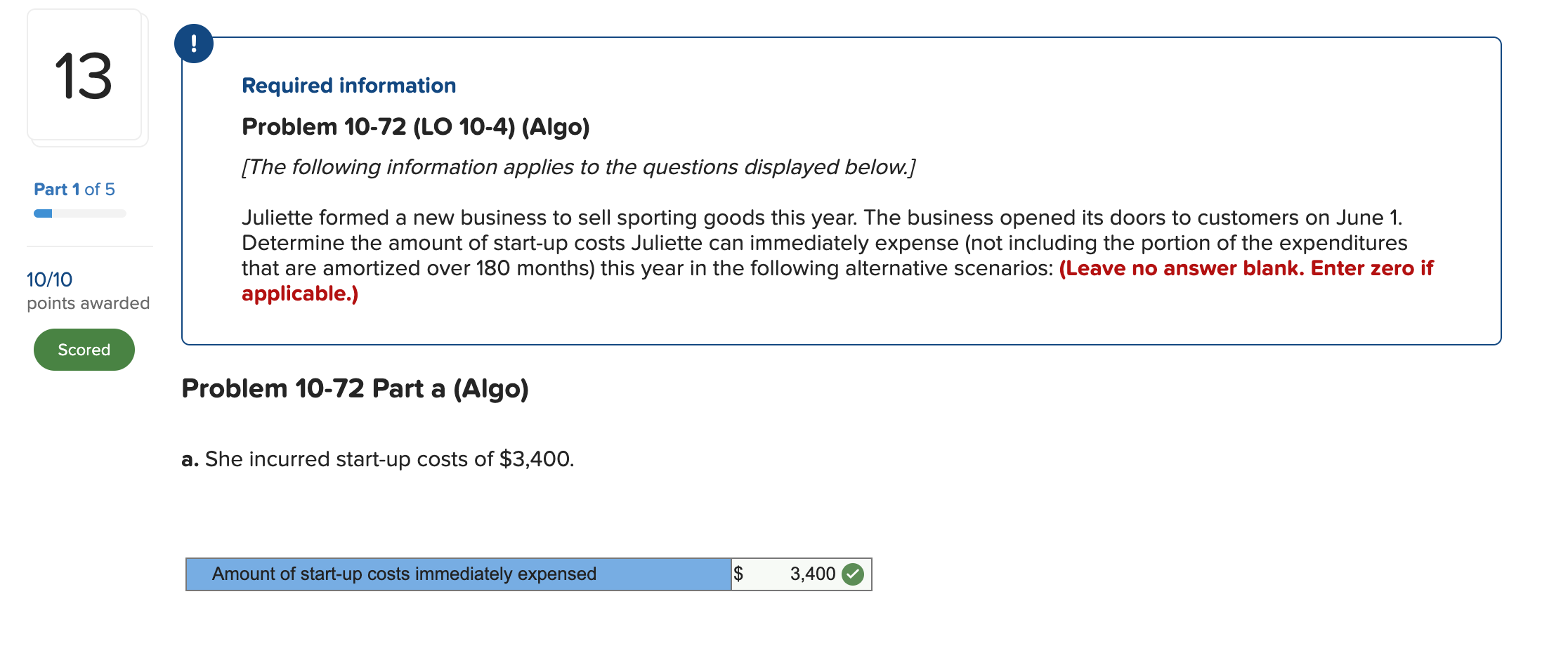

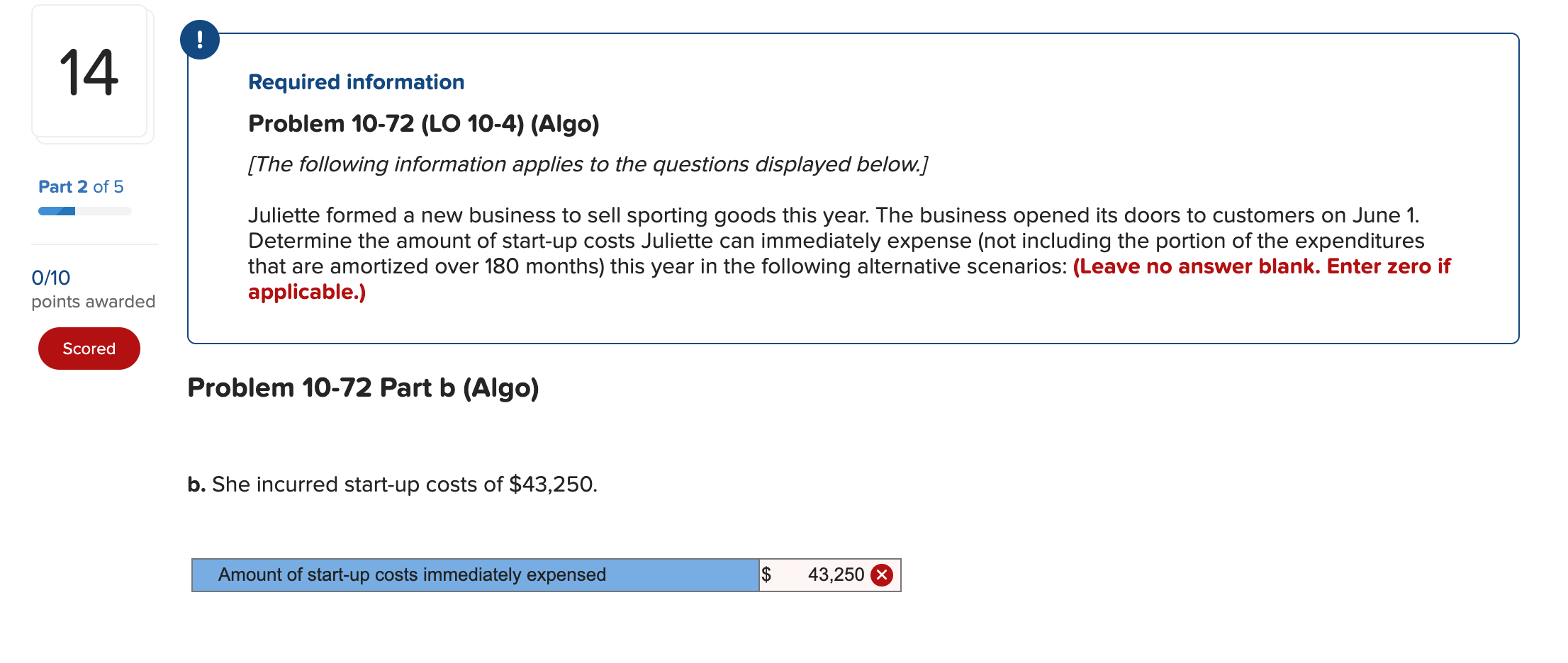

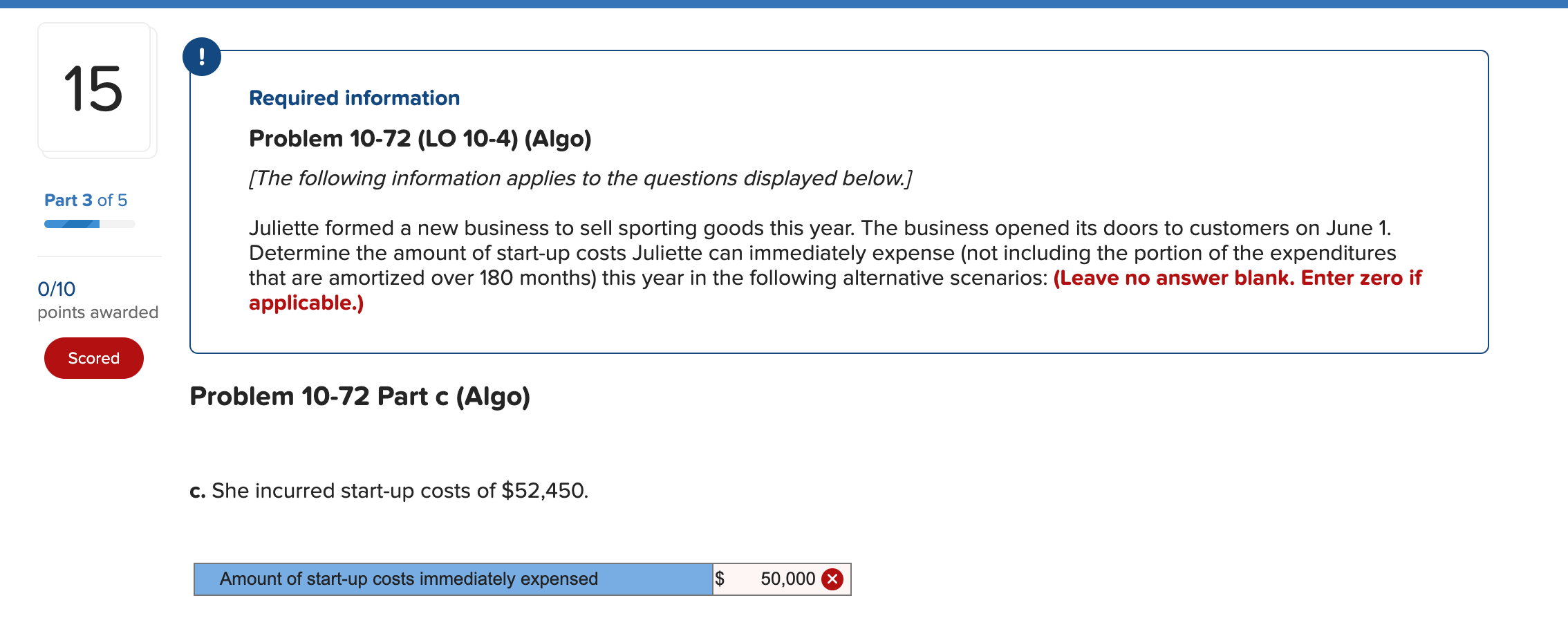

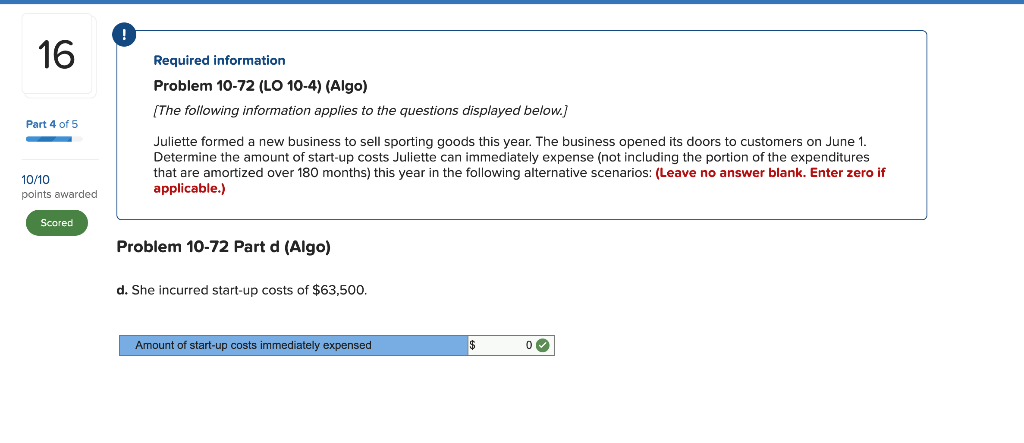

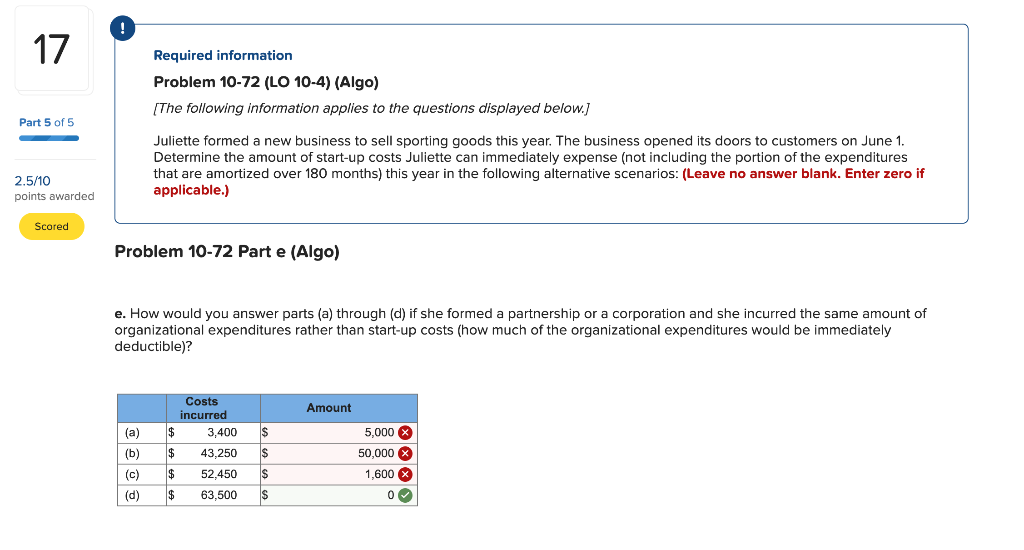

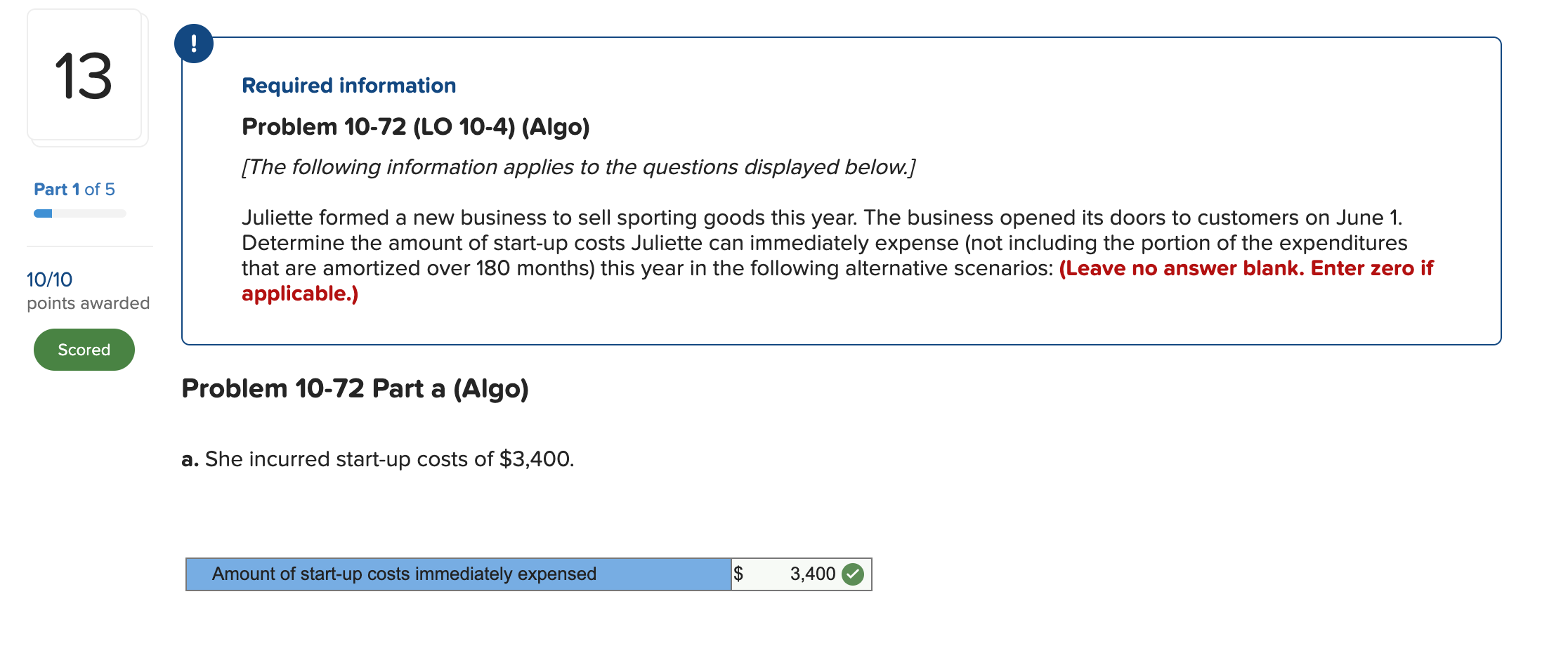

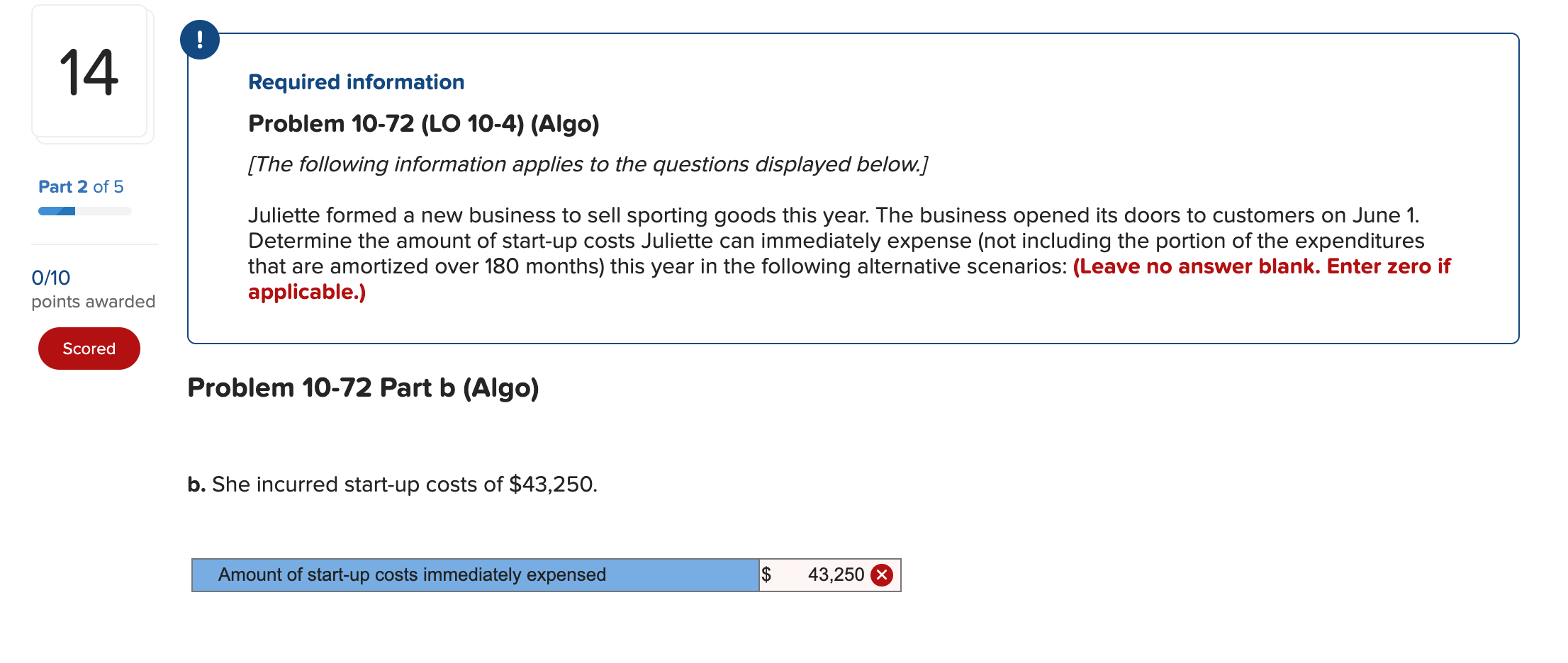

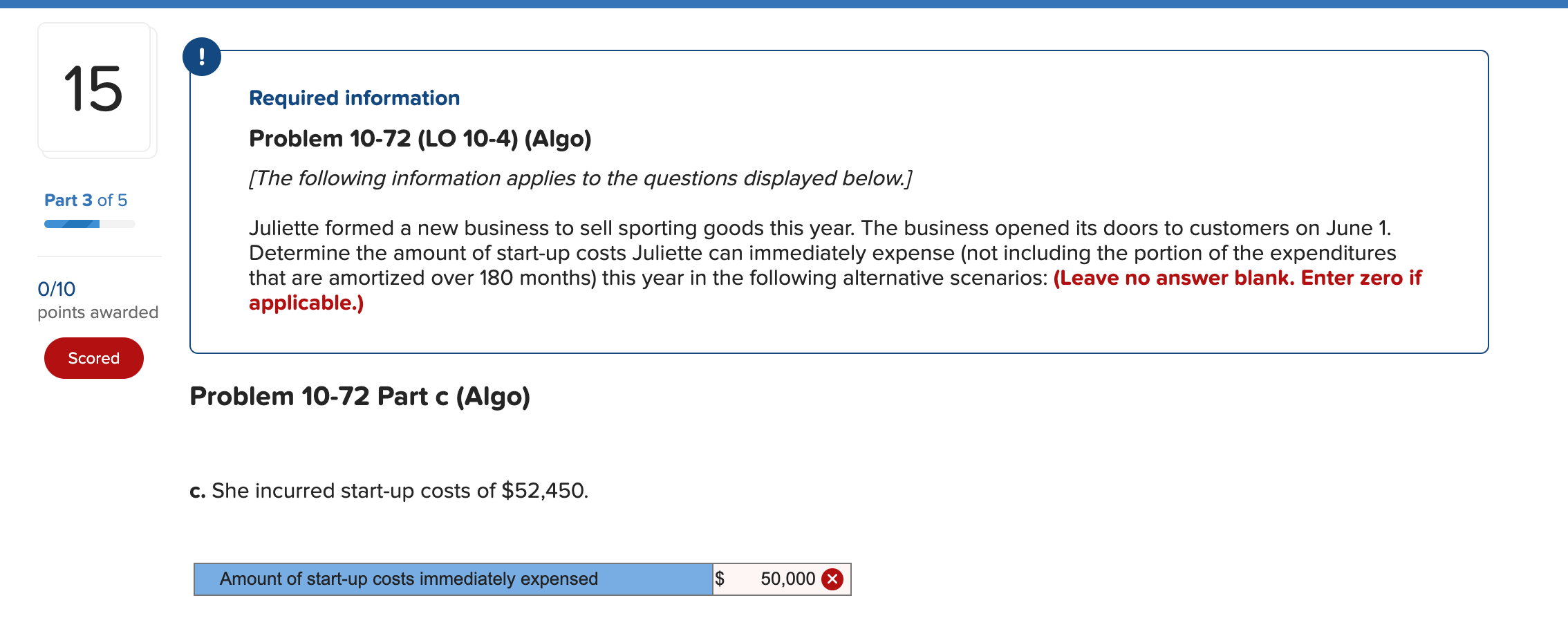

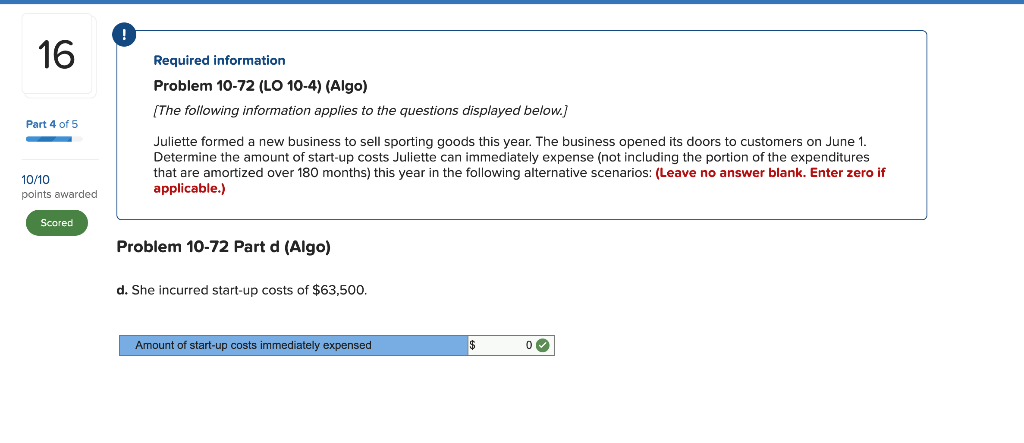

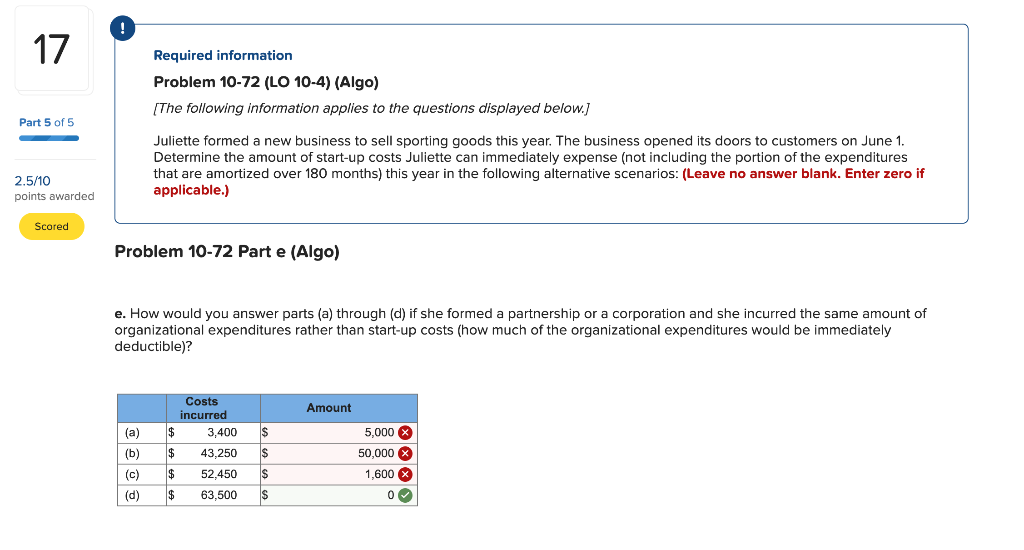

! 13 Required information Problem 10-72 (LO 10-4) (Algo) [The following information applies to the questions displayed below.] Part 1 of 5 Juliette formed