Answered step by step

Verified Expert Solution

Question

1 Approved Answer

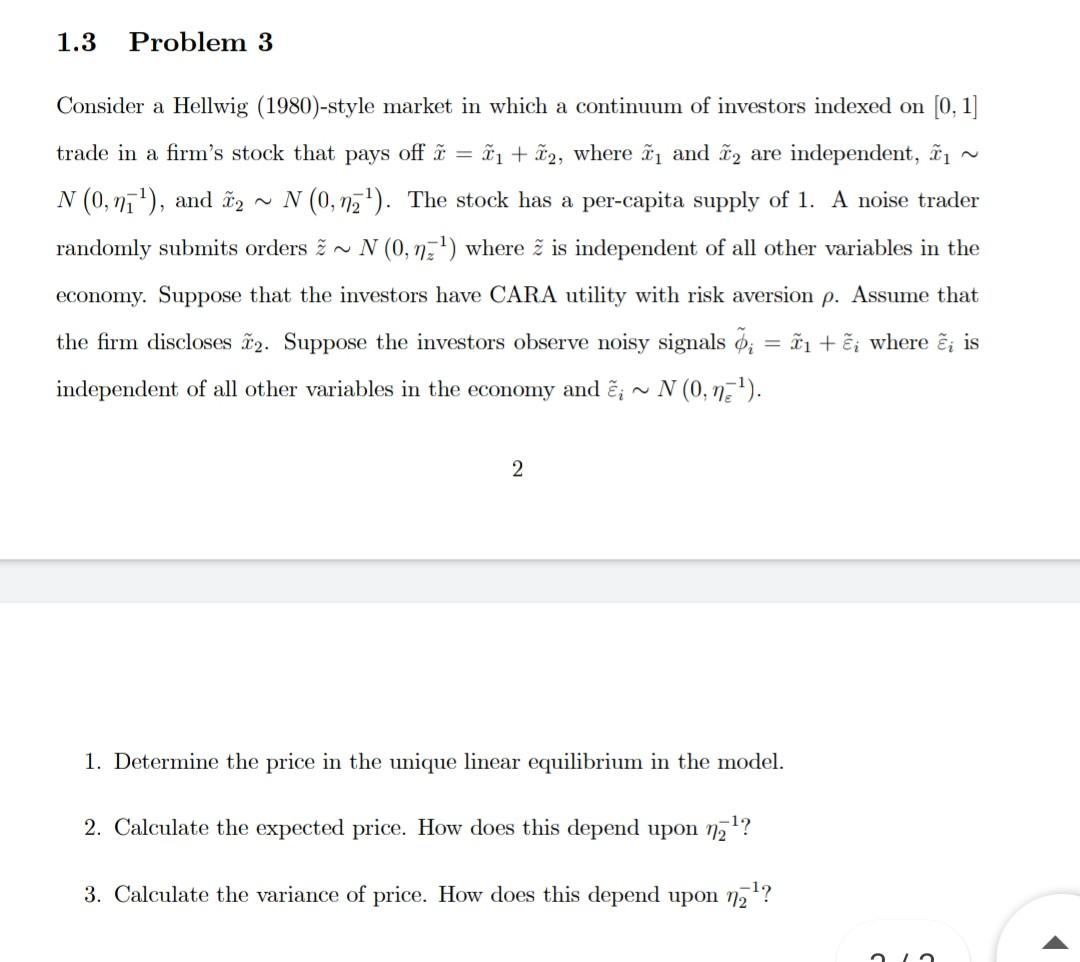

1.3 Problem 3 Consider a Hellwig (1980)-style market in which a continuum of investors indexed on [0, 1] trade in a firm's stock that pays

1.3 Problem 3 Consider a Hellwig (1980)-style market in which a continuum of investors indexed on [0, 1] trade in a firm's stock that pays off t = i + 72, where i and in are independent, i ~ N (0,n), and 72 N (0,12). The stock has a per-capita supply of 1. A noise trader randomly submits orders ~ N (0,nz") where is independent of all other variables in the economy. Suppose that the investors have CARA utility with risk aversion p. Assume that the firm discloses t2. Suppose the investors observe noisy signals ; = +i where i is independent of all other variables in the economy and ; ~ N (0,13). 2 1. Determine the price in the unique linear equilibrium in the model. 2. Calculate the expected price. How does this depend upon na?? 3. Calculate the variance of price. How does this depend upon na!? 1.3 Problem 3 Consider a Hellwig (1980)-style market in which a continuum of investors indexed on [0, 1] trade in a firm's stock that pays off t = i + 72, where i and in are independent, i ~ N (0,n), and 72 N (0,12). The stock has a per-capita supply of 1. A noise trader randomly submits orders ~ N (0,nz") where is independent of all other variables in the economy. Suppose that the investors have CARA utility with risk aversion p. Assume that the firm discloses t2. Suppose the investors observe noisy signals ; = +i where i is independent of all other variables in the economy and ; ~ N (0,13). 2 1. Determine the price in the unique linear equilibrium in the model. 2. Calculate the expected price. How does this depend upon na?? 3. Calculate the variance of price. How does this depend upon na

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started