Answered step by step

Verified Expert Solution

Question

1 Approved Answer

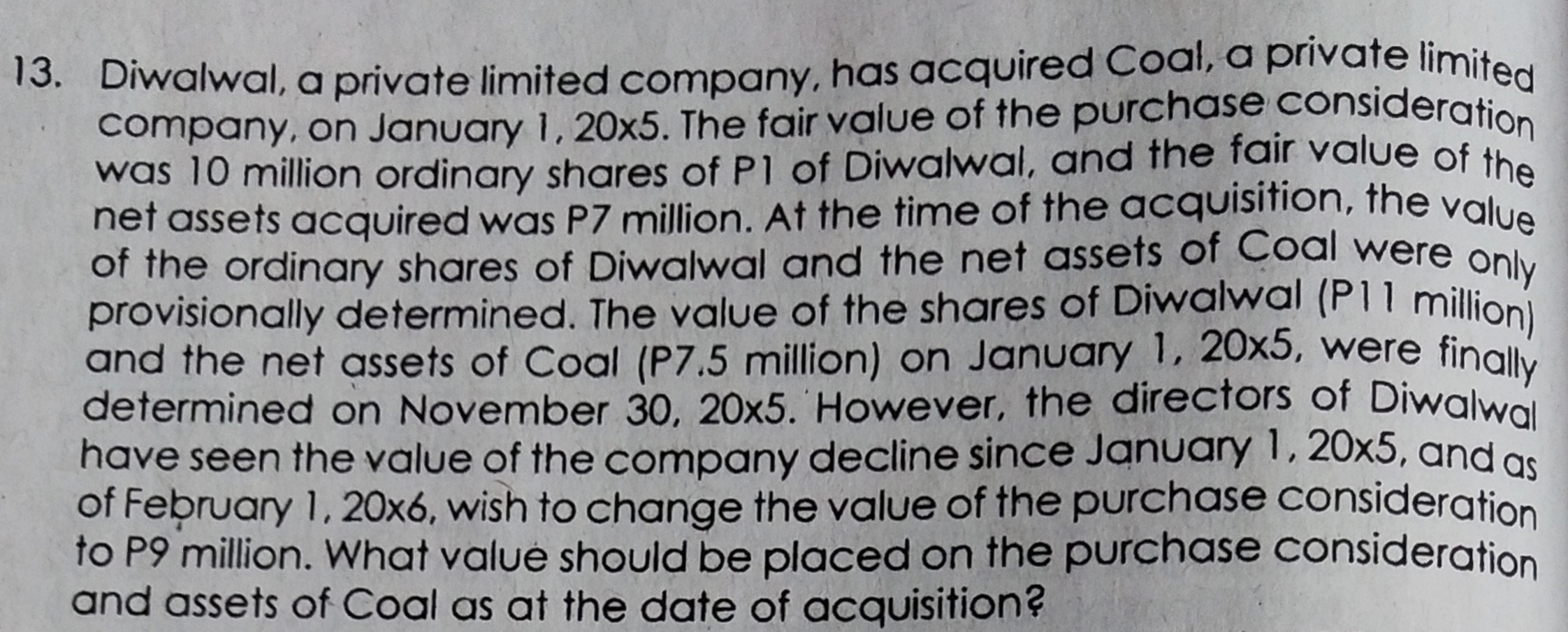

13. Diwalwal, a private limited company, has acquired Coal, a private limited company, on January 1, 20x5. The fair value of the purchase consideration

