Answered step by step

Verified Expert Solution

Question

1 Approved Answer

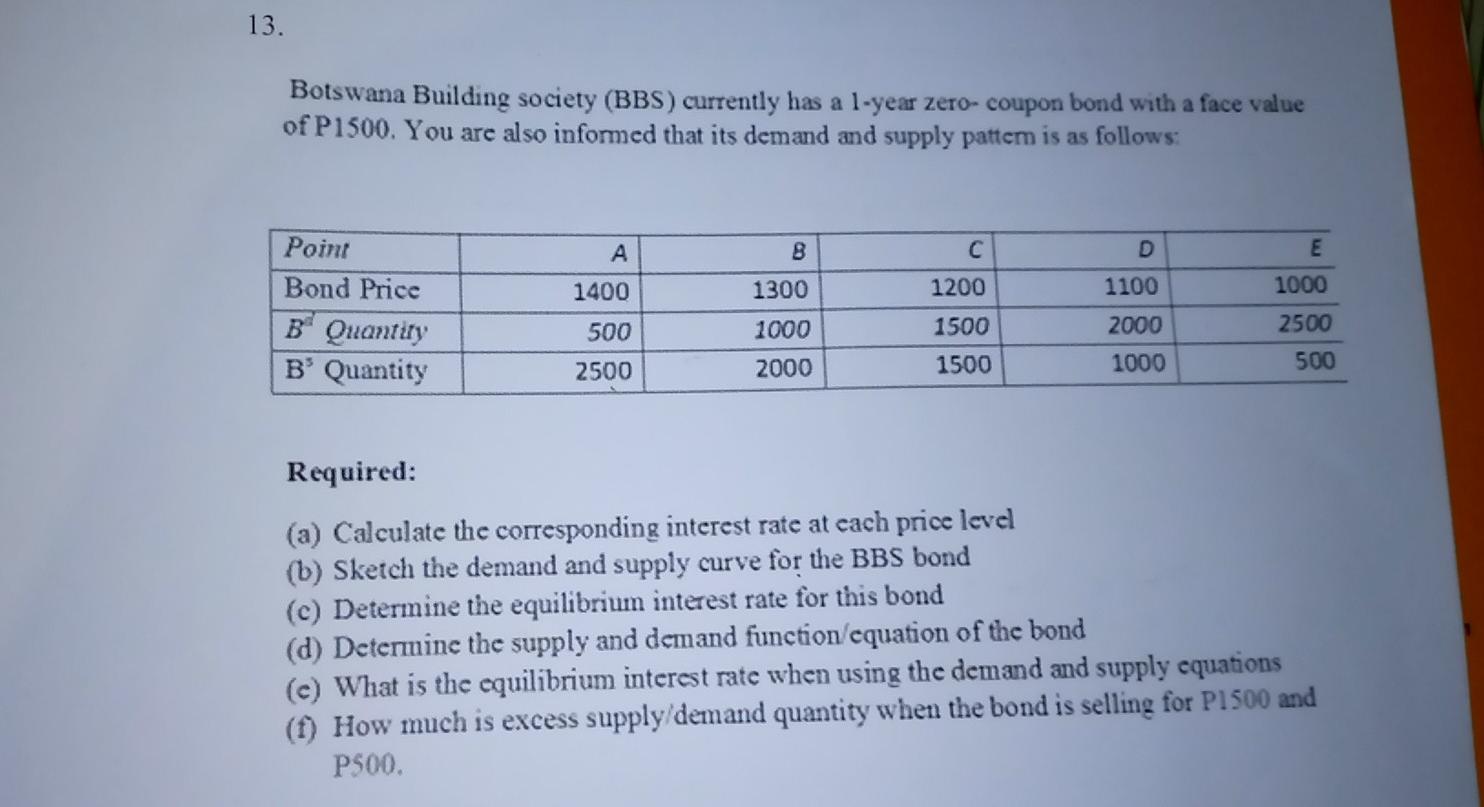

13. Botswana Building society (BBS) currently has a 1-year zero-coupon bond with a face value of P1500. You are also informed that its demand and

13. Botswana Building society (BBS) currently has a 1-year zero-coupon bond with a face value of P1500. You are also informed that its demand and supply patter is as follows: 8 D E 1000 1400 1200 1100 Point Bond Price B Quantiry B Quantity 1300 1000 500 1500 2500 2000 1000 2500 2000 1500 500 Required: (a) Calculate the corresponding interest rate at cach price level (b) Sketch the demand and supply curve for the BBS bond (c) Determine the equilibrium interest rate for this bond (d) Deteruine the supply and demand function/cquation of the bond (c) What is the equilibrium interest rate when using the demand and supply equations (1) How much is excess supply demand quantity when the bond is selling for P1500 and P500. 13. Botswana Building society (BBS) currently has a 1-year zero-coupon bond with a face value of P1500. You are also informed that its demand and supply patter is as follows: 8 D E 1000 1400 1200 1100 Point Bond Price B Quantiry B Quantity 1300 1000 500 1500 2500 2000 1000 2500 2000 1500 500 Required: (a) Calculate the corresponding interest rate at cach price level (b) Sketch the demand and supply curve for the BBS bond (c) Determine the equilibrium interest rate for this bond (d) Deteruine the supply and demand function/cquation of the bond (c) What is the equilibrium interest rate when using the demand and supply equations (1) How much is excess supply demand quantity when the bond is selling for P1500 and P500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started