a new business to sell sporting goods this year. The business opened its doors to customers on June 1. Determine the amount of start-up costs Juliette can immediately expense (not including the portion of the expenditures that are amortized over 180 months) this year in the following alternative scenarios: (Leave no answer blank. Enter zero if applicable.) 10/10 points awarded Scored Problem 10-72 Part a (Algo) a. She incurred start-up costs of $3,400. Amount of start-up costs immediately expensed $ 3,400 ! 14 Required information Problem 10-72 (LO 10-4) (Algo) [The following information applies to the questions displayed below.] Part 2 of 5 Juliette formed a new business to sell sporting goods this year. The business opened its doors to customers on June 1. Determine the amount of start-up costs Juliette can immediately expense (not including the portion of the expenditures that are amortized over 180 months) this year in the following alternative scenarios: (Leave no answer blank. Enter zero if applicable.) 0/10 points awarded Scored Problem 10-72 Part b (Algo) b. She incurred start-up costs of $43,250. Amount of start-up costs immediately expensed $ 43,250 X 15 Required information Problem 10-72 (LO 10-4) (Algo) [The following information applies to the questions displayed below.] Part 3 of 5 Juliette formed a new business to sell sporting goods this year. The business opened its doors to customers on June 1. Determine the amount of start-up costs Juliette can immediately expense (not including the portion of the expenditures that are amortized over 180 months) this year in the following alternative scenarios: (Leave no answer blank. Enter zero if applicable.) 