Answered step by step

Verified Expert Solution

Question

1 Approved Answer

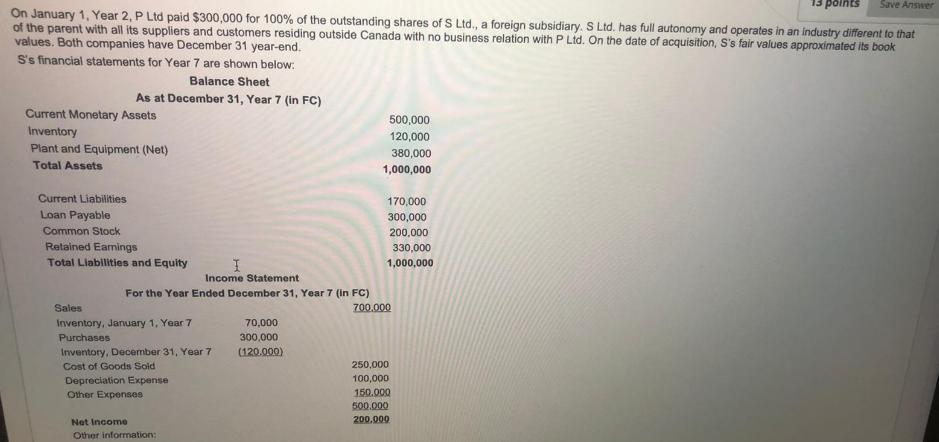

13 points Save Answer On January 1, Year 2, P Ltd paid $300,000 for 100% of the outstanding shares of S Ltd., a foreign

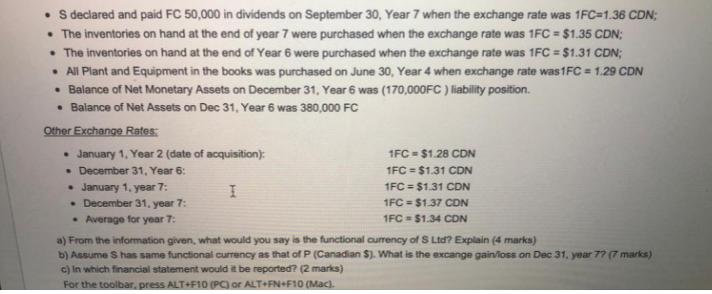

13 points Save Answer On January 1, Year 2, P Ltd paid $300,000 for 100% of the outstanding shares of S Ltd., a foreign subsidiary. S Ltd. has full autonomy and operates in an industry different to that of the parent with all its suppliers and customers residing outside Canada with no business relation with P Ltd. On the date of acquisition, S's fair values approximated its book values. Both companies have December 31 year-end. S's financial statements for Year 7 are shown below: Balance Sheet As at December 31, Year 7 (in FC) Current Monetary Assets Inventory Plant and Equipment (Net) Total Assets Current Liabilities Loan Payable Common Stock Retained Earnings Total Liabilities and Equity I Income Statement Sales Inventory, January 1, Year 7 Purchases Inventory, December 31, Year 7 Cost of Goods Sold Depreciation Expense Other Expenses Net Income Other information: 500,000 120,000 For the Year Ended December 31, Year 7 (in FC) 700.000 70,000 300,000 (120.000) 380,000 1,000,000 170,000 300,000 200,000 330,000 1,000,000 250,000 100,000 150.000 500.000 200,000 S declared and paid FC 50,000 in dividends on September 30, Year 7 when the exchange rate was 1FC-1.36 CDN; The inventories on hand at the end of year 7 were purchased when the exchange rate was 1FC = $1.35 CDN; The inventories on hand at the end of Year 6 were purchased when the exchange rate was 1FC = $1.31 CDN; All Plant and Equipment in the books was purchased on June 30, Year 4 when exchange rate was 1FC = 1.29 CDN Balance of Net Monetary Assets on December 31, Year 6 was (170,000FC) liability position. Balance of Net Assets on Dec 31, Year 6 was 380,000 FC Other Exchange Rates: January 1, Year 2 (date of acquisition): December 31, Year 6: January 1, year 7: December 31, year 7: Average for year 7: I 1FC=$1.28 CDN 1FC=$1.31 CDN 1FC=$1.31 CDN 1FC = $1.37 CDN 1FC = $1.34 CON a) From the information given, what would you say is the functional currency of S Ltd? Explain (4 marks) b) Assume S has same functional currency as that of P (Canadian $). What is the excange gainioss on Dec 31, year 77 (7 marks) c) In which financial statement would it be reported? (2 marks) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac).

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a From the information given what would you say is the functional currency of S Ltd Explain 4 marks ANS WER The functional currency of S Ltd is the Ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started