Question

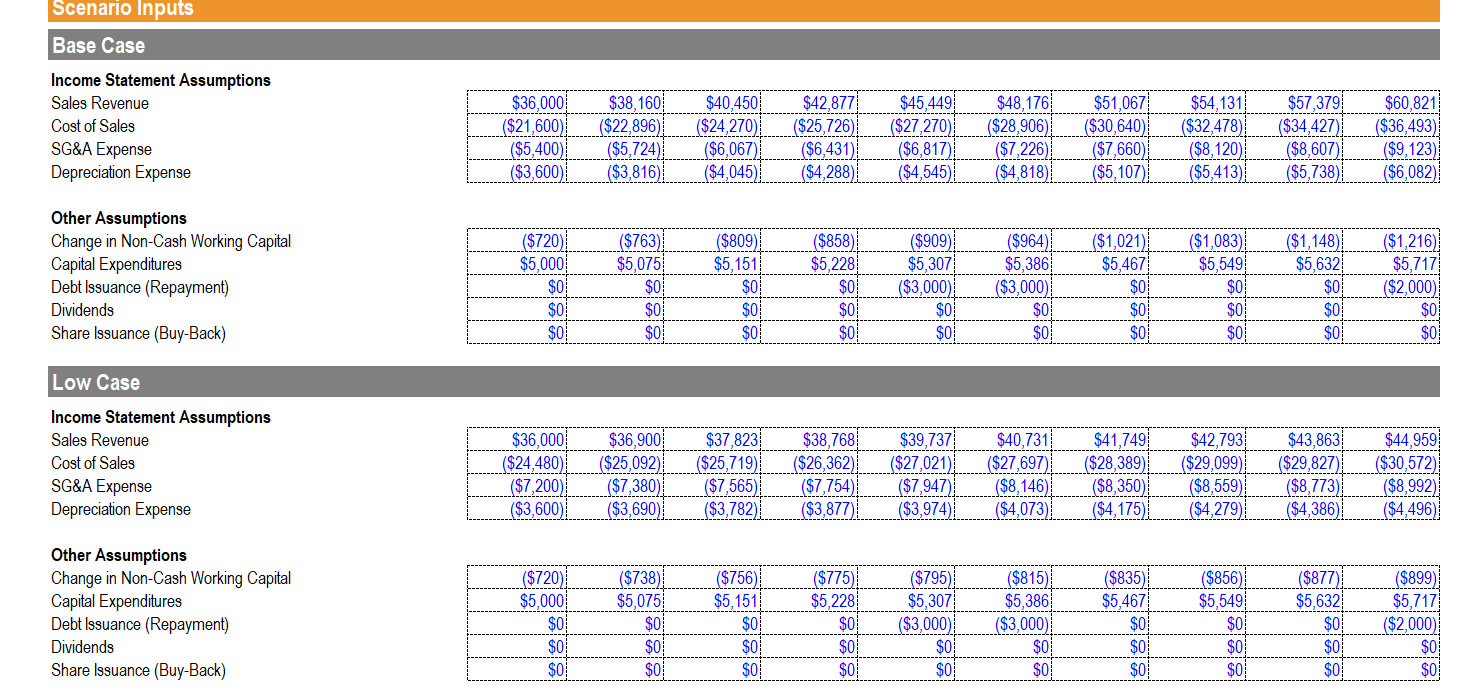

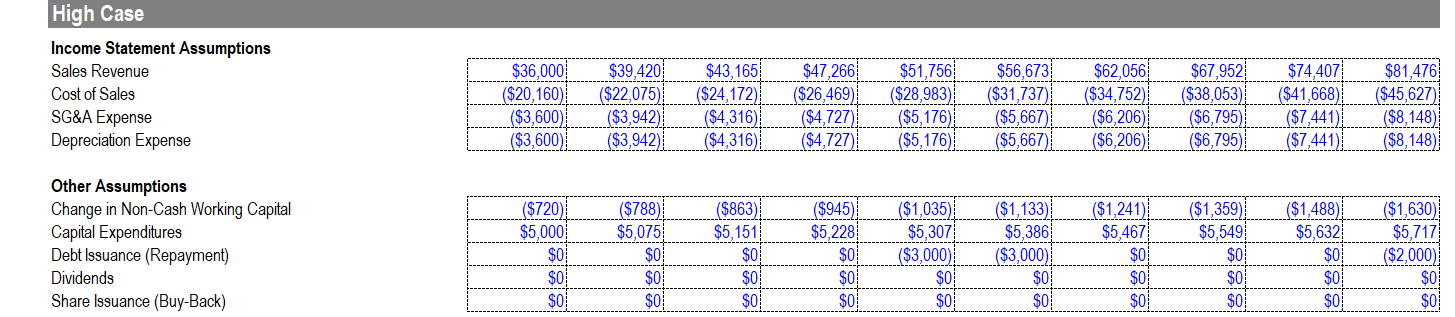

13 Under the Base Case, what is the average implied enterprise value based using: 1. NPV 2. Value implied by comparable company analysis 3. Value

