Answered step by step

Verified Expert Solution

Question

1 Approved Answer

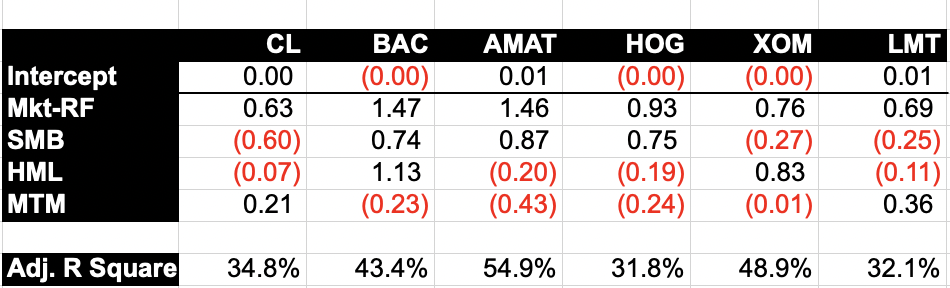

1.3 Estimates: Question: Intercept Mkt-RF SMB HML MTM CL 0.00 0.63 (0.60) (0.07) 0.21 BAC (0.00) 1.47 0.74 1.13 (0.23) AMAT 0.01 1.46 0.87 (0.20)

1.3 Estimates:

Question:

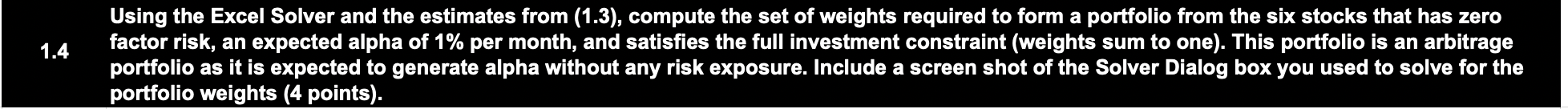

Intercept Mkt-RF SMB HML MTM CL 0.00 0.63 (0.60) (0.07) 0.21 BAC (0.00) 1.47 0.74 1.13 (0.23) AMAT 0.01 1.46 0.87 (0.20) (0.43) HOG (0.00) 0.93 0.75 (0.19) (0.24) XOM (0.00) 0.76 (0.27) 0.83 (0.01) LMT 0.01 0.69 (0.25) (0.11) 0.36 Adj. R Square 34.8% 43.4% 54.9% 31.8% 48.9% 32.1% 1.4 Using the Excel Solver and the estimates from (1.3), compute the set of weights required to form a portfolio from the six stocks that has zero factor risk, an expected alpha of 1% per month, and satisfies the full investment constraint (weights sum to one). This portfolio is an arbitrage portfolio as it is expected to generate alpha without any risk exposure. Include a screen shot of the Solver Dialog box you used to solve for the portfolio weights (4 points). Intercept Mkt-RF SMB HML MTM CL 0.00 0.63 (0.60) (0.07) 0.21 BAC (0.00) 1.47 0.74 1.13 (0.23) AMAT 0.01 1.46 0.87 (0.20) (0.43) HOG (0.00) 0.93 0.75 (0.19) (0.24) XOM (0.00) 0.76 (0.27) 0.83 (0.01) LMT 0.01 0.69 (0.25) (0.11) 0.36 Adj. R Square 34.8% 43.4% 54.9% 31.8% 48.9% 32.1% 1.4 Using the Excel Solver and the estimates from (1.3), compute the set of weights required to form a portfolio from the six stocks that has zero factor risk, an expected alpha of 1% per month, and satisfies the full investment constraint (weights sum to one). This portfolio is an arbitrage portfolio as it is expected to generate alpha without any risk exposure. Include a screen shot of the Solver Dialog box you used to solve for the portfolio weights (4 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started