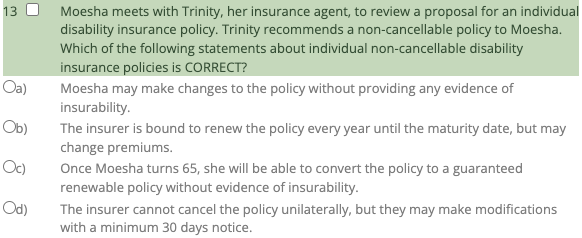

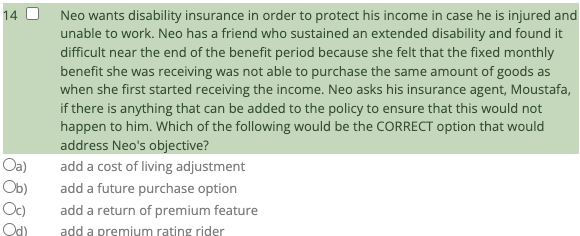

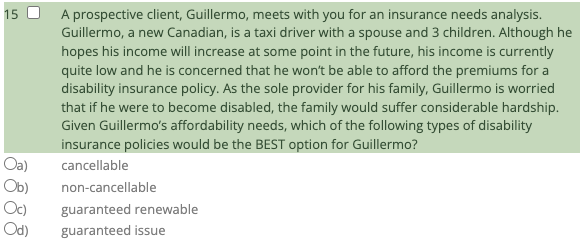

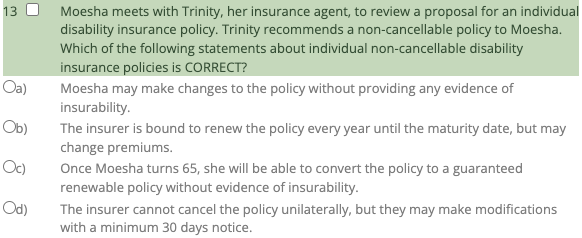

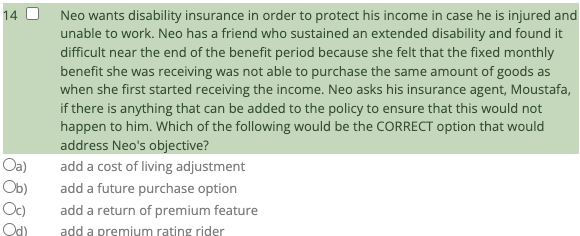

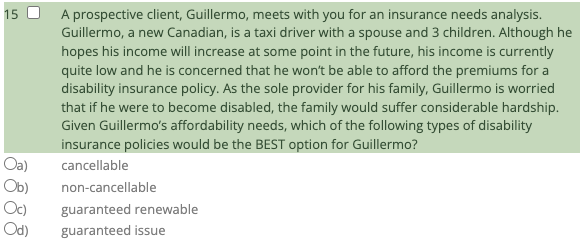

13 Oa) Ob) Moesha meets with Trinity, her insurance agent, to review a proposal for an individual disability insurance policy. Trinity recommends a non-cancellable policy to Moesha. Which of the following statements about individual non-cancellable disability insurance policies is CORRECT? Moesha may make changes to the policy without providing any evidence of insurability. The insurer is bound to renew the policy every year until the maturity date, but may change premiums. Once Moesha turns 65, she will be able to convert the policy to a guaranteed renewable policy without evidence of insurability. The insurer cannot cancel the policy unilaterally, but they may make modifications with a minimum 30 days notice. Oc) Od) 14 4 Neo wants disability insurance in order to protect his income in case he is injured and unable to work. Neo has a friend who sustained an extended disability and found it difficult near the end of the benefit period because she felt that the fixed monthly benefit she was receiving was not able to purchase the same amount of goods as when she first started receiving the income. Neo asks his insurance agent, Moustafa, if there is anything that can be added to the policy to ensure that this would not happen to him. Which of the following would be the CORRECT option that would address Neo's objective? add a cost of living adjustment add a future purchase option add a return of premium feature add a premium rating rider Oa) Ob) Oc) Od) 15 A prospective client, Guillermo, meets with you for an insurance needs analysis. Guillermo, a new Canadian, is a taxi driver with a spouse and 3 children. Although he hopes his income will increase at some point in the future, his income is currently quite low and he is concerned that he won't be able to afford the premiums for a disability insurance policy. As the sole provider for his family, Guillermo is worried that if he were to become disabled, the family would suffer considerable hardship. Given Guillermo's affordability needs, which of the following types of disability insurance policies would be the BEST option for Guillermo? cancellable non-cancellable guaranteed renewable guaranteed issue Oa) Ob) Oc) Od)