13 Under the Base Case, what is the average implied enterprise value based using:

1. NPV

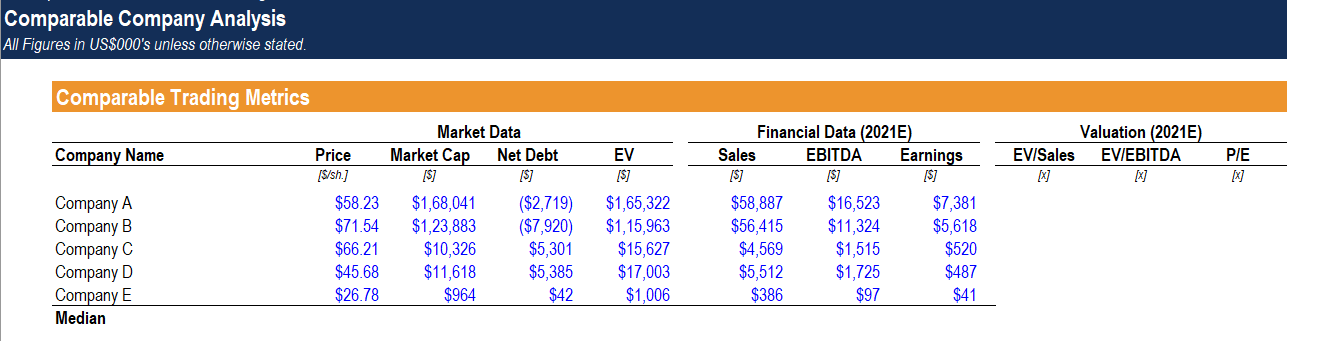

2. Value implied by comparable company analysis

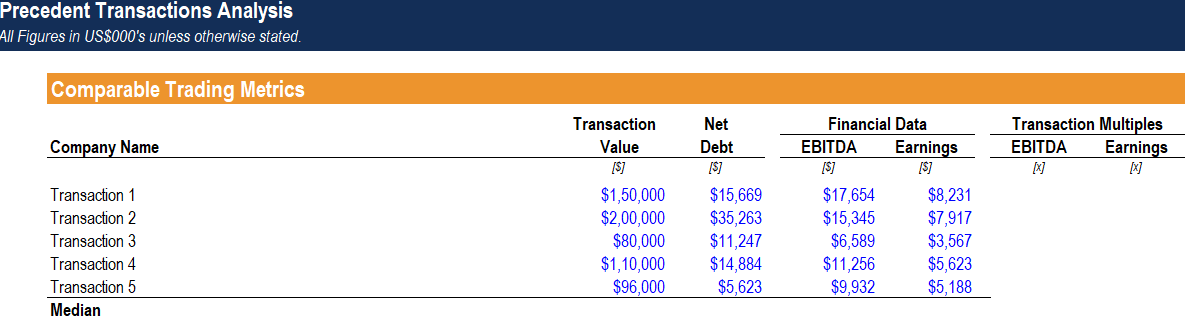

3. Value implied by precedent transactions

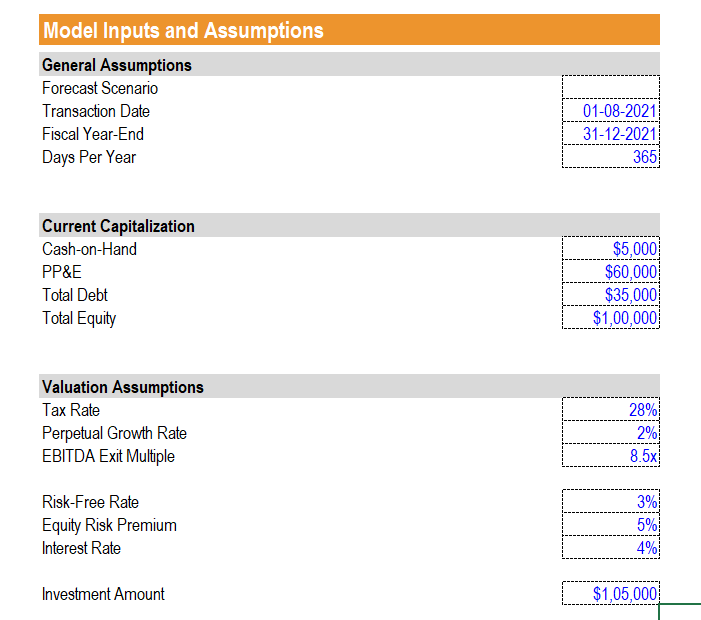

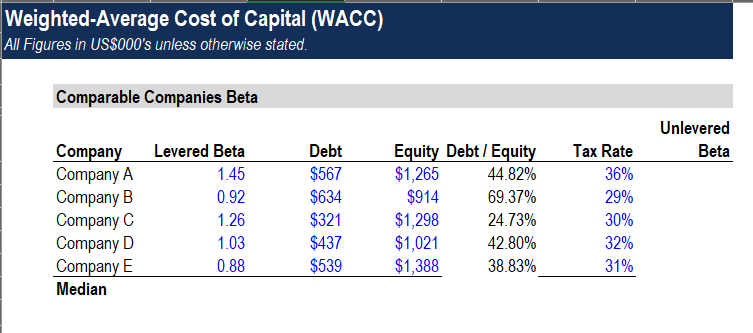

If the NPV value is given a weighting of 60%, the value implied by comparable company analysis is given a weighting of 25% and the value implied by precedent transactions a weighting of 15%. For comparable company analysis and precedent transactions, use 2021E amounts and the median EV/EBITDA. For NPV, assume the terminal value is based on the perpetual growth rate assumption outlined on the "Control Panel" tab.

Review Later

$90,468

$91,268

$91,071

$91,871

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started