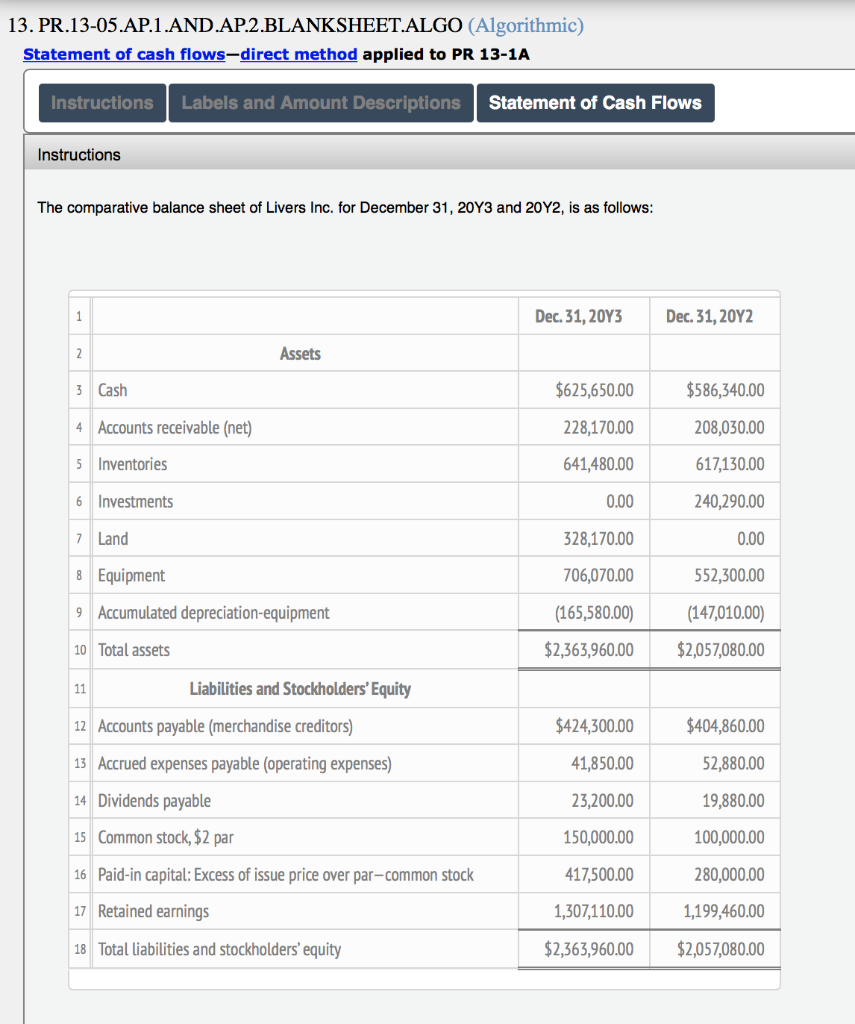

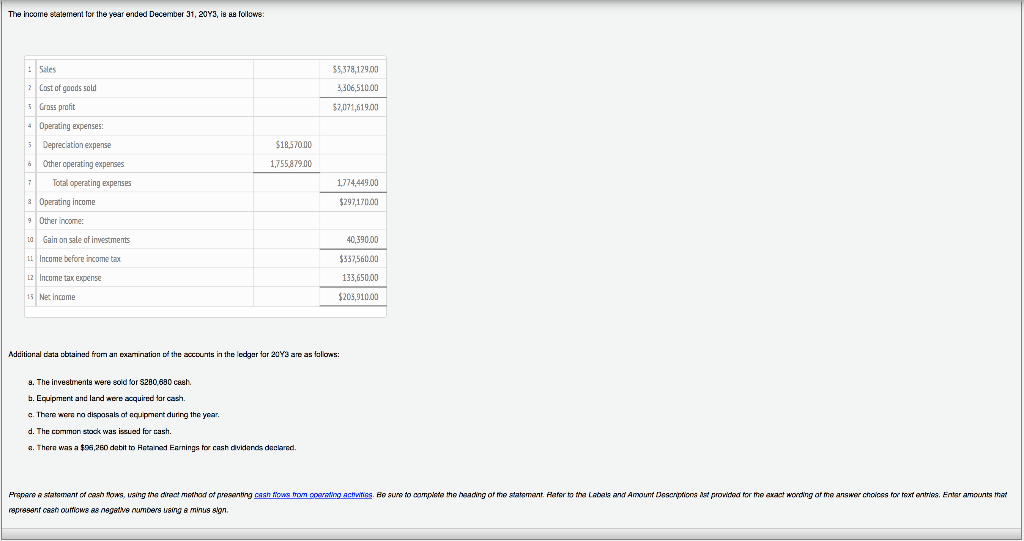

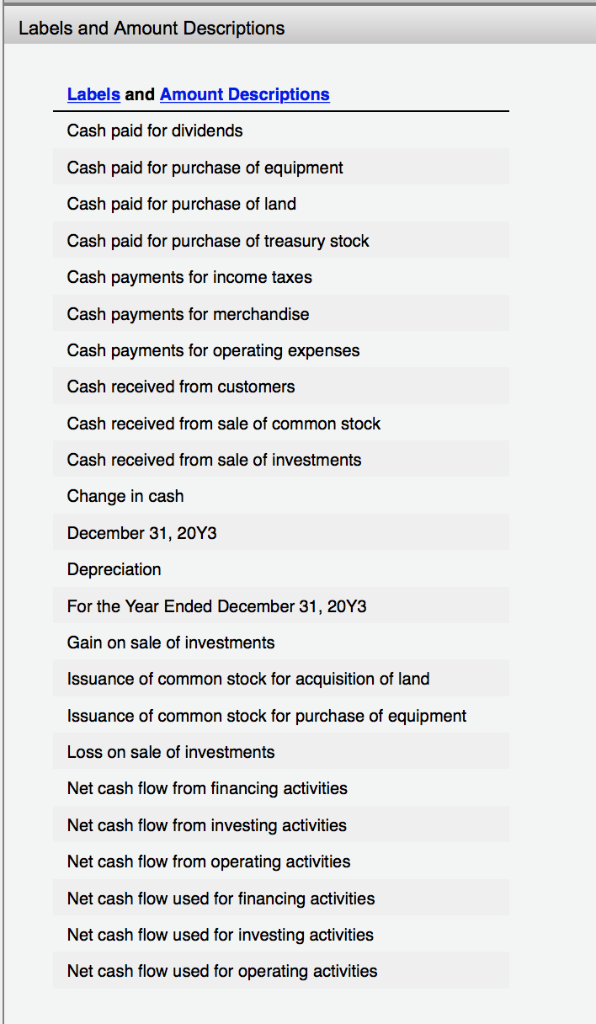

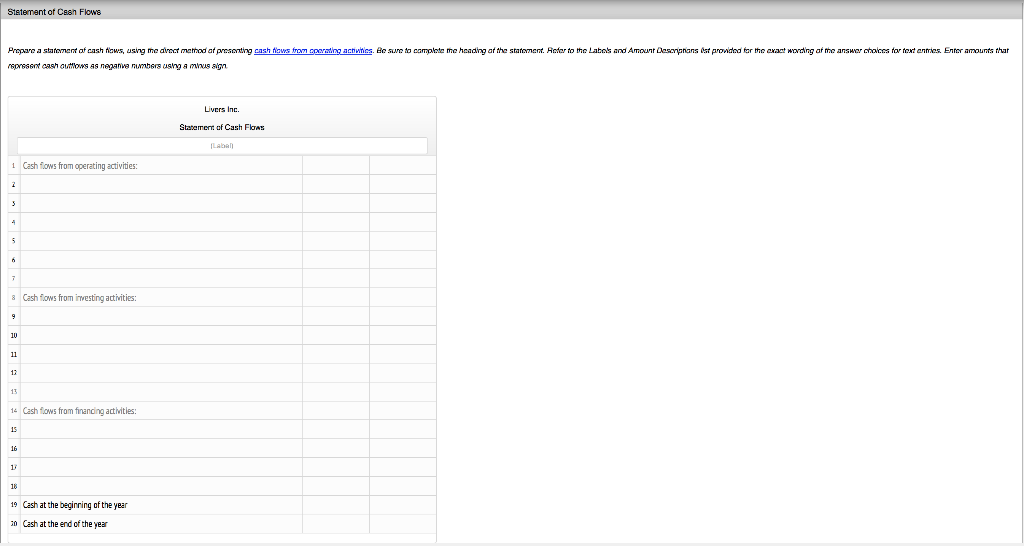

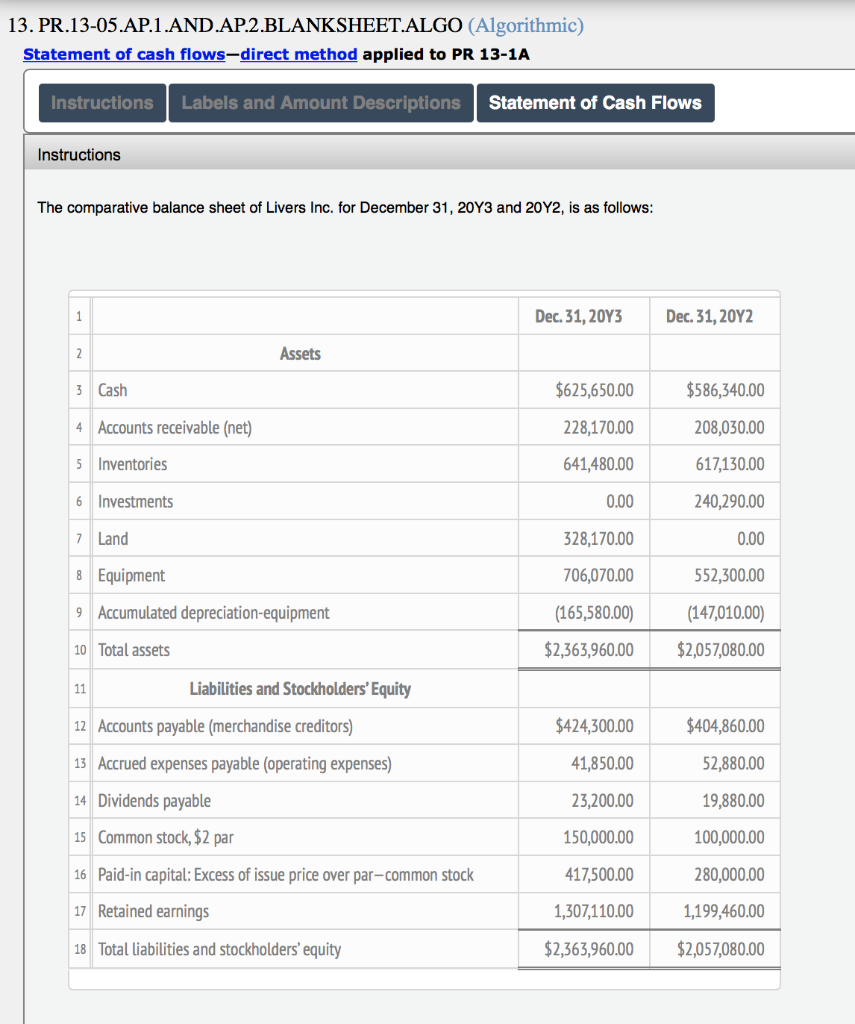

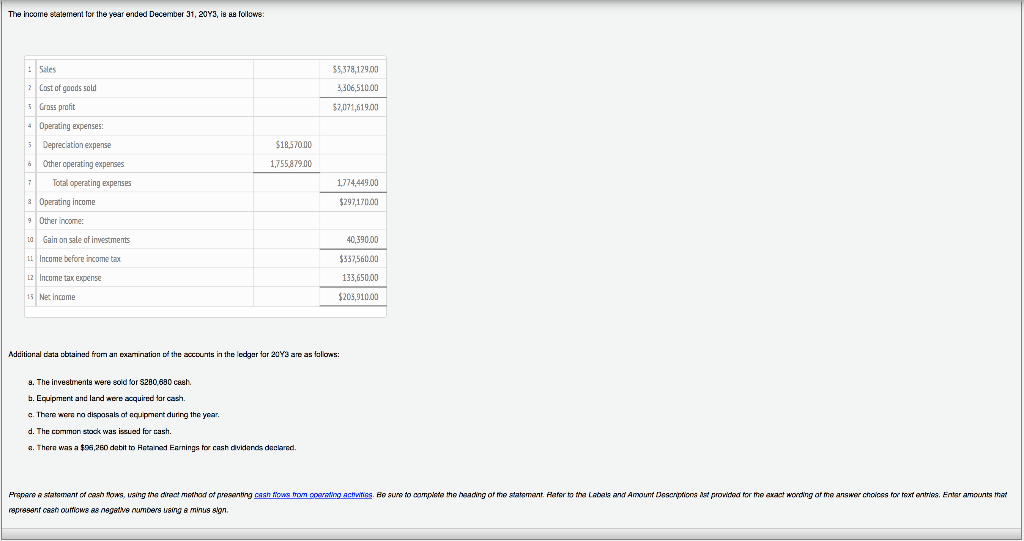

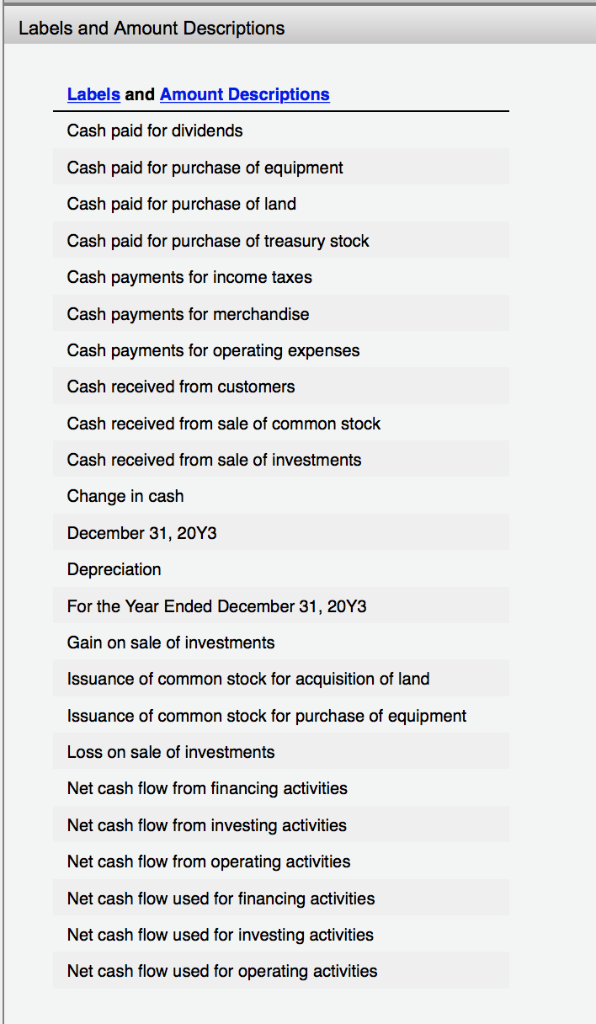

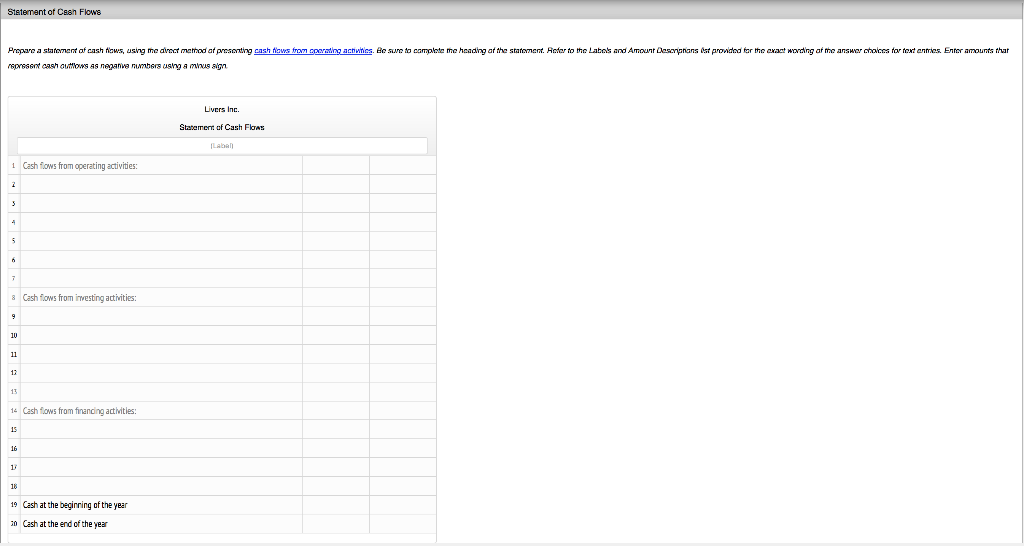

13. PR. 13-05 .AP.1.AND.AP2.BLANKSHEET.ALGO (Algorithmic) Statement of cash flows-direct method applied to PR 13-1A Instructions Labels and Amount Descriptions Statement of Cash Flows Instructions The comparative balance sheet of Livers Inc. for December 31, 20Y3 and 20Y2, is as follows Dec. 31,20Y3 Dec. 31,20Y Assets 625,650.00 228,170.00 41,480.00 0.00 328,170.00 706,070.00 $586,340.00 208,030.00 617,130.00 240,290.00 0.00 552,300.00 165,580.00(147,010.00) 