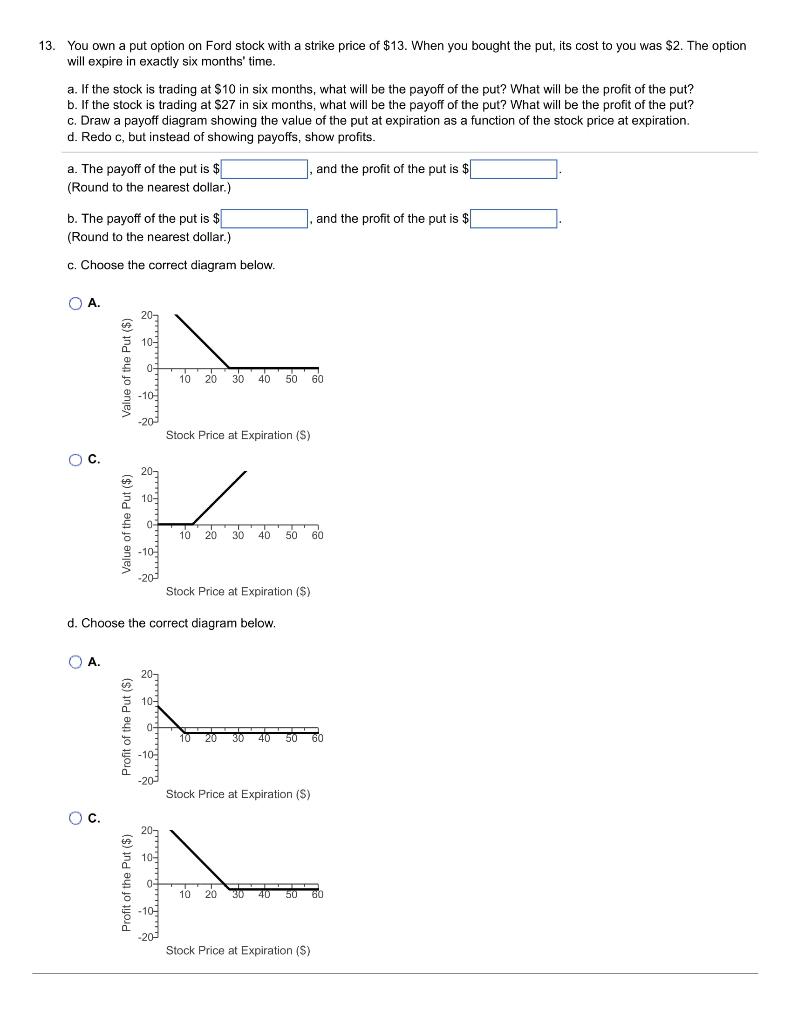

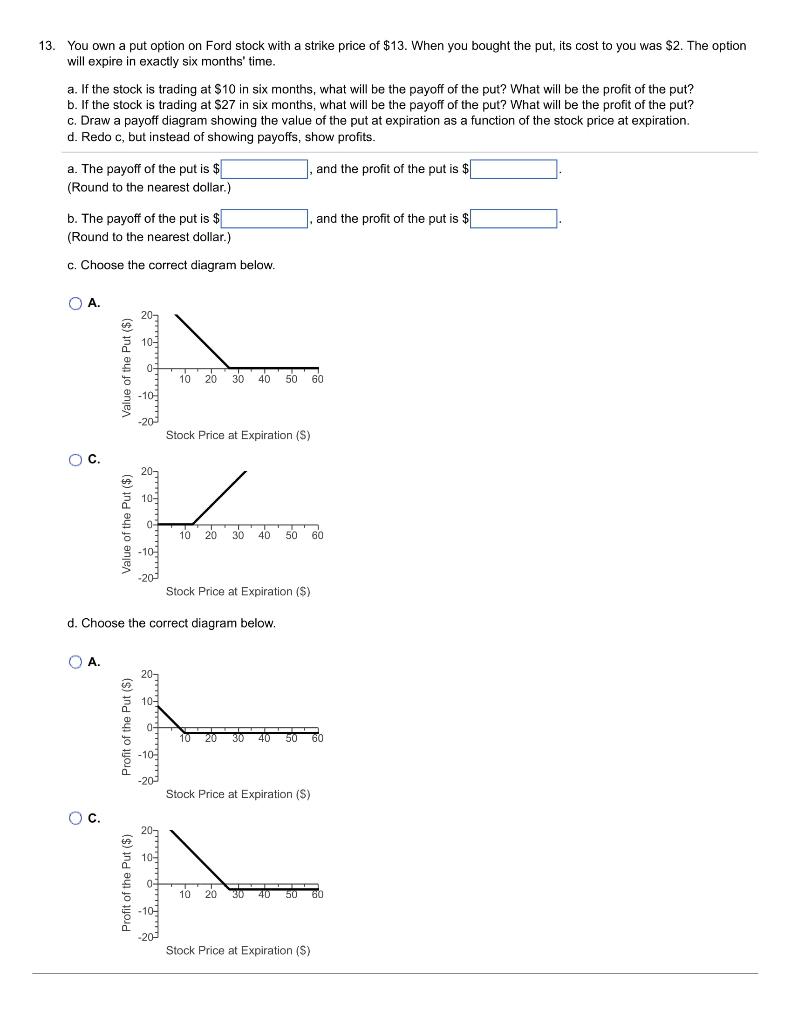

13. You own a put option on Ford stock with a strike price of $13. When you bought the put, its cost to you was $2. The option will expire in exactly six months' time. a. If the stock is trading at $10 in six months, what will be the payoff of the put? What will be the profit of the put? b. If the stock is trading at $27 in six months, what will be the payoff of the put? What will be the profit of the put? C. Draw a payoff diagram showing the value of the put at expiration as a function of the stock price at expiration. d. Redo c, but instead of showing payoffs, show profits. a. The payoff of the put is $ (Round to the nearest dollar.) and the profit of the put is $ and the profit of the put is $ b. The payoff of the put is $ (Round to the nearest dollar.) c. Choose the correct diagram below. O A. 20- 10- Value of the Put ($) 04. 10 20 30 40 50 60 -10 -20 Stock Price at Expiration (S) OC. 20- 102 Value of the Put ($) 0 10 20 30 4050 60 - 10 -20- Stock Price at Expiration (S) d. Choose the correct diagram below. O A. 20- 10- Profit of the Put ($) 0 2001 60 -10 Stock Price at Expiration (S) OC. 10- Profit of the Put ($) 10 20 30 40 50 60 -10 Stock Price at Expiration (S) 13. You own a put option on Ford stock with a strike price of $13. When you bought the put, its cost to you was $2. The option will expire in exactly six months' time. a. If the stock is trading at $10 in six months, what will be the payoff of the put? What will be the profit of the put? b. If the stock is trading at $27 in six months, what will be the payoff of the put? What will be the profit of the put? C. Draw a payoff diagram showing the value of the put at expiration as a function of the stock price at expiration. d. Redo c, but instead of showing payoffs, show profits. a. The payoff of the put is $ (Round to the nearest dollar.) and the profit of the put is $ and the profit of the put is $ b. The payoff of the put is $ (Round to the nearest dollar.) c. Choose the correct diagram below. O A. 20- 10- Value of the Put ($) 04. 10 20 30 40 50 60 -10 -20 Stock Price at Expiration (S) OC. 20- 102 Value of the Put ($) 0 10 20 30 4050 60 - 10 -20- Stock Price at Expiration (S) d. Choose the correct diagram below. O A. 20- 10- Profit of the Put ($) 0 2001 60 -10 Stock Price at Expiration (S) OC. 10- Profit of the Put ($) 10 20 30 40 50 60 -10 Stock Price at Expiration (S)