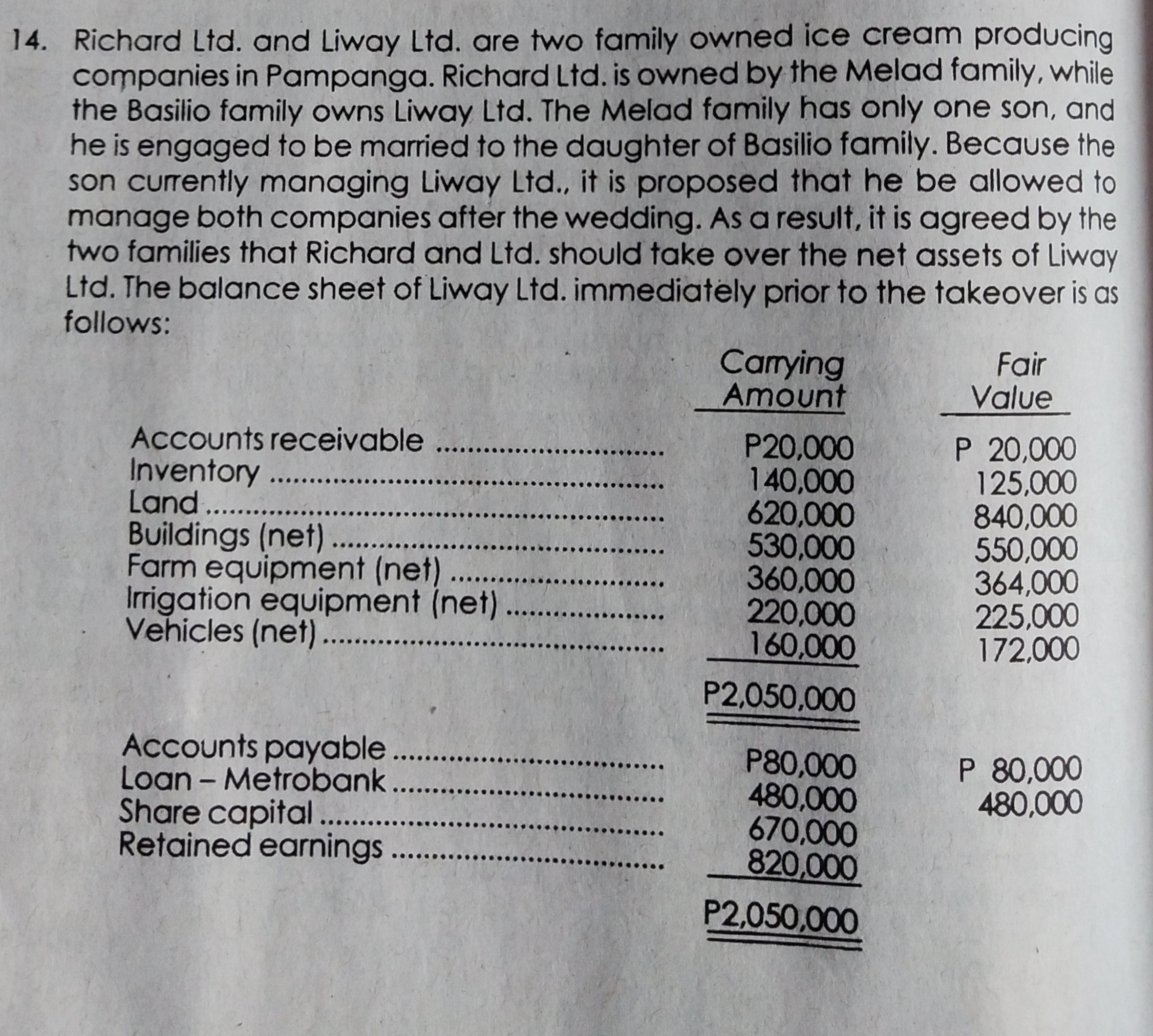

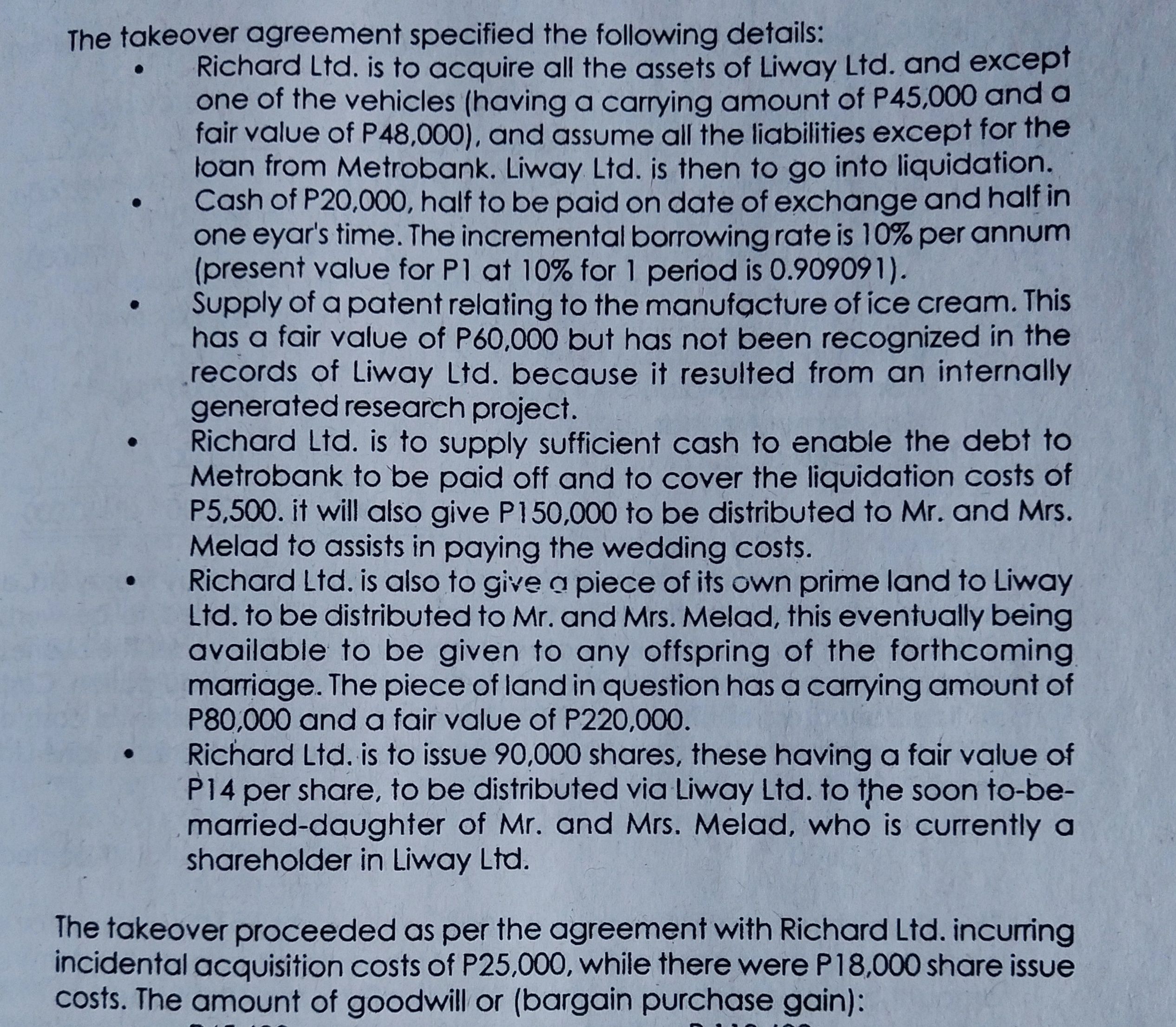

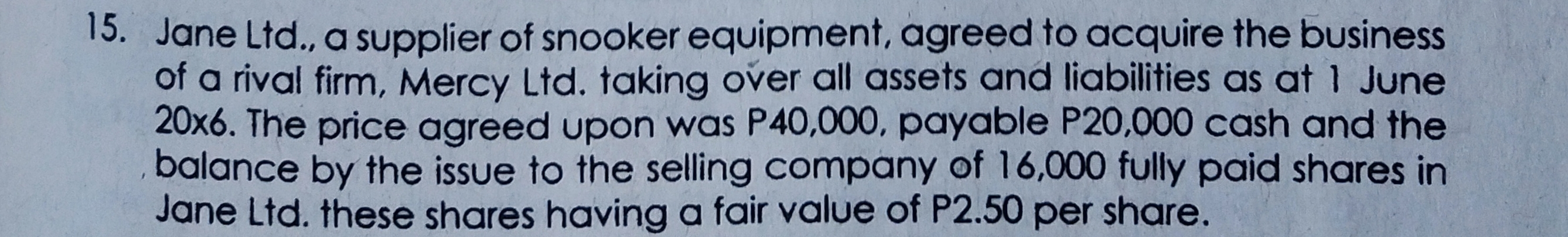

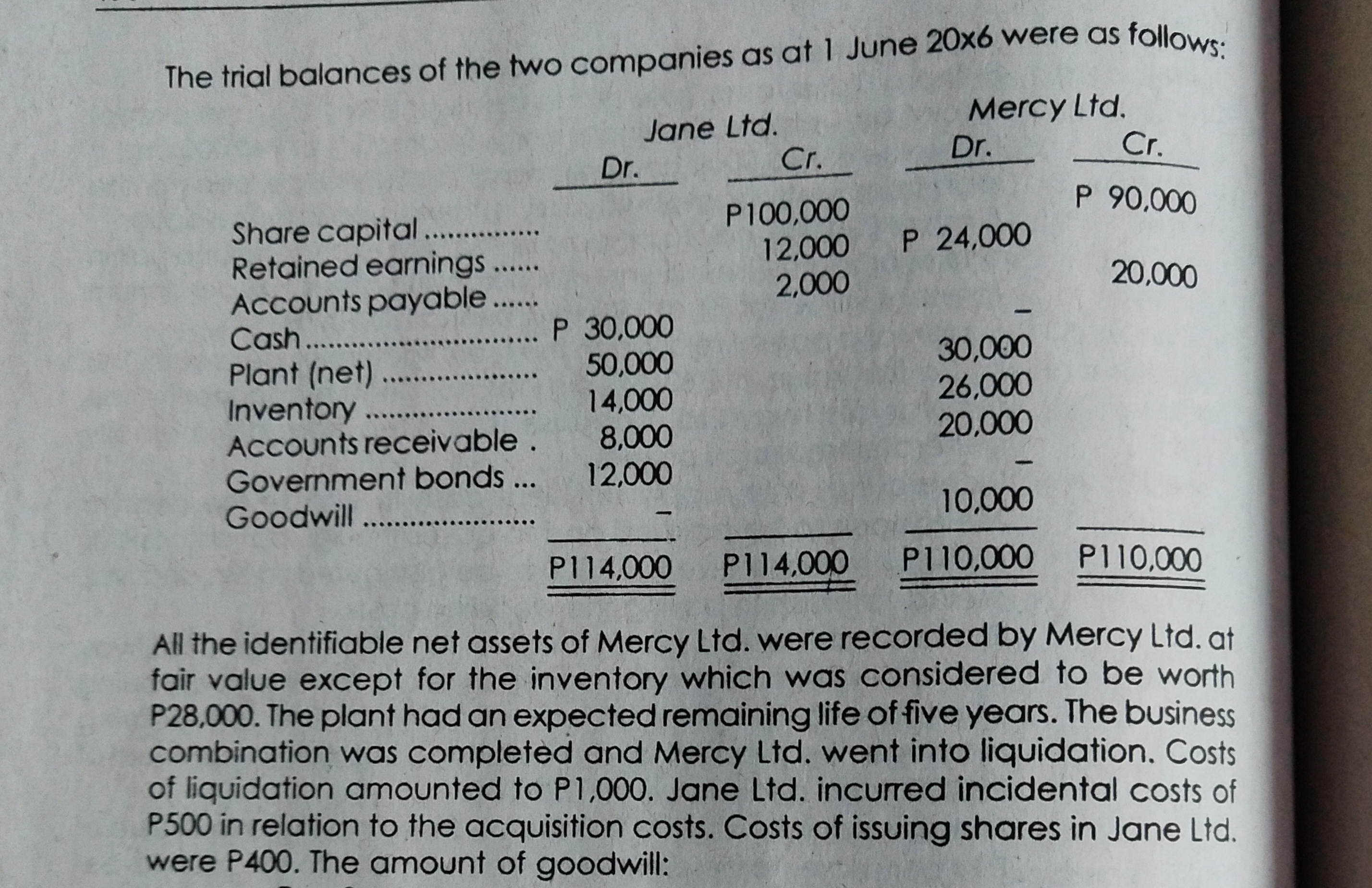

13. Diwalwal, a private limited company, has acquired Coal, a private limited company, on January 1, 20x5. The fair value of the purchase consideration was 10 million ordinary shares of P1 of Diwalwal, and the fair value of the net assets acquired was P7 million. At the time of the acquisition, the value of the ordinary shares of Diwalwal and the net assets of Coal were only provisionally determined. The value of the shares of Diwalwal (P11 million) and the net assets of Coal (P7.5 million) on January 1, 20x5, were finally determined on November 30, 20x5. However, the directors of Diwalwal have seen the value of the company decline since January 1, 20x5, and as of February 1, 20x6, wish to change the value of the purchase consideration to P9 million. What value should be placed on the purchase consideration and assets of Coal as at the date of acquisition? 14. Richard Ltd. and Liway Ltd. are two family owned ice cream producing companies in Pampanga. Richard Ltd. is owned by the Melad family, while the Basilio family owns Liway Ltd. The Melad family has only one son, and he is engaged to be married to the