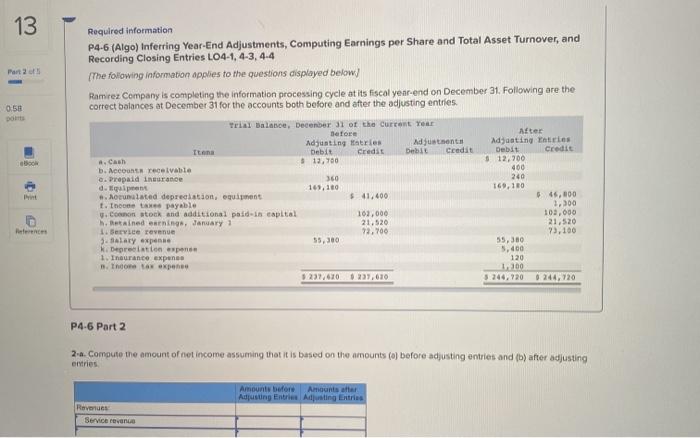

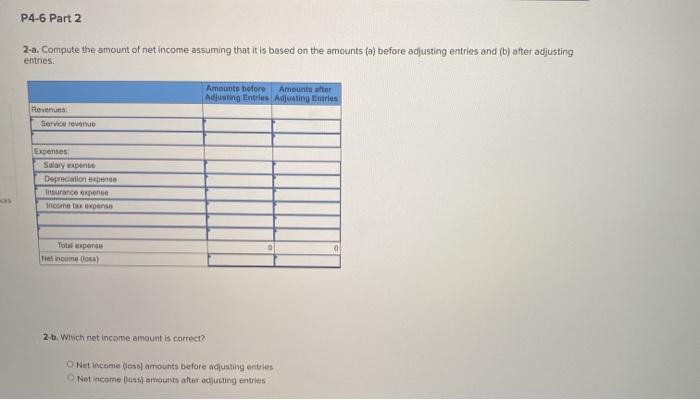

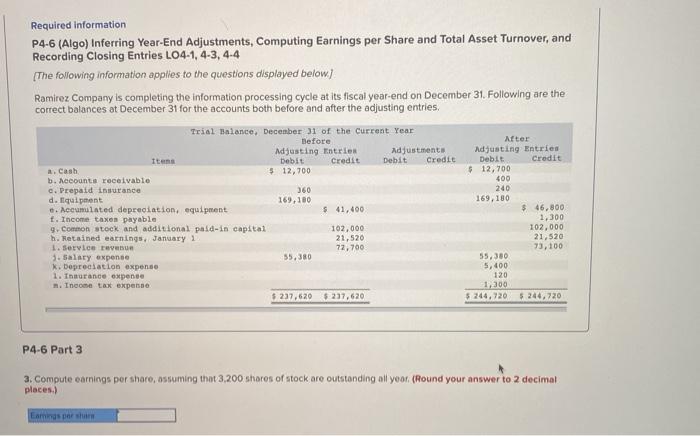

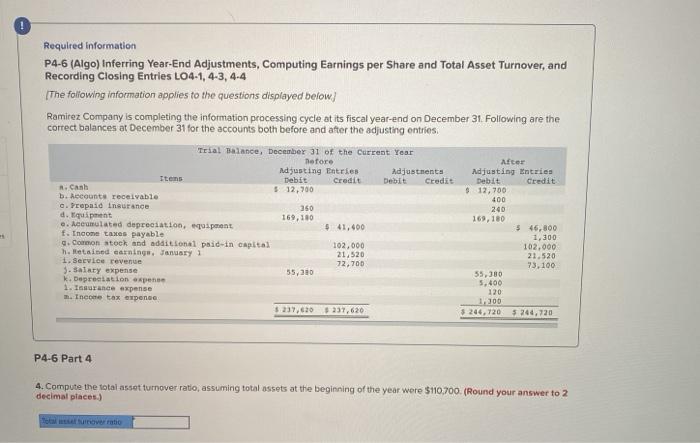

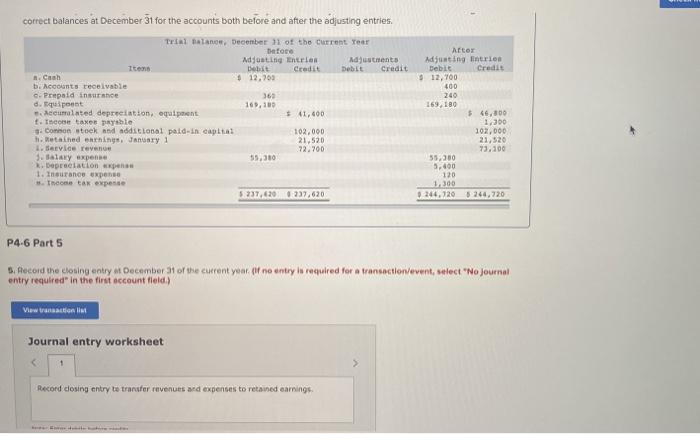

13 Part 2 0:58 Required information P4-6 (Algo) Inferring Year-End Adjustments, Computing Earnings per Share and Total Asset Turnover, and Recording Closing Entries L04-1, 4-3, 4.4 (The following information applies to the questions displayed below) Ramirez Company is completing the information processing cycle at its fiscal year-end on December 31. Following are the correct balances at December 31 for the accounts both before and after the adjusting entries. Trial Balance, December 31 of the current Year Before After Adjunting atries Adjustments Adjusting entries Items Debit Credit Debit Credit Debit Credit 12,700 $12.900 b. Mot receivable 400 c. Prepaid insurance 360 240 d. Egapent 169,10 169, 110 .. Morlated depreciation, equipment $ 41,600 $ 45,000 1. Those are payable 3.300 u. Conon stock and additional paid-1 capital 103,000 102,000 Retained enting, January 1 21.520 1. Service revenue 21.520 92.700 73,100 3. Salary expense 55,300 K. Depreciation expende 55,380 5.400 1. Insurance expense 120 Theore tax expense 1.100 3.237.6700227,670 3.244.720 0244,720 References P4.6 Part 2 2... Compute the amount of not income assuming that it is based on the amounts (a) before adjusting entries and (b) after adjusting entries Amounts before Amounts after Adjusting Entries Adjusting Entries Revenues Service revenue P4-6 Part 2 2-a. Compute the amount of net income assuming that it is based on the amounts (a) before adjusting entries and (b) after adjusting entries Amounts before Amounts for Adjusting Entries Adjusting Entries Revenus: Service revenue Expenses Salary expen Depreciation expense Insurance expense Income tax expense Total sporto Net Income (los) 2-b. Which net income amount is correct? ONet Income foss) amounts before adjusting entries Net income foss) amounts after adjusting entries Required information P4-6 (Algo) Inferring Year-End Adjustments, Computing Earnings per Share and Total Asset Turnover, and Recording Closing Entries L04-1,4-3, 4-4 (The following information applies to the questions displayed below) Ramirez Company is completing the information processing cycle at its fiscal year-end on December 31. Following are the correct balances at December 31 for the accounts both before and after the adjusting entries, Trial Balance, December 31 of the current Year Before After Adjusting Entries Adjustment Adjusting Entries Items Debit Credit Debit Credit Debit Credit 2. Cash $ 12,700 $ 12,700 b. Accounts receivable 400 c. Prepaid insurance 360 240 d. quipment 169,180 169,180 . Accumulated depreciation