0/10 points awarded Scored Problem 10-72 Part c (Algo) c. She incurred start-up costs of $52,450. Amount of start-up costs immediately expensed $ $ 50,000 16 Required information Problem 10-72 (LO 10-4) (Algo) (The following information applies to the questions displayed below.) Part 4 of 5 Juliette formed a new business to sell sporting goods this year. The business opened its doors to customers on June 1. Determine the amount of start-up costs Juliette can immediately expense (not including the portion of the expenditures that are amortized over 180 months) this year in the following alternative scenarios: (Leave no answer blank. Enter zero if applicable.) 10/10 points awarded Scored Problem 10-72 Part d (Algo) d. She incurred start-up costs of $63,500. Amount of start-up costs immediately expensed 0 17 Required information Problem 10-72 (LO 10-4) (Algo) [The following information applies to the questions displayed below.] Part 5 of 5 Juliette formed a new business to sell sporting goods this year. The business opened its doors to customers on June 1. Determine the amount of start-up costs Juliette can immediately expense (not including the portion of the expenditures that are amortized over 180 months) this year in the following alternative scenarios: (Leave no answer blank. Enter zero if applicable.) 2.5/10 points awarded Scored Problem 10-72 Parte (Algo) e. How would you answer parts (a) through (d) if she formed a partnership or a corporation and she incurred the same amount of organizational expenditures rather than start-up costs (how much of the organizational expenditures would be immediately deductible)? Amount $ Costs incurred 3,400 43.250 $ $ (a) (b) (c) (d) 54 55 5,000 % 50,000 X 1,600 X 0 $ 52.450 Is $ 63.500 s