daughter of Basilio family. Because the son currently managing Liway Ltd., it is proposed that he be allowed to manage both companies after the wedding. As a result, it is agreed by the two families that Richard and Ltd. should take over the net assets of Liway Ltd. The balance sheet of Liway Ltd. immediately prior to the takeover is as follows: Carrying Amount Fair Value Accounts receivable..... P20,000 P 20,000 Inventory....... 140,000 125,000 Land......... 620,000 840,000 Buildings (net)......... 530,000 550,000 Farm equipment (net) .......... 360,000 364,000 Irrigation equipment (net) ........ 220,000 225,000 Vehicles (net).......... 160,000 172,000 P2,050,000 Accounts payable Loan - Metrobank........ Share capital......... P80,000 P 80,000 480,000 480,000 670,000 Retained earnings........ 820,000 P2,050,000 The takeover agreement specified the following details: Richard Ltd. is to acquire all the assets of Liway Ltd. and except one of the vehicles (having a carrying amount of P45,000 and a fair value of P48,000), and assume all the liabilities except for the loan from Metrobank. Liway Ltd. is then to go into liquidation. Cash of P20,000, half to be paid on date of exchange and half in one eyar's time. The incremental borrowing rate is 10% per annum (present value for P1 at 10% for 1 period is 0.909091). Supply of a patent relating to the manufacture of ice cream. This has a fair value of P60,000 but has not been recognized in the records of Liway Ltd. because it resulted from an internally generated research project. Richard Ltd. is to supply sufficient cash to enable the debt to Metrobank to be paid off and to cover the liquidation costs of P5,500. it will also give P150,000 to be distributed to Mr. and Mrs. Melad to assists in paying the wedding costs. Richard Ltd. is also to give a piece of its own prime land to Liway Ltd. to be distributed to Mr. and Mrs. Melad, this eventually being available to be given to any offspring of the forthcoming. marriage. The piece of land in question has a carrying amount of P80,000 and a fair value of P220,000. Richard Ltd. is to issue 90,000 shares, these having a fair value of P14 per share, to be distributed via Liway Ltd. to the soon to-be- married-daughter of Mr. and Mrs. Melad, who is currently a shareholder in Liway Ltd. The takeover proceeded as per the agreement with Richard Ltd. incurring incidental acquisition costs of P25,000, while there were P18,000 share issue costs. The amount of goodwill or (bargain purchase gain): 15. Jane Ltd., a supplier of snooker equipment, agreed to acquire the business of a rival firm, Mercy Ltd. taking over all assets and liabilities as at 1 June 20x6. The price agreed upon was P40,000, payable P20,000 cash and the balance by the issue to the selling company of 16,000 fully paid shares in Jane Ltd. these shares having a fair value of P2.50 per share. The trial balances of the two companies as at 1 June 20x6 were as follows: Jane Ltd. Mercy Ltd. Dr. Cr. Dr. Share capital....... P100,000 Cr. P 90,000 Retained earnings...... 12,000 P 24,000 Accounts payable..... 2,000 20,000 Cash........... ...... P 30,000 Plant (net).......... 50,000 30,000 Inventory ....... 14,000 Accounts receivable. 8,000 26,000 20,000 Government bonds ... 12,000 - Goodwill........ P114,000 P114,000 10,000 P110,000 P110,000 All the identifiable net assets of Mercy Ltd. were recorded by Mercy Ltd. at fair value except for the inventory which was considered to be worth P28,000. The plant had an expected remaining life of five years. The business combination was completed and Mercy Ltd. went into liquidation. Costs of liquidation amounted to P1,000. Jane Ltd. incurred incidental costs of P500 in relation to the acquisition costs. Costs of issuing shares in Jane Ltd. were P400. The amount of goodwill:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started