equipment $ 41,400 46.800 f. Income taxes payable 1,300 9. Common stock and additional paid-in capital 102,000 102.000 Retained earnings, January 1 22,520 21, 520 1. Service revenue 72,700 73,100 3. Salary expense 55,380 55,380 k. Depreciation expense 5,400 1. Insurance expense 120 m. Income tax expense 1,309 237,620 $ 237,620 $244.720 $244.720 P4-6 Part 3 3. Compute camnings por share, assuming that 3.200 shares of stock are outstanding all year (Round your answer to 2 decimal places.) Earnings por su Required information P4-6 (Algo) Inferring Year-End Adjustments, Computing Earnings per Share and Total Asset Turnover, and Recording Closing Entries L04-1, 4-3, 4-4 (The following information applies to the questions displayed below) Ramirez Company is completing the information processing cycle at its fiscal year-end on December 31. Following are the correct balances at December 31 for the accounts both before and after the adjusting entries. Trial Balance, December 31 of the Current Year Before After Adjusting Entries Adjustments Adjusting Entries Items Debit Credit Debit Credit Debit Credit A Anh $12.700 $ 12,700 b. Accounts receivable c. Prepaid Insurance 350 240 d. Equipment 169, 180 169,180 e. Accumulated depreciation, quipment 5 41,400 $ 46,800 f. Income taxes payable 1,300 Common stock and additional paid in capital 102,000 102.000 1. Metained earnings, January 1 21,520 21.520 1. Service revenue 72,700 73,100 3. Salary expense 55,330 k. Depreciation expense 55,380 5,400 1. Insurance expense 120 m. Income tax expense 1.300 5.237.620 237,620 $ 246, 720 5.244,220 400 P4-6 Part 4 4. Compute the total asset turnover ratio, assuming total assets at the beginning of the year were $110.700. (Round your answer to 2 decimal places.) correct balances at December 31 for the accounts both before and after the adjusting entries. 360 Trial balance, December of the current Tear Before Adjusting their Adjustments Item Debit Credit Credit 8. Cash $ 12,700 b. Accounts receivable c. Prepaid insurance d. Equipoent 169,109 ecumalated depreciation equipment $ 41,400 t. The taxes payshte 5. Connon steek and additional pald.in capital 102.000 Retained things. Jangary 1 21.520 1. Service revenge 72.700 1. Balaxy expense 55,310 Depreciation des 1. Insurance expense 3. The tax expense 3.237.620 0237,620 Actor Adjusting Intries Debit Credit $ 12,700 400 240 169, 180 $ 46,00 1.300 102.000 21,520 73.100 55.000 5.400 120 1.300 244,220 5.264, 720 P4-6 Part 5 Record the closing entry of December of the current year. If no entry to required for a transaction/event, select "No Journal entry required in the first account field) Vlow eaction Journal entry worksheet + > Record closing entry to transfer revenues and expenses to retained earnings