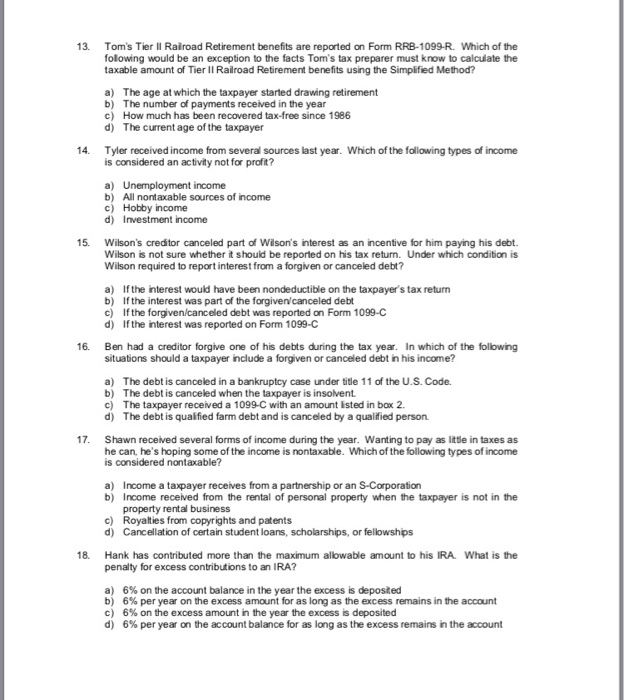

13. Tom's Tier II Rairoad Retirement benefits are reported on Form RRB-1099-R. Which of the folowing would be an exception to the facts Tom's tax preparer must know to calculate the taxable amount of Tier Il Rairoad Retirement benefits using the Simplified Method? The age at which the taxpayer started drawing retirement a) b) The number of payments received in the year c) d) How much has been recovered tax-free since 1986 The current age of the taxpayer Tyler received income from several sources last year. Which of the fallowing types of income is considered an activity not for proft? 14. a) Unemployment income b) All nontaxable sources of income c) Hobby income d) Investment income 5. Wilson's creditor canceled part of Wilson's interest as an incentive for him paying his debt. Wilson is not sure whether it should be reported on his tax return. Under which condition is Wilson required to report interest from a forgiven or canceled debt? f the interest would have been nondeductible on the taxpayer's tax return b) a) If the interest was part of the forgivencanceled debt c) If the forgiven/canceled debt was reported on Form 1099-C d) If the interest was reported on Form 1099-C 16. Ben had a creditor forgive one of his debts during the tax year. In which of the following situations should a taxpayer include a forgiven or canceled debt in his income? a) The debt is canceled in a bankruptcy case under title 11 of the U.S. Code. b) The debt is canceled when the taxpayer is insolvent c) The taxpayer received a 1099-C with an amount isted in box 2. d) The debt is qualified farm debt and is canceled by a qualified person. 17. Shawn received several forms of income during the year. Wanting to pay as little in taxes as he can, he's hoping some of the income is nontaxable. Which of the following types of income is considered nontaxable? a) Income a taxpayer receives from a partnership or an S-Corporation b) Income received from the rental of personal property when the taxpayer is not in the property rental business c) Royalties from copyrights and patents d) Cancellation of certain student loans, scholarships, or fellowships Hank has contributed more than the maximum allowable amount to his IRA What is the penalty for excess contributions to an IRA? a) 18. b) c) d) 6% on the account balance in the year the excess is deposited 6% per year on the excess amount for as long as the excess remains in the account 6% on the excess amount in the year the excess is deposited 6% per year on the account balance for as long as the excess remains in the account