2363,960.00 $2,057,080.00 3 Cash 4 Accounts receivable (net) 5 Inventories 6 Investments 7 Land 8 Equipment 9 Accumulated depreciation-equipment 0 Total assets Liabilities and Stockholders' Equity $404,860.00 52,880.00 19,880.00 100,000.00 280,000.00 1,199,460.00 2,363,960.00 $2,057,080.00 $424,300.00 41,850.00 3,200.00 150,000.00 417,500.00 1,307,110.00 2Accounts payable (merchandise creditors) 3 Accrued expenses payable (operating expenses) 14 Dividends payable 15 Common stock, $2 par 16 Paid-in capital: Excess of issue price over par-common stock 7 Retained earnings 18 Total liabilities and stockholders equity The roome statement for the year ended December 31, 20Y3, i8 88 rdlowe Sales 2 Cast of goods sold 5,378,129.00 3,306,51000 $7,071,61900 Gross profit 4Operating expenses: cation expense Other cperating expenses 171 Total operating expenses 1857000 1,755,87900 177444900 8 Oparating income 9 Other income: L Gain on sale of inwestments LL Income before income tax L2 I Income tax expense Nec income $297,170.00 40,390.00 337,560.00 133,650.00 203,910.00 Additianal ta cbained from an exannatian o the accounts in the ledger far 20Y3 are as falaows: 9. The inveetmente were soid tor S280,880 ceeh. b. Equpmert and land were acquired far cash. a. Tha wera ro dispasals at aqupmart durirg the yoar d. The common stock was issued for cash a. Thera was a S56,260 dabit to Hataned Earnings tor cash dvidards daland. Prapas a siatsmanr o ash os, aing the ret mathod o presaning cash ws om earain acnes. Boao to aampise the haacing or mo statamant. Rarerto tha Labals and Amaunt