Answered step by step

Verified Expert Solution

Question

1 Approved Answer

13. Check the following combinations of puts and calls and determine whether they conform to the putcall parity rule for European options. If you see

13. Check the following combinations of puts and calls and determine whether they conform to the putcall parity rule for European options. If you see any violations, suggest a strategy.

a. July 155

b. August 160

c. October 170

14. Repeat problem 13 using American putcall parity, but do not suggest a strategy.

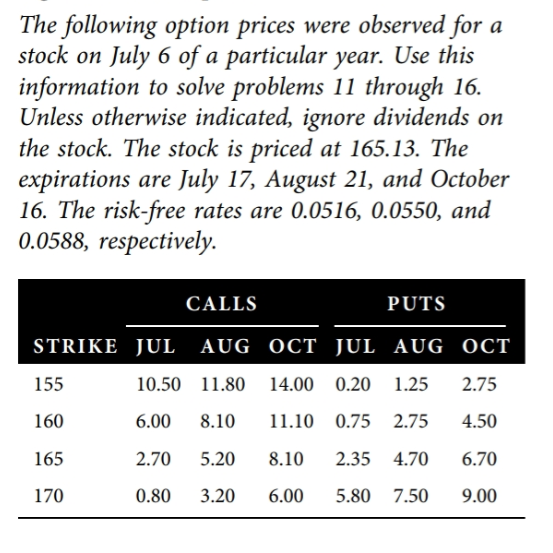

The following option prices were observed for a stock on July 6 of a particular year. Use this information to solve problems 11 through 16. Unless otherwise indicated, ignore dividends on the stock. The stock is priced at 165.13. The expirations are July 17, August 21, and October 16. The risk-free rates are 0.0516, 0.0550, and 0.0588, respectively. CALLS PUTS 155 STRIKE JUL AUG OCT JUL AUG OCT 10.50 11.80 14.00 0.20 1.25 2.75 160 6.00 8.10 11.10 0.75 2.75 4.50 2.70 5.20 8.10 2.35 4.70 6.70 170 0.80 3.20 6.00 5.80 7.50 9.00 165 The following option prices were observed for a stock on July 6 of a particular year. Use this information to solve problems 11 through 16. Unless otherwise indicated, ignore dividends on the stock. The stock is priced at 165.13. The expirations are July 17, August 21, and October 16. The risk-free rates are 0.0516, 0.0550, and 0.0588, respectively. CALLS PUTS 155 STRIKE JUL AUG OCT JUL AUG OCT 10.50 11.80 14.00 0.20 1.25 2.75 160 6.00 8.10 11.10 0.75 2.75 4.50 2.70 5.20 8.10 2.35 4.70 6.70 170 0.80 3.20 6.00 5.80 7.50 9.00 165Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started