Answered step by step

Verified Expert Solution

Question

1 Approved Answer

13. Veblen Company manufactures a variety of athletic shoes: basketball, running, and tennis. Sales of the tennis shoes have fallen off. Veblen is considering

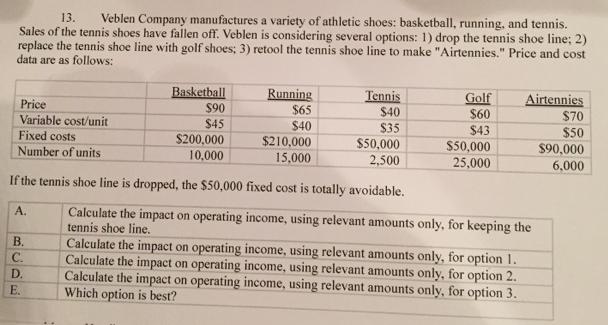

13. Veblen Company manufactures a variety of athletic shoes: basketball, running, and tennis. Sales of the tennis shoes have fallen off. Veblen is considering several options: 1) drop the tennis shoe line; 2) replace the tennis shoe line with golf shoes; 3) retool the tennis shoe line to make "Airtennies." Price and cost data are as follows: Basketball $90 Running $65 $40 $210,000 Tennis $40 Golf Airtennies $70 Price Variable cost/unit Fixed costs Number of units $60 $45 $35 $43 $50 $200,000 $50,000 $50,000 25,000 $90,000 10,000 15,000 2,500 6.000 If the tennis shoe line is dropped, the $50,000 fixed cost is totally avoidable. A. Calculate the impact on operating income, using relevant amounts only, for keeping the tennis shoe line. Calculate the impact on operating income, using relevant amounts only, for option 1. Calculate the impact on operating income, using relevant amounts only, for option 2. Calculate the impact on operating income, using relevant amounts only, for option 3. Which option is best? B. C. D. E.

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Basketball Running Tennis Golf Airtennies Price 90 65 40 60 70 Less variable cost 45 40 35 43 50 Contribution per unit 45 25 5 17 20 x No of units pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started