Answered step by step

Verified Expert Solution

Question

1 Approved Answer

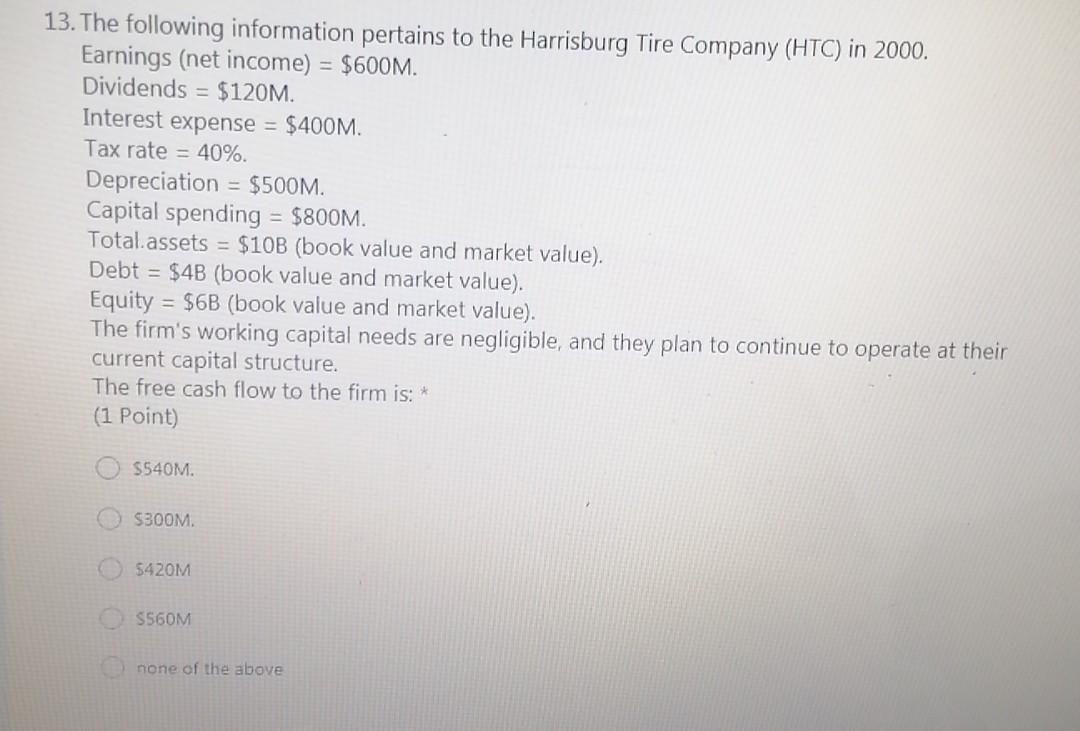

13. The following information pertains to the Harrisburg Tire Company (HTC) in 2000. Earnings (net income) = $600M. Dividends = $120M. Interest expense $400M. Tax

13. The following information pertains to the Harrisburg Tire Company (HTC) in 2000. Earnings (net income) = $600M. Dividends = $120M. Interest expense $400M. Tax rate = 40% Depreciation = $500M. Capital spending = $800M. Total.assets = $10B (book value and market value). Debt = $4B (book value and market value). Equity = $6B (book value and market value). The firm's working capital needs are negligible, and they plan to continue to operate at their current capital structure. The free cash flow to the firm is: * (1 Point) $540M. $300M 5420M S560M none of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started