Answered step by step

Verified Expert Solution

Question

1 Approved Answer

13. what is the amount of jill and jack's Nol? 11) A taxpayer has income from salary of $67,000, a passive activity loss of $12,000

13. what is the amount of jill and jack's Nol?

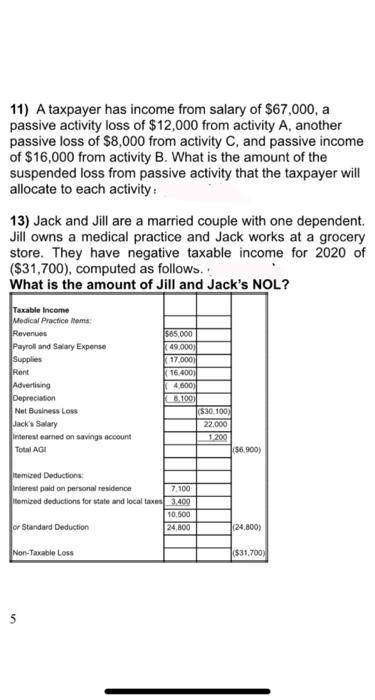

11) A taxpayer has income from salary of $67,000, a passive activity loss of $12,000 from activity A, another passive loss of $8,000 from activity C, and passive income of $16,000 from activity B. What is the amount of the suspended loss from passive activity that the taxpayer will allocate to each activity: 13) Jack and Jill are a married couple with one dependent. Jill owns a medical practice and Jack works at a grocery store. They have negative taxable income for 2020 of ($31,700), computed as follows. What is the amount of Jill and Jack's NOL? Taxable income Medical Practice tems: Revenues Payroll and Saltary Expense Supplies Rent Advertising Depreciation Net Business Los Jack's Salary Interest earned on savings account Total AGI 565.000 149.000) 17.000 16.400) 4.600) 8.100) ($30.100) 22.000 1.200 (56.900) itemized Deductions interest paid on personal residence 7.100 temized deductions for state and local taxes 3.400 10.500 or Standard Deduction 24,800 (24,800) Non-Taxable Loss ($31.700 5 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started