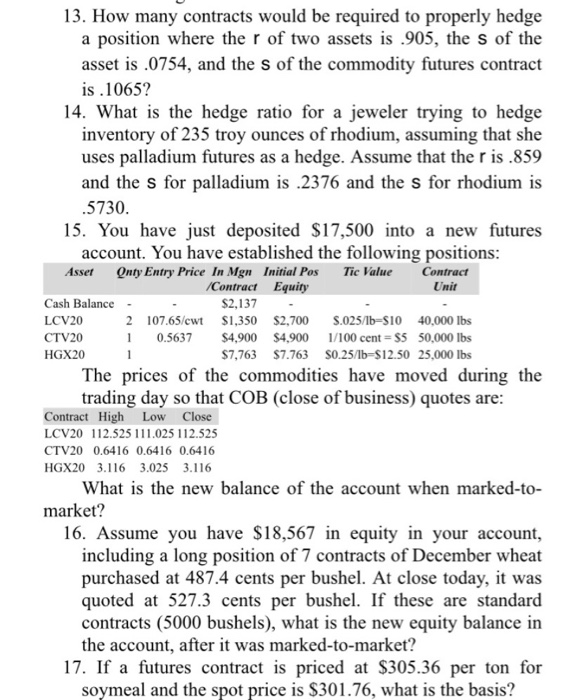

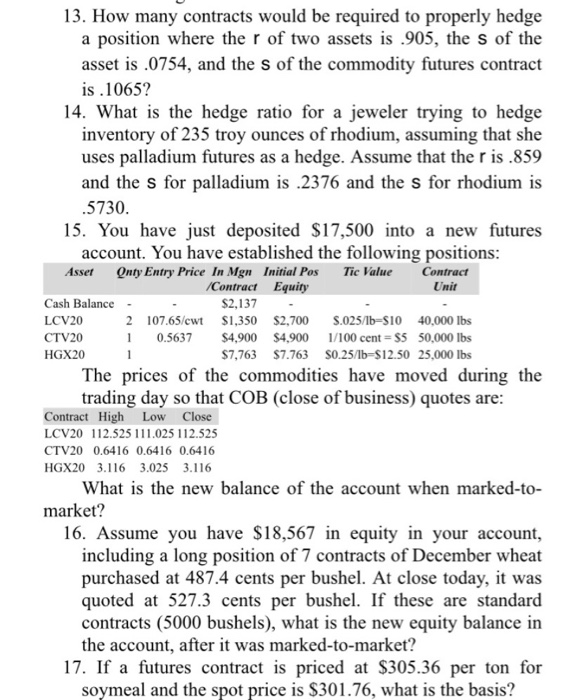

13. How many contracts would be required to properly hedge a position where the r of two assets is 905, the s of the asset is .0754, and the s of the commodity futures contract is .1065? 14. What is the hedge ratio for a jeweler trying to hedge inventory of 235 troy ounces of rhodium, assuming that she uses palladium futures as a hedge. Assume that the r is.859 and the s for palladium is .2376 and the s for rhodium is .5730. 15. You have just deposited $17,500 into a new futures account. You have established the following positions: Asset Onty Entry Price In Mgn Initial Pos Tic Value Contract Contract Equity Unit Cash Balance - $2,137 LCV20 2 107.65/cwt $1,350 $2,700 $.025/1b=$10 40,000 lbs CTV20 10.5637 $4,900 $4,900 /100 cent = $5 50,000 lbs HGX20 1 $7,763 $7.763 $0.25/1b=$12.50 25,000 lbs The prices of the commodities have moved during the trading day so that COB (close of business) quotes are: Contract High Low Close LCV20 112.525 111.025 112.525 CTV20 0.6416 0.6416 0.6416 HGX20 3.116 3.025 3.116 What is the new balance of the account when marked-to- market? 16. Assume you have $18,567 in equity in your account, including a long position of 7 contracts of December wheat purchased at 487.4 cents per bushel. At close today, it was quoted at 527.3 cents per bushel. If these are standard contracts (5000 bushels), what is the new equity balance in the account, after it was marked-to-market? 17. If a futures contract is priced at $305.36 per ton for soymeal and the spot price is $301.76, what is the basis? 13. How many contracts would be required to properly hedge a position where the r of two assets is 905, the s of the asset is .0754, and the s of the commodity futures contract is .1065? 14. What is the hedge ratio for a jeweler trying to hedge inventory of 235 troy ounces of rhodium, assuming that she uses palladium futures as a hedge. Assume that the r is.859 and the s for palladium is .2376 and the s for rhodium is .5730. 15. You have just deposited $17,500 into a new futures account. You have established the following positions: Asset Onty Entry Price In Mgn Initial Pos Tic Value Contract Contract Equity Unit Cash Balance - $2,137 LCV20 2 107.65/cwt $1,350 $2,700 $.025/1b=$10 40,000 lbs CTV20 10.5637 $4,900 $4,900 /100 cent = $5 50,000 lbs HGX20 1 $7,763 $7.763 $0.25/1b=$12.50 25,000 lbs The prices of the commodities have moved during the trading day so that COB (close of business) quotes are: Contract High Low Close LCV20 112.525 111.025 112.525 CTV20 0.6416 0.6416 0.6416 HGX20 3.116 3.025 3.116 What is the new balance of the account when marked-to- market? 16. Assume you have $18,567 in equity in your account, including a long position of 7 contracts of December wheat purchased at 487.4 cents per bushel. At close today, it was quoted at 527.3 cents per bushel. If these are standard contracts (5000 bushels), what is the new equity balance in the account, after it was marked-to-market? 17. If a futures contract is priced at $305.36 per ton for soymeal and the spot price is $301.76, what is the basis