Jsscrrnons Ast rowid represent cean oumowe ae negetve numoers using minus s gn. or mo aat wing ar me answorcnoces for ext antries. Entar amonts ma Labels and Amount Descriptions Labels and Amount Descriptions Cash paid for dividends Cash paid for purchase of equipment Cash paid for purchase of land Cash paid for purchase of treasury stock Cash payments for income taxes Cash payments for merchandise Cash payments for operating expenses Cash received from customers Cash received from sale of common stock Cash received from sale of investments Change in cash December 31, 20Y3 Depreciation For the Year Ended December 31, 20Y3 Gain on sale of investments Issuance of common stock for acquisition of land Issuance of common stock for purchase of equipment Loss on sale of investments Net cash flow from financing activities Net cash flow from investing activities Net cash flow from operating activities Net cash flow used for financing activities Net cash flow used for investing activities Net cash flow used for operating activities Stetemant of Csan Flows Propare a statoment af cash s, using me arnct mehod af psonting cash ows ton goring achwtics. Besu pese cash aamows as neanv nnbers asv a mius ain to camplote me heading af the stament. Anfor to the Latos and Amount asapans st pronnd ar he cxact warding af me answwer choices tor text anmies. Enter amounts thar Livers Inc. Statemert af Cash Flas LAbA Cash fows from operating activities: Cash flows from investing activities: 8 4 Cash ows from finanding actvitles: 19 Cash at the beginring of the year o Cash at the end of the year