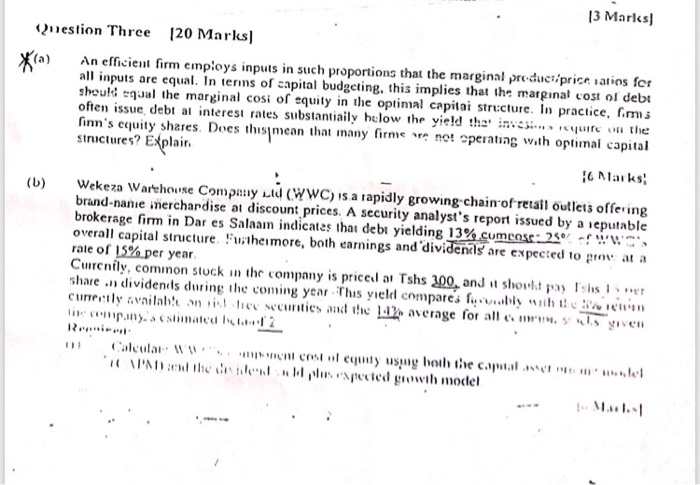

13 Marks Question Three (20 Marks X (a) Ana An efficient firm employs inputs in such proportions that the marginal product/price atins for all inputs are equal. In terms of capital budgeting. this implies that the marginal cost of deb should equal the marginal cosi of equity in the optimal capital structure. In practice, cims often issue debt at interest rates substantiaily hulow the yield the in f o on the finn's cquity shares. Does this mean that inany firme not operating with optimal capital structures? Explain 16 Marks (1) Wekeza Warehouse Company Ltd (WWC) is a rapidly growing chain of retail outlets offering brand-nanie inerchardise at discount prices. A security analyst's report issued by a reputable brokerage firm in Dar es Salaam indicates that debt yielding 13% cumcose: 250 W overall capital structure. Furthermore, both earnings and dividends are expected to provat a rale of 15% per year Cuircnily, common stuck in the company is priced at Tshs 300, and shovka Tshs et share.) dividenils during the coming year This yield compares by siiht currectly available on the securities and the average for alle given companya estimated 2 111 Calcular WWI I 'Mind the on I Calcutyung both the capital l uspected growth model e 13 Marks Question Three (20 Marks X (a) Ana An efficient firm employs inputs in such proportions that the marginal product/price atins for all inputs are equal. In terms of capital budgeting. this implies that the marginal cost of deb should equal the marginal cosi of equity in the optimal capital structure. In practice, cims often issue debt at interest rates substantiaily hulow the yield the in f o on the finn's cquity shares. Does this mean that inany firme not operating with optimal capital structures? Explain 16 Marks (1) Wekeza Warehouse Company Ltd (WWC) is a rapidly growing chain of retail outlets offering brand-nanie inerchardise at discount prices. A security analyst's report issued by a reputable brokerage firm in Dar es Salaam indicates that debt yielding 13% cumcose: 250 W overall capital structure. Furthermore, both earnings and dividends are expected to provat a rale of 15% per year Cuircnily, common stuck in the company is priced at Tshs 300, and shovka Tshs et share.) dividenils during the coming year This yield compares by siiht currectly available on the securities and the average for alle given companya estimated 2 111 Calcular WWI I 'Mind the on I Calcutyung both the capital l uspected growth model e