Answered step by step

Verified Expert Solution

Question

1 Approved Answer

13) You buy one call contract and also buy one put contract, both with the strike price of $80. The call premium is $6 and

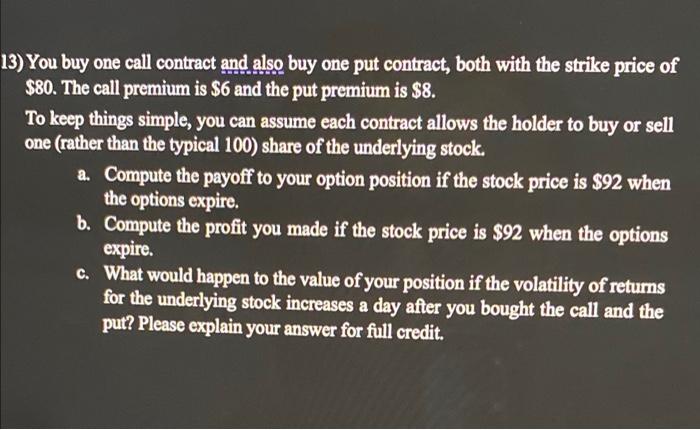

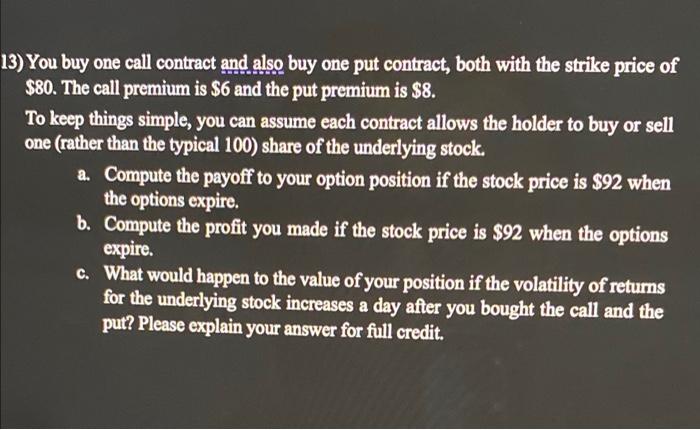

13) You buy one call contract and also buy one put contract, both with the strike price of $80. The call premium is $6 and the put premium is $8. To keep things simple, you can assume each contract allows the holder to buy or sell one (rather than the typical 100) share of the underlying stock. a. Compute the payoff to your option position if the stock price is $92 when the options expire. b. Compute the profit you made if the stock price is $92 when the options expire. c. What would happen to the value of your position if the volatility of returns for the underlying stock increases a day after you bought the call and the put? Please explain your answer for full credit

13) You buy one call contract and also buy one put contract, both with the strike price of $80. The call premium is $6 and the put premium is $8. To keep things simple, you can assume each contract allows the holder to buy or sell one (rather than the typical 100) share of the underlying stock. a. Compute the payoff to your option position if the stock price is $92 when the options expire. b. Compute the profit you made if the stock price is $92 when the options expire. c. What would happen to the value of your position if the volatility of returns for the underlying stock increases a day after you bought the call and the put? Please explain your answer for full credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started