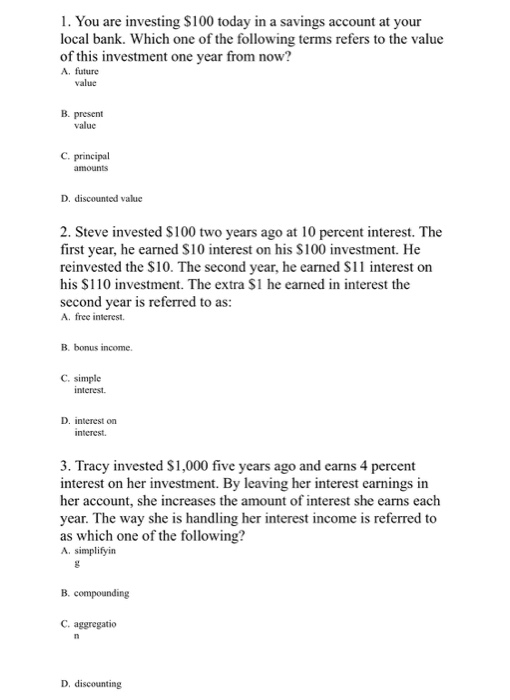

13. At 5 percent interest, how long does it take to double your money? B 1421 C. 1642 years D. 122 14. You are comparing two annuities which offer quarterly payments of S2,500 for five years and pay 0.75 percent interest per month. Annuity A will pay you on the first day of each month while annuity B will pay you on the last day of each month. Which one of the following statements is correct concerning these two annuities? A. These two annuities have equal present values bul meua future values the end of year five B. These two annuities have equal present values as of today and equal future values at the end of year five C. Annuity A has a smaller future value than annuity D. Anny has a smaller present value than annuity 15. Which statement(s) are correct? Present value is larger the shorter the time period 21, Present value is larger the smaller the interest rate 3. Future value increase with the time period 4) Future value decreases with the interest rate A) 1 and 2 B) I and 3 C) 1,2 and 3 D) All of them 16. Auto Loans R Them loans you $24,000 for four years to buy a car. The loan must be repaid in 48 equal monthly payments. The annual interest rate on the loan is 9 percent. What is the monthly payment? A) $500.92 B) S543.79 C) S563.82 D) $597.24 17. What is the present value of an annuity of $12 received at the end of each year for seven years? Assume a discount rate of 11%. The first payment will be received one year from today (round to nearest Sl). A) $25 B) S40 C) SS7 D) $118 8. You invested $1,400 in an account that pays 5 percent simple interest. How much more could you have cared over a 20-year period if the interest had compounded annually? A $74922 B SX30.11 C. 5882.19 D. 591462 9. You are depositing $1,500 in a retirement account today and expect to earn an average return of 7.5 percent on this money. How much additional income will you carn if you leave the money invested for 45 years instead of just 40 years? A $10,721.08 B SII C. $12,441.56 D. S12.COR.19 10. Your father invested a lump sum 26 years ago at 4.25 percent interest. Today, he gave you the proceeds of that investment which totaled S51,480.79. How much did your father originally invest? A SIS.929.47 $16.500.00 C. $17,444.56 D. $17.500.00 11. Forty years ago, your mother invested $5,000. Today, that investment is worth $430,065.11. What is the average annual rate of return she earned on this investment? A1 percent B 11.7 C 11.8 percent D. 11.91 percent 12.On your ninth birthday, you received $300 which you invested at 4.5 percent interest, compounded annually. Your investment is now worth $756. How old are you today? 4. Sue and Neal are twins. Sue invests $5,000 at 7 percent when she is 25 years old. Neal invests $5,000 at 7 percent when he is 30 years old. Both investments compound interest annually. Both Sue and Neal retire at age 60. Which one of the following statements is correct assuming that neither Sue nor Neal has withdrawn any money from their accounts? A Sue will have les mocy when she retires the B. Sue will have more money than Neal as long as they retreat the same C Neal will came interest than D. If both Sue and Neal wait to ape 20 to retine, then they will have equal amounts of 5. You want to have $1 million in your savings account when you retire. You plan on investing a single lump sum today to fund this goal. You are planning on investing in an account which will pay 7.5 percent annual interest. Which of the following will reduce the amount that you must deposit today if you are to have your desired S1 million on the day you retire? 1. Invest in a different account paying a higher rate of interest. II. Invest in a different account paying a lower rate of interest. III. Retire later. IV. Retire sooner. only C. las II D. Lund IV 6. Alex invested $10.500 in an account that pays 6 percent simple interest. How much money will he have at the end of four years? A $12. 7 B $13.000 C. 51.256 DUS 7. Today, you carn a salary of $36,000. What will be your annual salary twelve years from now if you can annual raises of 3.6 percent? AS5501254 B. 557.414.06 $ 335.34 D. $59.122.08 1. You are investing $100 today in a savings account at your local bank. Which one of the following terms refers to the value of this investment one year from now? A future value B. present value C. principal amounts D. discounted value 2. Steve invested $100 two years ago at 10 percent interest. The first year, he earned $10 interest on his $100 investment. He reinvested the $10. The second year, he earned Sll interest on his $110 investment. The extra $1 he earned in interest the second year is referred to as: A free interest B. bonus income C. simple interest D. interest on interest 3. Tracy invested $1,000 five years ago and carns 4 percent interest on her investment. By leaving her interest earnings in her account, she increases the amount of interest she earns each year. The way she is handling her interest income is referred to as which one of the following? A. simplifyin B. compounding C. aggregatio D. discounting